Best-In-Class Undervalued Stocks

Companies, such as J Sainsbury, trading at a market price below their true values are considered to be undervalued. Smart investors can make money from this discrepancy by buying these shares, because they believe the current market prices will eventually move towards their true value. If you’re looking for capital gains in your next investment, I suggest you take a look at my list of potentially undervalued stocks.

J Sainsbury plc (LSE:SBRY)

J Sainsbury plc, together with its subsidiaries, engages in the food, general merchandise and clothing retailing, and financial services activities in the United Kingdom. Formed in 1869, and run by CEO Michael Coupe, the company currently employs 118,700 people and with the market cap of GBP £5.35B, it falls under the mid-cap group.

SBRY’s shares are now trading at -42% beneath its intrinsic value of £4.2, at the market price of UK£2.44, based on my discounted cash flow model. This discrepancy gives us a chance to invest in SBRY at a discount.

SBRY is also in good financial health, with short-term assets covering liabilities in the near future as well as in the long run. The stock’s debt-to equity ratio of 32.52% has been reducing over time, signalling SBRY’s capacity to pay down its debt. Dig deeper into J Sainsbury here.

Braveheart Investment Group plc (AIM:BRH)

Braveheart Investment Group plc is a private equity and venture capital firm specializing in start-up, early stage, expansion stage, turnaround, restructuring, management buy-out, management buy-in, loan and mezzanine funding, and follow-on and secondary purchase stage investments in unquoted emerging companies. Braveheart Investment Group was started in 1997 and with the company’s market cap sitting at GBP £4.33M, it falls under the small-cap group.

BRH’s stock is currently hovering at around -36% lower than its actual worth of £0.25, at a price tag of UK£0.16, based on its expected future cash flows. This difference in price and value gives us a chance to buy low. Furthermore, BRH’s PE ratio is trading at around 8.52x relative to its Capital Markets peer level of, 15.57x meaning that relative to its comparable company group, you can buy BRH for a cheaper price. BRH also has a healthy balance sheet, as near-term assets sufficiently cover liabilities in the near future as well as in the long run.

Continue research on Braveheart Investment Group here.

Somero Enterprises, Inc. (AIM:SOM)

Somero Enterprises, Inc., together with its subsidiaries, designs, assembles, remanufactures, sells, and distributes concrete leveling, contouring, and placing equipment. Established in 1985, and now run by John Cooney, the company employs 179 people and with the company’s market cap sitting at GBP £203.88M, it falls under the small-cap group.

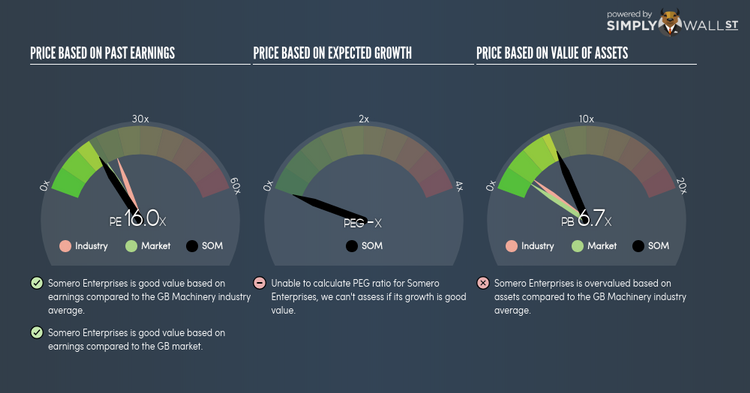

SOM’s shares are currently trading at -59% beneath its intrinsic value of $8.47, at a price of UK£3.50, according to my discounted cash flow model. The mismatch signals a potential chance to invest in SOM at a discounted price. In addition to this, SOM’s PE ratio is currently around 15.95x against its its Machinery peer level of, 21.34x implying that relative to its comparable company group, you can purchase SOM’s stock for a lower price right now. SOM is also in great financial shape, as current assets can cover liabilities in the near term and over the long run. SOM also has no debt on its balance sheet, which gives it headroom to grow and financial flexibility. Continue research on Somero Enterprises here.

For more financially sound, undervalued companies to add to your portfolio, you can use our free platform to explore our interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.