Are Bed Bath & Beyond's Turnaround Efforts About to Pay Off?

On Friday, shares of home goods retailer Bed Bath & Beyond Inc. (NASDAQ:BBBY) spiked more than 7% before giving up most of those gains to close at $22.59 per share, up 2.22% for the day, following the announcement that activist investor Ryan Cohen has struck a deal with the company.

According to the terms of the deal, three people chosen by Cohens RC Ventures will immediately join Bed Baths board as independent directors. A four-person committee will look into options for divesting the Buybuy Baby business, and Cohens people will work to shake up the business operations, which have lagged as executives racked up high pay despite poor performance.

Last month, RC Ventures revealed it had taken a nearly 10% stake in Bed Bath and intended to push the retailer to make sweeping changes to turn around its downward trajectory.

Cohen is the latest player to join Bed Baths turnaround effort. Former Target Corp. (NYSE:TGT) executive Mike Tritton, who took over as Bed Baths CEO in 2019 to much fanfare, has overhauled many aspects of the business in an attempt to turn it around, including a heavier emphasis on private label, store remodels, closures of underperforming locations and the sales of smaller retailers under its umbrella, such as the Christmas Tree Shops and Cost Plus World Market.

After years of turnaround efforts and market volatility, spanning the pandemic and a meme stock rally in January of 2021, could things finally begin to turn in Bed Baths favor?

Optimizing operations

Like Trittons changes, it seems Cohen will also be focusing on optimizing the efficiency of Bed Baths operations, which will likely include further downsizing with the sale of Buybuy Baby. This could bring in cash for the company to apply toward other growth ventures.

Business optimization changes could also include tying compensation for top executives to performance in order to align managements interests with those of the company. Indeed, in its letter to Bed Bath, RC Ventures points to the disconnect between performance and management incentives as a potential reason for the disappointing results of its growth strategy:

We have carefully assessed Bed Baths assets, balance sheet, corporate governance, executive compensation, existing strategy and potential alternatives. While we like Bed Baths brand and capital allocation policy, we have concerns about leaderships compensation relative to performance and its strategy for reigniting meaningful growth. Approximately 18 months after releasing a 170-page cover-the-waterfront plan, the Company is struggling to reverse sustained market share losses, stem years-long share price declines and navigate supply chain volatility. Meanwhile, the Companys named executive officers were collectively awarded nearly $36 million in compensation last fiscal year a seemingly outsized sum for a retailer with a nearly $1.6 billion market capitalization.

All too often, businesses can fall victim to top management that is only interested in lining their own pockets, not growing the business or creating value for shareholders. Thats what has been happening at Bed Bath, and incentivizing those in charge to focus on improving the company could go a long way toward turning the business around.

Supply chain woes

Improving Bed Baths business will also hinge on getting the supply chain back on track. After the pandemic devastated the companys sales, it couldnt even get products back on the shelves to take advantage of the economic recovery, resulting in an estimated $100 million worth of lost sales in the third quarter of fiscal 2021.

On-shelf availability affected our top 200 items such as kitchen appliances and personal electronics, as well as our key categories such as bed and bath. The customer experience was compromised as strong demand wasnt met with strong product availability, Tritton said.

The companys scattershot strategy has not helped with its supply chain woes. As Cohens firm astutely pointed out in its letter, Bed Bath probably should have focused on sustaining the right inventory mix for customers amid the supply chain issues rather than prioritizing the launch of new private-label brands.

At bottom, cracks have emerged in Bed Baths overly ambitious strategy. Leadership should assess whether a shrinking small-cap retailer with a modest cash position and nearly $1.2 billion in debt can afford to roll the dice, opines RC Capitals letter.

Digital shift takes competition to new levels

Its not just the pandemic that has taken a toll on Bed Baths business. As other retailers have been recovering, the company has been underperforming many of its peers, which is especially disheartening given that the hot housing market was a strong incentive for consumers to purchase home goods in 2021.

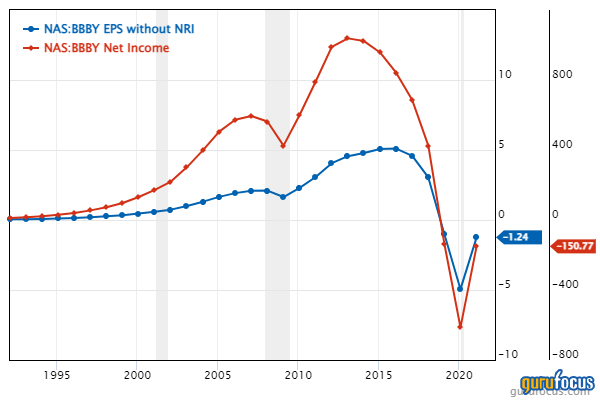

Even before Covid came into the picture, earnings had been in decline, with net income beginning to drop in 2014 and earnings per share following in 2017.

The main reason for this can be attributed to the increasing digitization of the retail market. The increasing popularity of e-commerce has dramatically lowered the entry point for new competitors to enter all sorts of retail markets, and home goods are no exception. The flood of new competitors has lured many customers away from big-box options like Bed Bath.

The company is trying to combat this by expanding its e-commerce offerings. Its loyalty program, Beyond+, is priced at $29 per year and offers a 20% discount on all purchases as well as free standard shipping. Subscribers for this program had grown to 2.2 million as of November 2021.

Valuation

Theres no sugar-coating it: Bed Bath probably will never return to the historical peak of its business. Competition, especially from digital channels, has eroded the popularity not just of its business, but of its business model as well. The company played its cards wrong by trying to expand when it should have been defensive and failing to keep the interests of top management aligned with those of the company.

That being said, Wall Street is expecting the company to return to profitability in fiscal 2023, and this process could be further improved if RC Capital is successful in its efforts to get the company to downsize and focus on new ways to create value for shareholders.

Are Bed Bath & Beyonds turnaround efforts about to pay off? Unfortunately, the answer to this question is not clear yet. Those interested in this stock will want to keep a close eye on three main things going forward: the structure of the compensation plans for executives, rebranding for an increasingly digital sales environment and whether the company decides to make risky or defensive moves to create value.

This article first appeared on GuruFocus.