Best-In-Class Dividend Stocks

Dividend-paying companies such as Maintel Holdings and Portmeirion Group can help grow your portfolio income through their sizeable dividend payouts. Great dividend payers create a safe bet to increase investors’ portfolio value as payouts provide steady income and cushion against market risks Dividends can be underrated but they form a large part of investment returns, playing an important role in compounding returns in the long run. Here are other similar dividend stocks that could be valuable additions to your current holdings.

Maintel Holdings Plc (AIM:MAI)

Maintel Holdings Plc, through its subsidiaries, provides managed communications services for the private and public sectors in the United Kingdom and internationally. Founded in 1991, and currently lead by Edward Buxton, the company employs 631 people and with the company’s market capitalisation at GBP £95.81M, we can put it in the small-cap stocks category.

MAI has a large dividend yield of 4.56% and the company currently pays out 80.46% of its profits as dividends . In the last 10 years, shareholders would have been happy to see the company increase its dividend from £0.054 to £0.308. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. The company has also had a strong past 12 months, reporting a double digit EPS growth of 252.3%.

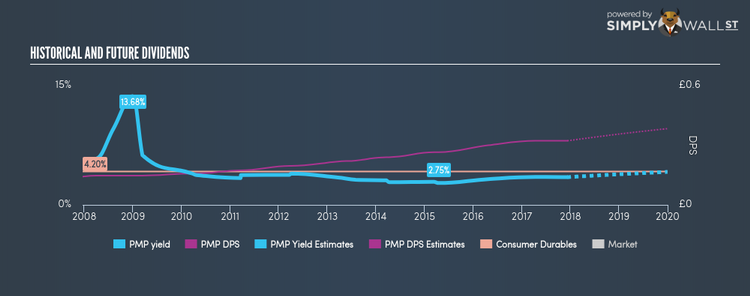

Portmeirion Group plc (AIM:PMP)

Portmeirion Group PLC manufactures, markets, and distributes ceramics, home fragrances, and associated homeware products in the United Kingdom, the United States, South Korea, and rest of the world. Founded in 1912, and headed by CEO Lawrence Bryan, the company size now stands at 788 people and with the company’s market cap sitting at GBP £99.00M, it falls under the small-cap category.

PMP has a good-sized dividend yield of 3.49% and pays 53.01% of it’s earnings as dividends . In the case of PMP, they have increased their dividend per share from £0.1425 to £0.3225 so in the past 10 years. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend.

City of London Investment Group PLC (LSE:CLIG)

City of London Investment Group PLC is a publically owned investment manager. Established in 1991, and currently headed by CEO Barry Olliff, the company employs 73 people and with the company’s market capitalisation at GBP £105.98M, we can put it in the small-cap stocks category.

CLIG has a substantial dividend yield of 6.11% and pays out 67.79% of its profit as dividends , with analysts expecting this ratio to be 71.15% in the next three years. Despite there being some hiccups, dividends per share have increased during the past 10 years.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.