Becton, Dickinson Global Foothold Strong, Recalls Rampant

On Aug 10, we issued an updated research report on Becton, Dickinson and Company BDX. The company’s solid global expansion is a major positive, while product recall issues and foreign exchange headwinds persist.

The stock currently carries a Zacks Rank #3 (Hold).

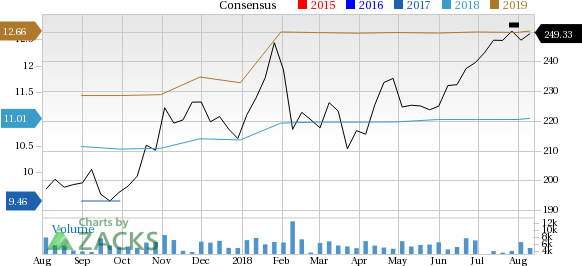

Price Performance

In the past year, shares of Becton, Dickinson, also known as BD, have rallied 23.5%, outperforming the industry’s rise of 11.1%. The current level is also higher than the S&P 500’s return of 15.5%.

Over the last 60 days, the Zacks Consensus Estimate for the company’s current-year earnings per share inched up 0.2% to $11.01.

Becton, Dickinson and Company Price and Consensus

Becton, Dickinson and Company Price and Consensus | Becton, Dickinson and Company Quote

What’s Favoring BD?

BD is focused on overseas expansion, in particular, emerging markets. In the recently reported third quarter of fiscal 2018, BD delivered strong sales internationally, which totaled $1.94 billion, up 35.4% from the year-ago quarter and 5.1% at constant currency (cc).

Per management, overseas revenue growth was driven by strong performance by the BD Life Sciences segment as well as the Medication Delivery Solutions and Medication Management Solutions units. The Surgery and Peripheral Intervention units in the BD Interventional segment also drove growth.

Emerging markets revenues grew 10.5%. Revenues in China rose 13.2%, driven by double-digit growth in the Life Sciences and Interventional segments. In addition, revenues in Latin America grew high single digits.

Buoyed by a solid fiscal third-quarter show, BD lifted its guidance for fiscal 2018. The company expects sales to improve 31.5% on a reported basis in 2018, compared to the previous range of 31-31.5%. At cc, revenues are expected to grow 5.5%, compared to the previous range of 5-5.5%.

Earnings are expected within $10.95-$11.05 compared with the previous $10.90-$11.05. This represents growth of approximately 15.5-16.5% over fiscal 2017 and 12% at cc.

Per management, the acquisition of C.R. Bard is expected to prove accretive to adjusted earnings per share on high single-digit basis in fiscal 2019.

Deterrents

Within its Diabetes Care business, BD has temporarily paused shipments of its insulin infusion sets. This was due to a moderately-higher-than-anticipated rate of complaints associated with insertion that occurred during the pilot launch of the product. However, BD is continuing to work closely with Medtronic MDT toward full commercialization of the product.

Moreover, in the Life Sciences business, management at BD confirmed that a few customers have reported issues pertaining to the Barricor blood collection tubes.

BD also generates more than half of its revenues from international operations. Fluctuations in foreign currency exchange rates adversely affect these revenues.

Moreover, lower reimbursements for medical products and services may negatively impact prices of BD’s products.

Key Picks

A few better-ranked stocks in the broader medical space are Intuitive Surgical ISRG and Inogen, Inc. INGN.

Intuitive Surgical’s expected long-term earnings growth rate is 14.7%. The stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Inogen’s long-term expected earnings growth rate is 24.5%. The stock carries a Zacks Rank #2 (Buy).

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Intuitive Surgical, Inc. (ISRG) : Free Stock Analysis Report

Inogen, Inc (INGN) : Free Stock Analysis Report

Medtronic PLC (MDT) : Free Stock Analysis Report

Becton, Dickinson and Company (BDX) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research