Best ASX Undervalued Stocks

A stock that you can buy at a price below what it is worth is considered undervalued. This is the case for Shriro Holdings and Xenith IP Group. Investors can determine how much a company is worth based on how much money they are expected to make in the future, or compared to the value of their peers. The list I’ve put together below are of stocks that compare favourably on all criteria, which potentially makes them good investments if you believe the price should eventually reflect the stock’s actual value.

Shriro Holdings Limited (ASX:SHM)

Shriro Holdings Limited manufactures and distributes kitchen appliances and consumer products in Australia and New Zealand. Established in 2015, and now led by CEO Tim Hargreaves, the company now has 262 employees and with the stock’s market cap sitting at AUD A$129.32M, it comes under the small-cap group.

SHM’s shares are currently trading at -39% beneath its actual value of $2.23, at the market price of AU$1.36, based on its expected future cash flows. The divergence signals an opportunity to buy SHM shares at a low price. In addition to this, SHM’s PE ratio is around 8.91x relative to its Consumer Durables peer level of, 13.3x indicating that relative to its peers, SHM can be bought at a cheaper price right now. SHM is also a financially robust company, as near-term assets sufficiently cover liabilities in the near future as well as in the long run.

More detail on Shriro Holdings here.

Xenith IP Group Limited (ASX:XIP)

Xenith IP Group Limited provides intellectual property (IP) services and advice relating to the identification, registration, management, commercialization, and enforcement of IP rights in Australia, New Zealand, and internationally. Formed in 1859, and headed by CEO Craig Dower, the company provides employment to 100 people and with the market cap of AUD A$105.57M, it falls under the small-cap stocks category.

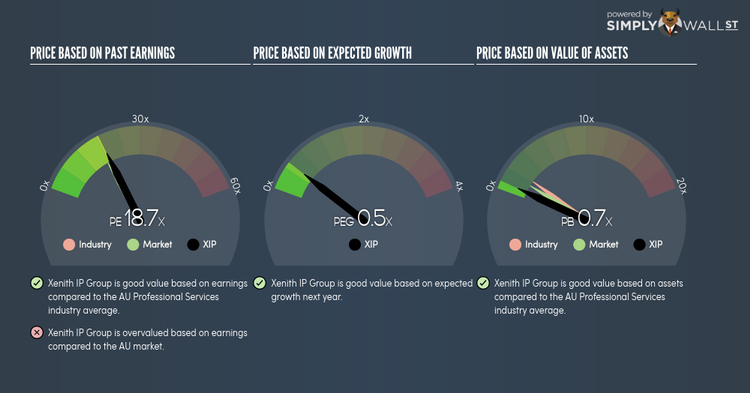

XIP’s shares are currently hovering at around -42% less than its value of $2.07, at the market price of AU$1.19, based on its expected future cash flows. This price and value mismatch indicates a potential opportunity to buy the stock at a low price. What’s even more appeal is that XIP’s PE ratio is currently around 18.65x relative to its Professional Services peer level of, 18.77x indicating that relative to other stocks in the industry, we can buy XIP’s stock at a cheaper price today. XIP is also a financially healthy company, with short-term assets covering liabilities in the near future as well as in the long run.

Dig deeper into Xenith IP Group here.

SDI Limited (ASX:SDI)

SDI Limited engages in the research and development, manufacture, and distribution of amalgam and composite restorative materials, and other dental materials in Australia, Europe, the United States, Brazil, and internationally. SDI was formed in 1972 and has a market cap of AUD A$68.35M, putting it in the small-cap category.

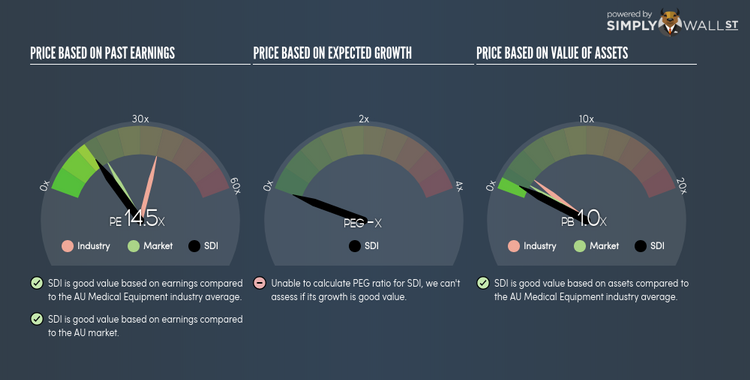

SDI’s stock is currently trading at -55% beneath its real value of $1.28, at a price of AU$0.57, based on its expected future cash flows. This mismatch signals an opportunity to buy SDI shares at a discount. What’s even more appeal is that SDI’s PE ratio stands at around 14.52x against its its Medical Equipment peer level of, 36.09x suggesting that relative to its comparable set of companies, we can purchase SDI’s shares for cheaper. SDI is also robust in terms of financial health, as near-term assets sufficiently cover liabilities in the near future as well as in the long run. It’s debt-to-equity ratio of 6.65% has been dropping over the past couple of years indicating SDI’s capacity to pay down its debt. Continue research on SDI here.

Or create your own list by filtering ASX companies based on fundamentals such as intrinsic discount, health score and future outlook using this free stock screener.

For more financially sound, undervalued companies to add to your portfolio, explore this interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.