Best-In-Class TSX Energy Dividend Stocks

The energy industry is highly dependent on commodity prices, making its profits and cash flows sensitive to the economic cycle. However, after the 50% plunge in oil prices in 2014, energy companies are now benefiting from the recovery through higher cash flows. As a result, shareholders are paying more attention to companies like Ensign Energy Services and Pason Systems, and have rising expectations for dividend payments as well. Below is my list of huge dividend-paying stocks in the energy industry that continues to add value to my portfolio holdings.

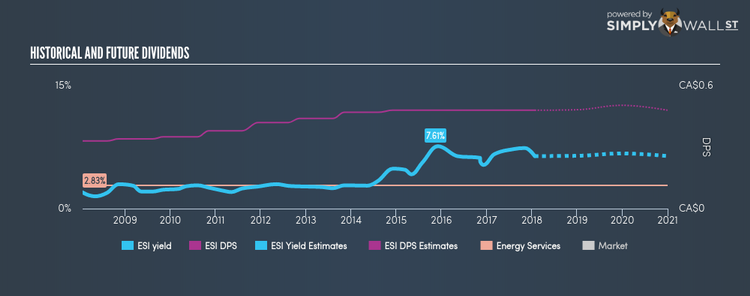

Ensign Energy Services Inc. (TSX:ESI)

ESI has a great dividend yield of 6.41% and a reasonably sustainable dividend payout ratio . ESI’s last dividend payment was $0.48, up from it’s payment 10 years ago of $0.33. The company has been a reliable payer too, not missing a payment during this time. The company’s future earnings growth looks promising, with analysts expecting earnings growth over the next three years to reach 74.78%. Interested in Ensign Energy Services? Find out more here.

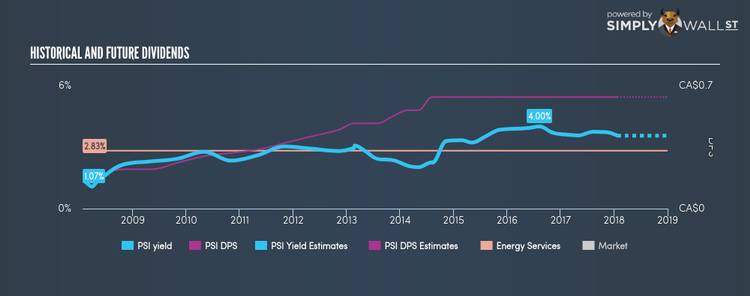

Pason Systems Inc. (TSX:PSI)

PSI has a decent dividend yield of 3.56% with a high payout ratio . In the case of PSI, they have increased their dividend per share from $0.16 to $0.68 so in the past 10 years. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period. The company also looks promising for it’s future growth, with analysts expecting an impressive doubling of earnings per share over the next year. More detail on Pason Systems here.

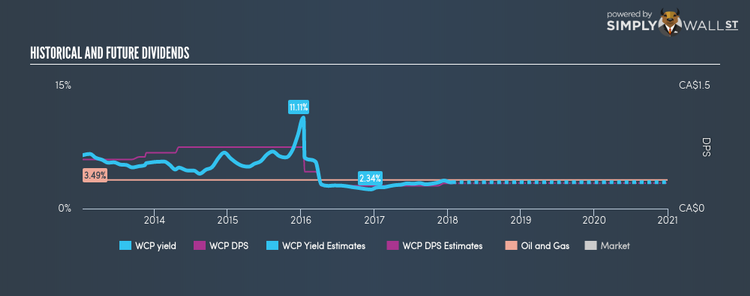

Whitecap Resources Inc. (TSX:WCP)

WCP has a good-sized dividend yield of 3.21% and their current payout ratio is 34.20% , and analysts are expecting a 87.22% payout ratio in the next three years. WCP’s dividend alone will put you better off than your bank interest, but the company’s yield isn’t only higher than the low risk savings rate. It’s also amongst the market’s top dividend payers. The company has a lower PE ratio than the CA Oil and Gas industry, which interested investors would be happy to see. The company’s PE is currently 11.9 while the industry is sitting higher at 16.7. More on Whitecap Resources here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.