Best-In-Class Dividend Stocks

One of the best paying dividend stock on our list is HNI. Dividend stocks are a great way to hedge your portfolio as they provide both steady income and cushion against market risks A large part of investment returns can be generated by dividend-paying stock given their role in compounding returns over time. I’ve made a list of other value-adding dividend-paying stocks for you to consider for your investment portfolio.

HNI Corporation (NYSE:HNI)

HNI Corporation manufactures and sells office furniture and hearth products in the United States, Canada, China, Hong Kong, India, Mexico, Dubai, and Taiwan. Started in 1944, and currently headed by CEO Stanley Askren, the company provides employment to 9,100 people and has a market cap of USD $1.53B, putting it in the small-cap stocks category.

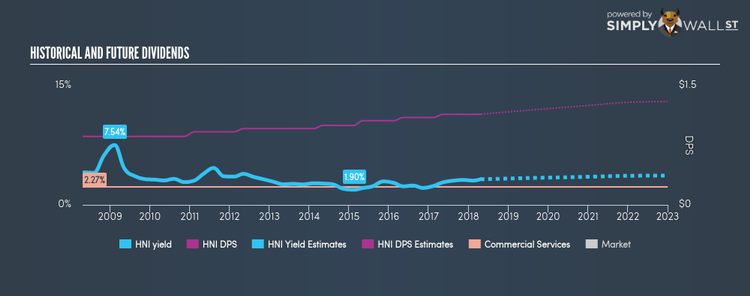

HNI has a wholesome dividend yield of 3.23% and pays out 56.91% of its profit as dividends . In the case of HNI, they have increased their dividend per share from US$0.86 to US$1.14 so in the past 10 years. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. HNI is a strong prospect for its future growth, with analysts expecting the company’s earnings to increase by 63.35% over the next three years. More on HNI here.

Aircastle Limited (NYSE:AYR)

Aircastle Limited, through its subsidiaries, leases, finances, sells, and manages commercial flight equipment to airlines worldwide. Started in 2004, and headed by CEO Michael Inglese, the company employs 111 people and with the stock’s market cap sitting at USD $1.55B, it comes under the small-cap group.

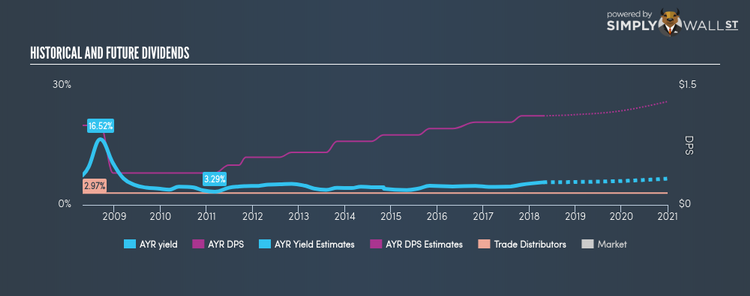

AYR has an alluring dividend yield of 5.68% and the company currently pays out 56.47% of its profits as dividends . Although investors would have seen a few years of reduced payments, it has picked up again, with dividends increasing from US$1.00 to US$1.12 over the past 10 years. More detail on Aircastle here.

M.D.C. Holdings, Inc. (NYSE:MDC)

M.D.C. Holdings, Inc., through its subsidiaries, engages in the homebuilding and financial service businesses. Started in 1972, and now led by CEO Larry Mizel, the company provides employment to 1,491 people and with the company’s market capitalisation at USD $1.59B, we can put it in the small-cap stocks category.

MDC has a substantial dividend yield of 4.23% and the company currently pays out 39.05% of its profits as dividends . MDC’s DPS have risen to US$1.20 from US$0.88 over a 10 year period. During this period, the company has not missed a dividend payment – as you would expect from a company increasing their dividend. More on M.D.C. Holdings here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.