Best Buy (BBY) Steals the Limelight on Smart Omnichannel Moves

Best Buy Co., Inc.’s BBY digital efforts ever since the outbreak of the COVID pandemic to cater to consumers’ necessities are commendable. Best Buy continuously focuses on improving its digital capabilities including boosting its omnichannel services, such as buy online and pickup in store services. The company is also deepening its customer engagement with more in-home consultations and in-home installations.

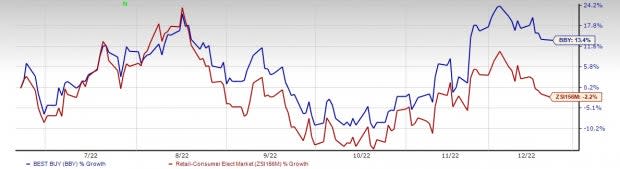

Buoyed by the aforesaid tailwinds, shares of this electronics retailer have gained 13.4% in the past six months against the industry’s 2.2% fall.

Delving Deeper

Best Buy continuously focuses on improving its digital capabilities including boosting its omnichannel services, such as buy online and pickup in store services. The company provides convenient pickup options like in-store pickup, curbside pickup, lockers and alternate pickup locations. Its consultation service, which supports customers with personalized tech needs, has been gaining traction.

Management is focused on enhancing the customers’ shopping experience this holiday season. Best Buy has been offering free next-day delivery on several items along with convenience store and curbside pickup options.

In addition, management is focused on making significant investments in fundamental technology capabilities, such as data and analytics as well as cloud migration to drive scale, efficiency and effectiveness. Best Buy continues making investments in the stores and elevating the shopping experience. BBY is also constantly conducting various tests and pilots to become a more customer-centric, digitally focused and efficient company.

Image Source: Zacks Investment Research

Markedly, the company’s annual membership program, Best Buy Totaltech, provides customers with tech support from Geek Squad agents, exclusive member prices on merchandise, up to twenty-four months of product protection on most purchases, free delivery and installation, and an extended sixty-day window for returns and exchanges, among other features.

The company enrolled over 1 million members since its launch nationwide in October. Management is on track to double the number of members by the fiscal 2025 end.

Best Buy is gradually progressing on its virtual store format, where customers interact with experts via chat, audio, video and screen sharing. Moreover, the company has been making investments in the distribution center network to improve productivity. Best Buy has invested in store-based fulfillment, which includes ship-from-store customer fulfillment centers.

Furthermore, the company is making significant headway in the health and beauty category. To this end, management had launched a skincare technology product across 300 stores and online. In the health business category, the company has launched over-the-counter hearing aids with a new online hearing assessment tool in about 300 stores and online.

In November 2021, the company acquired Current Health which develops a market-leading remote patient monitoring platform allowing physicians to monitor and connect with patients in their homes. The company’s other notable buyouts in the health space include GreatCall in 2018 and Critical Signal Technologies in 2019. Such well-chalked plans are likely to keep contributing to the company’s online revenues.

Bottom Line

All in all, Best Buy seems well poised to tap growth opportunities, given its solid tech-agnostic drives. While the aforesaid efforts are likely to drive sales, the company’s earnings status looks no less favorable. It delivered an earnings surprise of 13.8% in the trailing four quarters, on average.

The Zacks Consensus Estimate for Best Buy’s earnings per share currently stood at $2.09 for the fourth quarter and $6.55 for fiscal 2023, mirroring growth of 3.5% and 6.2%, respectively, over the past 30 days. An expected long-term earnings growth rate of 17.7% coupled with a Value Score of A further speaks volumes for this Zacks Rank #3 (Hold) stock.

Solid Picks in Retail

We highlighted three better-ranked stocks, namely Tecnoglass TGLS, Wingstop WING and Capri Holdings CPRI.

Tecnoglass manufactures and sells architectural glass and windows, and aluminum products for the residential and commercial construction industries. TGLS currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Tecnoglass’ current financial-year sales and earnings per share suggests growth of 43.4% and 82.2%, respectively, from the year-ago reported figures. TGLS has a trailing four-quarter earnings surprise of 26.9%, on average.

Wingstop, which franchises and operates restaurants, currently sports a Zacks Rank #2 (Buy). The company has a trailing four-quarter earnings surprise of 5.8%, on average.

The Zacks Consensus Estimate for Wingstop’s current financial-year sales and earnings per share suggests growth of 25.5% and 23%, respectively, from the year-ago reported numbers. WING has an expected EPS growth rate of 5.8% for three-five years.

Capri Holdings, a global fashion luxury group of iconic brands like Versace, Jimmy Choo and Michael Kors, carries a Zacks Rank of 2 at present.

The Zacks Consensus Estimate for Capri Holdings’ current financial-year sales and earnings per share suggests growth of 0.9% and 10.5%, respectively, from the corresponding year-ago tallies. CPRI has a trailing four-quarter earnings surprise of 21%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Best Buy Co., Inc. (BBY) : Free Stock Analysis Report

Tecnoglass Inc. (TGLS) : Free Stock Analysis Report

Wingstop Inc. (WING) : Free Stock Analysis Report

Capri Holdings Limited (CPRI) : Free Stock Analysis Report