Is a Beat in Store for Ally Financial (ALLY) in Q3 Earnings?

Ally Financial Inc. ALLY is slated to announce third-quarter results on Oct 16, before the market opens. Its revenues and earnings for the to-be-reported quarter are projected to have grown year over year.

In the last reported quarter, the company’s earnings surpassed the Zacks Consensus Estimate. Results benefited from an improvement in revenues. However, higher expenses along with rise in provisions were major headwinds.

The company boasts an impressive earnings surprise history. Its earnings surpassed the Zacks Consensus Estimate in each of the trailing four quarters, the average beat being 9.4%.

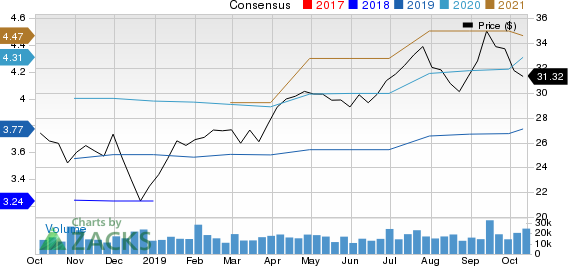

Ally Financial Inc. Price and Consensus

Ally Financial Inc. price-consensus-chart | Ally Financial Inc. Quote

Before we take a look at what our quantitative model predicts for the third quarter, let’s check the factors that are expected to have impacted results.

Factors to Influence Q3 Results

Owing to a fall in used-vehicle prices, the company’s lease revenues are projected to have declined in the to-be-reported quarter. Since it primarily deals in auto loans, this might have marginally hurt its earnings.

Notably, the Zacks Consensus Estimate for insurance premiums and service revenue earned is pegged at $266 million for the third quarter, suggesting sequential rise of 1.9%.

Moreover, the consensus estimate for net gain on mortgage and automotive loans is pegged at $6 million, suggesting significant growth sequentially. Further, the Zacks Consensus Estimate for servicing fees shows that this component is likely to have increased. The consensus estimate for the same is pegged at $6.33 million, suggesting rise of 26.6% from the prior quarter’s reported number.

However, the Zacks Consensus Estimate for net other gain on investments is pegged at $21.50 million, indicating a decline of 44.9% sequentially.

The Zacks Consensus Estimate for total non-interest income shows that the component is likely to have declined marginally in the third quarter. Its consensus estimate is pegged at $392 million, indicating a marginal decline from the prior quarter.

Despite the decline in interest rates and flattening of the yield curve, Ally Financial’s interest income is not expected to have been significantly impacted because of the ongoing optimization within the auto portfolio and its continued efforts to become a diversified bank.

Because of the company’s efforts to grow inorganically, introduce products and diversify operations, its expenses have remained elevated over the past few years. Moreover, as Ally Financial expands into newer areas of operations, total costs are expected to have increased in the third quarter.

Here is what our quantitative model predicts:

Chances of the company beating the Zacks Consensus Estimate in the third quarter are high. This is because it has the right combination of the two key ingredients — a positive Earnings ESP and Zacks Rank #3 (Hold) or better — to be confident of an earnings surprise call.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Earnings ESP: Ally Financial has an Earnings ESP of +2.06%.

Zacks Rank: The company currently carries a Zacks Rank #3.

The Zacks Consensus Estimate for earnings of 97 cents for the to-be-reported quarter has remained unchanged over the past 30 days. The figure indicates an improvement of 6.6% from the year-ago quarter’s reported number.

Moreover, the Zacks Consensus Estimate for sales for the third quarter is pegged at $1.56 billion, which suggests 3.3% growth from the prior-year quarter’s reported figure.

Other Stocks to Consider

Here are some other finance stocks that you may want to consider as these also have the right combination of elements to post an earnings beat this quarter, per our model.

Sallie Mae SLM has an Earnings ESP of +24.09% and sports a Zacks Rank #1 (Strong Buy) at present. The company is slated to release results on Oct 23.

Federated Investors, Inc FII is slated to release results on Oct 24. It currently has an Earnings ESP of +0.76% and a Zacks Rank #3.

T. Rowe Price Group, Inc TROW is also expected to release results on Oct 24. It presently has an Earnings ESP of +0.11% and a Zacks Rank #3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Ally Financial Inc. (ALLY) : Free Stock Analysis Report

SLM Corporation (SLM) : Free Stock Analysis Report

Federated Investors, Inc. (FII) : Free Stock Analysis Report

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research