Berkshire's Top Holdings Post Investment Gains in the 3rd Quarter

- By James Li

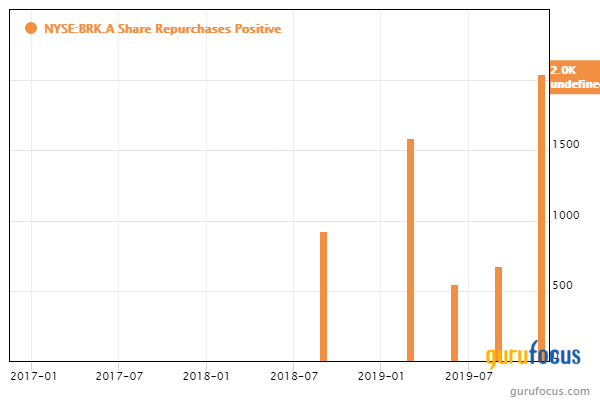

On Monday, shares of Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B) soared over 5% on the heels of the Omaha, Nebraska-based insurance conglomerate recording record share repurchases during the third quarter, coupled with strong gains in the equity portfolio's top holdings.

Buffett's conglomerate purchased approximately $2.55 billion worth of Class A stock and approximately $6.71 billion in Class B stock, smashing the UBS estimate of quarterly share repurchases of just $3.2 billion total. Additionally, the $9.26 billion worth of share repurchases topped the second-quarter total share repurchases of approximately $5.1 billion.

Operating earnings decline but investment gains skyrocket

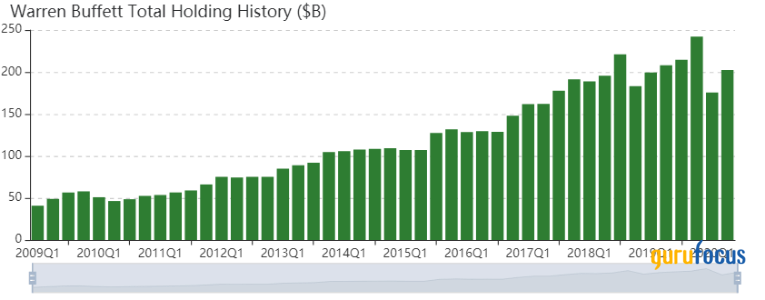

Berkshire reported operating earnings of $5.478 billion, down over 30% from third-quarter 2019 as the coronavirus pandemic negatively impacted the conglomerate's businesses, primarily in manufacturing, service and retail. Despite this, investment gains soared over 82% year over year to $30.137 billion, driven by gains in the equity portfolio's top holdings.

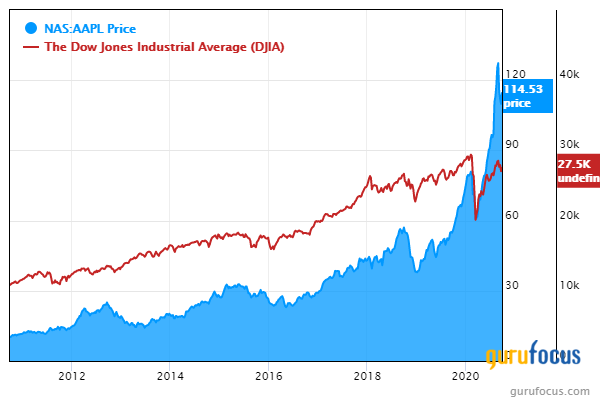

Shares of Apple Inc. (NASDAQ:AAPL), the top holding of Berkshire, increased approximately 2% on Monday, adding to its over 25% rally during the third quarter. Likewise, Coca-Cola Co. (NYSE:KO) gained over 10% during the third quarter.

Markets start new week with a bang as Dow hits record intraday high

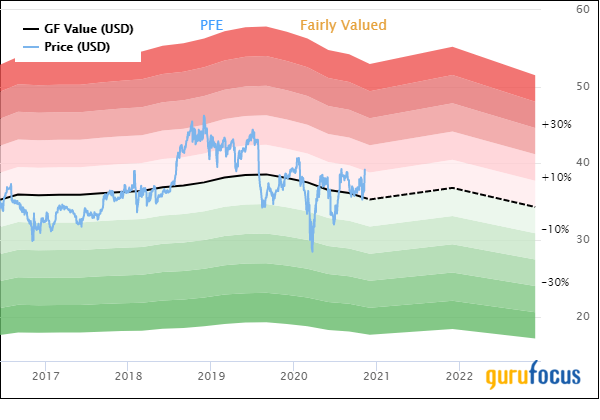

The Dow Jones Industrial Average hit a new all-time record intraday high of 29,933.83, just shy of the 30,000 milestone and up 1,610.43 points from last Friday's close of 28,323.40 on the heels of Pfizer Inc. (NYSE:PFE) and BioNTech SE (NASDAQ:BNTX) announcing that their candidate vaccine prevented with an over 90% effective rate the Covid-19 virus in participants without evidence of prior infection in the companies' first interim efficacy analysis. Dr. Albert Bourla, CEO of the New York-based drug manufacturer, called the observation "a great day for science and humanity."

Shares of Pfizer and BioNTech each soared over 7% on the news. Based on its current price-to-GF Value ratio of 1.09, Pfizer is fairly valued according to GuruFocus' unique valuation method.

Disclosure: Long Apple.

Read more here:

US Market Remains Significantly Overvalued Ahead of Election Day

Tech Companies Remain Overvalued Ahead of November

Warren Buffett's Apple Spooks on 4th-Quarter iPhone Sales Decline

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.