Best AIM Materials Dividend Picks For The Day

A favourable economic condition has been a large driver of growth for companies in the materials industry. Thus, there is ample opportunity to take advantage of improving economic conditions which has led to strong demand for commodities. Commodity prices are also a key determinant of these companies’ earnings, which in turn drives dividend payout and yield. As a long term investor, I favour these materials stocks with great dividend payments that continues to add value to my portfolio.

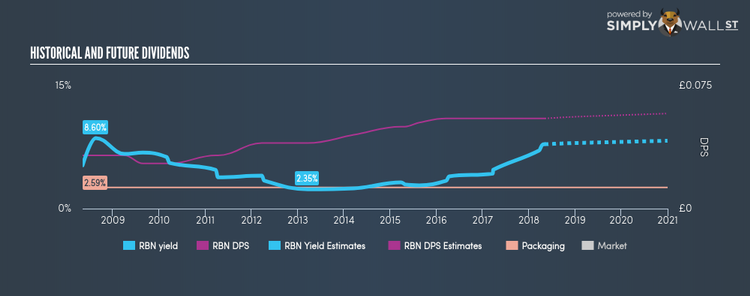

Robinson plc (AIM:RBN)

RBN has a sumptuous dividend yield of 7.86% with a generous payout ratio . While the yield has dropped at times in the last 10 years, dividends per share during this time have increased overall from UK£0.033 to UK£0.055. Interested in Robinson? Find out more here.

Pan African Resources PLC (AIM:PAF)

PAF has an appealing dividend yield of 6.39% and is paying out 61.41% of profits as dividends . With a yield above the savings rate, bank account beating investors will be happy, but perhaps even happier knowing that PAF is in the top quartile of market payers. Pan African Resources’s future earnings growth looks strong, with analysts expecting 57.86% EPS growth in the next three years. Dig deeper into Pan African Resources here.

Castings P.L.C. (LSE:CGS)

CGS has a good dividend yield of 3.33% and their current payout ratio is 50.24% . Over the past 10 years, CGS has increased its dividends from UK£0.097 to UK£0.14. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. CGS also has zero debt, which is always something that catches my attention. More on Castings here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.