Berry Global (BERY) Q2 Earnings Beat Estimates, Revenues Miss

Berry Global Group, Inc. BERY reported mixed second-quarter fiscal 2020 (ended Mar 28, 2020) results, wherein earnings surpassed the Zacks Consensus Estimate but revenues lagged the same.

In the fiscal second quarter, the company’s adjusted earnings of $1.19 per share were higher than 84 cents reported a year ago. However, the bottom line beat the Zacks Consensus Estimate of $1.07 by 11.2%.

Berry Global’s net sales were $2,975 million, reflecting a year-over-year increase of 52.6%. The improvement was driven by gains from acquired assets and 2% growth in organic volumes, partially offset by a decline in selling prices. However, the top line lagged the consensus estimate of $3,064 million by 2.9%.

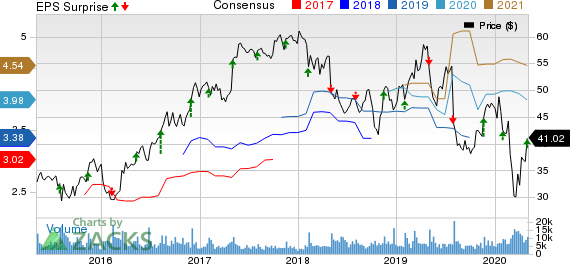

Berry Global Group, Inc. Price, Consensus and EPS Surprise

Berry Global Group, Inc. price-consensus-eps-surprise-chart | Berry Global Group, Inc. Quote

Segmental Performance

The company reports results under four segments — Consumer Packaging–International, Consumer Packaging–North America, Health, Hygiene & Specialties, and Engineered Materials. A brief snapshot of fiscal second-quarter segmental sales is provided below:

Consumer Packaging–International’s sales were $1,095million compared with $50 million in the year-ago quarter. The increase was driven by significant contribution of net sales from the RPC acquisition.It accounted for 36.8% of the quarter’s net sales.

Consumer Packaging–North America’s sales were $706 million, up 10.5% year over year. The increase was attributable to gains from acquired assets, partially offset by lower selling prices. It accounted for 23.7% of the quarter’s net sales.

Revenues generated from Health, Hygiene & Specialties amounted to $576 million, down 10.3% year over year. The fall was primarily attributable to divesture of the SFL business and lower selling prices. It accounted for 19.4% of the quarter’s net sales.

Revenues from Engineered Materials declined 3.4% year over year to $598 million. The fall was due to lower selling prices, partially offset by 2% growth in base volume. It accounted for 20.1% of the quarter’s net sales.

Margin Details

In the fiscal second quarter, Berry Global’s cost of goods sold increased 51.5% to $2,391 million. It represented 80.4% of net sales compared with 80.9% in the year-ago quarter. Selling, general and administrative expenses rose 42.7% to $204 million, and represented 6.9% of net sales.

Adjusted operating income in the quarter increased 45% to $332 million. In addition, adjusted operating margin came in at 11.1%, down 60 basis points year over year. Interest expenses were $111 million, up 68.2% year over year.

Balance Sheet & Cash Flow

Exiting second-quarter fiscal 2020, Berry Global’s cash and cash equivalents were $953 million, down from $750 million recorded a year ago. Current and long-term debt decreased 2.2% to $11,115 million from Dec 28, 2019.

In the first six months of fiscal 2020, the company generated net cash of $533 million from operating activities, reflecting an increase of 61% from the year-ago period.

In the quarter, capital invested for the purchasing of property, plant and equipment totaled $115 million, up from $92 million. Free cash flow in the reported quarter was $200 million, up from $78 million reported in the year-ago quarter.

Outlook

For fiscal 2020 (ending September 2020), Berry Global predicts free cash flow of more than $800 million, with cash flow from operations of a minimum of $1,400 million and capital expenditure of $600 million. Moreover, interest expenses for fiscal 2020 are predicted to be $430 million, while taxes are estimated to be $150 million. In addition, working capital, restructuring and other costs are anticipated to be $50 million.

Zacks Rank & Stocks to Consider

Berry Global currently carries a Zacks Rank #2 (Buy).

Some better-ranked stocks are Acco Brands Corporation ACCO, CECO Environmental Corp. CECE and Intellicheck, Inc. IDN. All the companies currently carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Acco Brands delivered a positive earnings surprise of 19.04%, on average, in the trailing four quarters.

CECO Environmental delivered a positive earnings surprise of 26.98%, on average, in the trailing four quarters.

Intellicheck delivered a positive earnings surprise of 36.91%, on average, in the trailing four quarters.

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Acco Brands Corporation (ACCO) : Free Stock Analysis Report

Berry Global Group, Inc. (BERY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research