Is Becton, Dickinson and Company (BDX) A Good Stock To Buy?

Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged through November 22nd. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 52% and 49% respectively. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That's why we weren't surprised when hedge funds’ top 20 large-cap stock picks generated a return of 34.7% through November 22nd and outperformed the broader market benchmark by 8.5 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

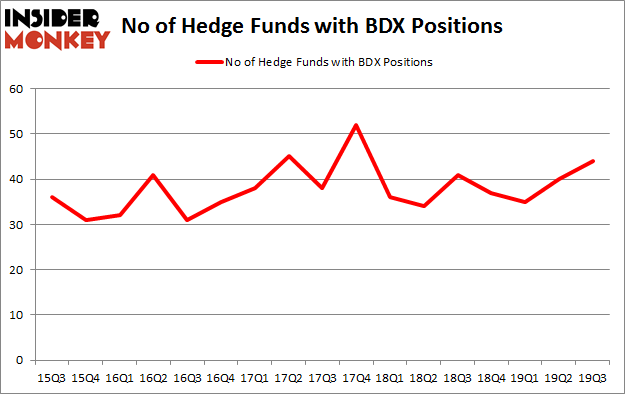

Becton, Dickinson and Company (NYSE:BDX) investors should be aware of an increase in hedge fund sentiment in recent months. BDX was in 44 hedge funds' portfolios at the end of the third quarter of 2019. There were 40 hedge funds in our database with BDX positions at the end of the previous quarter. Our calculations also showed that BDX isn't among the 30 most popular stocks among hedge funds (click for Q3 rankings, see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a multitude of indicators shareholders have at their disposal to appraise their holdings. A pair of the best indicators are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the best picks of the elite money managers can beat the S&P 500 by a significant margin (see the details here).

[caption id="attachment_340081" align="aligncenter" width="450"]

Phill Gross of Adage Capital Management[/caption]

Unlike the largest US hedge funds that are convinced Dow will soar past 40,000 or the world’s most bearish hedge fund that’s more convinced than ever that a crash is coming, our long-short investment strategy doesn’t rely on bull or bear markets to deliver double digit returns. We only rely on the best performing hedge funds‘ buy/sell signals. Let's take a glance at the new hedge fund action encompassing Becton, Dickinson and Company (NYSE:BDX).

What does smart money think about Becton, Dickinson and Company (NYSE:BDX)?

At the end of the third quarter, a total of 44 of the hedge funds tracked by Insider Monkey were long this stock, a change of 10% from the second quarter of 2019. On the other hand, there were a total of 41 hedge funds with a bullish position in BDX a year ago. With the smart money's positions undergoing their usual ebb and flow, there exists an "upper tier" of key hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

The largest stake in Becton, Dickinson and Company (NYSE:BDX) was held by Cantillon Capital Management, which reported holding $311.3 million worth of stock at the end of September. It was followed by GQG Partners with a $126.7 million position. Other investors bullish on the company included Generation Investment Management, Intermede Investment Partners, and Adage Capital Management. In terms of the portfolio weights assigned to each position Weiss Asset Management allocated the biggest weight to Becton, Dickinson and Company (NYSE:BDX), around 5% of its portfolio. Grisanti Brown & Partners is also relatively very bullish on the stock, setting aside 4.31 percent of its 13F equity portfolio to BDX.

As industrywide interest jumped, specific money managers were breaking ground themselves. Millennium Management, managed by Israel Englander, established the most outsized position in Becton, Dickinson and Company (NYSE:BDX). Millennium Management had $55.9 million invested in the company at the end of the quarter. John Osterweis's Osterweis Capital Management also initiated a $20.6 million position during the quarter. The other funds with new positions in the stock are Vishal Saluja and Pham Quang's Endurant Capital Management, Perella Weinberg Partners, and Michael Gelband's ExodusPoint Capital.

Let's go over hedge fund activity in other stocks - not necessarily in the same industry as Becton, Dickinson and Company (NYSE:BDX) but similarly valued. We will take a look at The TJX Companies, Inc. (NYSE:TJX), T-Mobile US, Inc. (NASDAQ:TMUS), Banco Santander, S.A. (NYSE:SAN), and Mitsubishi UFJ Financial Group Inc (NYSE:MUFG). All of these stocks' market caps are closest to BDX's market cap.

[table] Ticker, No of HFs with positions, Total Value of HF Positions (x1000), Change in HF Position TJX,48,1965386,-2 TMUS,60,1457333,-18 SAN,20,645984,-2 MUFG,10,60064,-2 Average,34.5,1032192,-6 [/table]

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.5 hedge funds with bullish positions and the average amount invested in these stocks was $1032 million. That figure was $1160 million in BDX's case. T-Mobile US, Inc. (NASDAQ:TMUS) is the most popular stock in this table. On the other hand Mitsubishi UFJ Financial Group Inc (NYSE:MUFG) is the least popular one with only 10 bullish hedge fund positions. Becton, Dickinson and Company (NYSE:BDX) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we'd rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 34.7% in 2019 through November 22nd and outperformed the S&P 500 ETF (SPY) by 8.5 percentage points. Unfortunately BDX wasn't nearly as popular as these 20 stocks and hedge funds that were betting on BDX were disappointed as the stock returned -1.2% during the fourth quarter (through 11/22) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far this year.

Disclosure: None. This article was originally published at Insider Monkey.

Related Content

How to Best Use Insider Monkey To Increase Your Returns

25 Biggest Hedge Funds In The World

Greenlight Capital 2019 Q3 Investor Letter