Is a Beat in the Cards for Fortive (FTV) in Q1 Earnings?

Fortive Corporation FTV is set to report first-quarter 2018 results on Apr 26.

The company topped the Zacks Consensus Estimate in the trailing four quarters, with an average beat of 4.69%.

Last quarter, Fortive delivered a positive earnings surprise of 5.13%. Earnings of 82 cents per share increased 21% year over year and 6.5% sequentially.

Revenues increased 11% year over year and 7.1% sequentially to $1.81 billion. Top-line growth was driven by strategic acquisitions and strength across all end-markets, particularly in China and North America.

For first-quarter 2018, Fortive expects adjusted net earnings between 72 cents and 76 cents per share.

Let’s see how things are shaping up for this quarter.

Expanding Product Portfolio & Acquisitions – Key Catalyst

Fortive’s diverse and expanding product portfolio is helping the company to perform well across all the geographic regions.

Acquisition of Industrial Scientific and Landauer, which enhanced the company’s product portfolio, will continue to drive revenues in the soon-to-be reported quarter.

The acquisitions of eMaint Enterprises by Fortive’s subsidiary, Fluke, and the buyout of Global Traffic Technologies have allowed the company to enter into the rapidly growing cloud computing market.

Tektronix 5 Series mixed-signal oscilloscope and the Fluke T6 non-contact voltage electrical tester have gained traction since its release and will continue to drive Fortive’s market share in China, Western Europe and North America. The company is likely to do well with its Fluke point-of-sale in India as well.

The recent agreement of merging its automation & specialty platform with Altra Industrial Motion Corp is aimed to focus more on software and service exposure and increase its merger & acquisitions capacity, which is likely to strengthen its product portfolio.

Moreover, the deal represents a tax efficient transaction which will be beneficial for Fortive’s shareholders.

Additionally, continuous efforts on improving mobile lead generation conversion rate and reducing ELD campaign cost per click are likely to improve the market share of Fortive in the soon-to-be reported quarter.

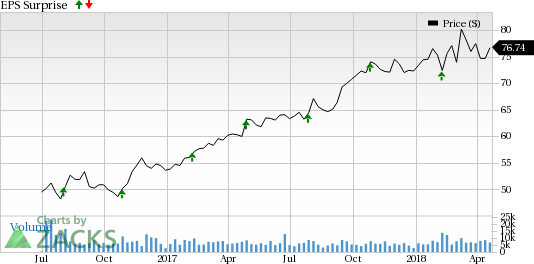

Fortive Corporation Price and EPS Surprise

Fortive Corporation Price and EPS Surprise | Fortive Corporation Quote

What Our Model Says

According to the Zacks model, a company with a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) has a good chance of beating estimates if it also has a positive Earnings ESP. The Sell-rated stocks (Zacks Rank #4 or 5) are best avoided. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Fortive has Zacks Rank #3 and its Earnings ESP is +3.43%. Therefore, our proven model shows that the company is likely to deliver a positive surprise this quarter.

Other Stocks That Warrant a Look

Here are a few other stocks worth considering as our model shows that these too have the right combination of elements to deliver an earnings beat in the upcoming releases.

Western Digital WDC has an Earnings ESP of +2.3% and a Zacks Rank #1. You can see the complete list of today’s Zacks #1 Rank stocks here.

Agilent Technologies A has an Earnings ESP of +3.72% and a Zacks Rank #2.

Advanced Micro Devices AMD has an Earnings ESP of +1.19% and a Zacks Rank #3.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +21.9% in 2017, our top stock-picking screens have returned +115.0%, +109.3%, +104.9%, +98.6%, and +67.1%.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - 2017, the composite yearly average gain for these strategies has beaten the market more than 19X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Western Digital Corporation (WDC) : Free Stock Analysis Report

Advanced Micro Devices, Inc. (AMD) : Free Stock Analysis Report

Agilent Technologies, Inc. (A) : Free Stock Analysis Report

Fortive Corporation (FTV) : Free Stock Analysis Report

To read this article on Zacks.com click here.