Best-In-Class Utilities Dividend Stocks

Regulators typically set customer rates for utilities to ensure investors recover a fair return on capital and allows the businesses keep their systems well maintained. This means utilities companies are among the most defensive investments with solid cash flows and high dividend payouts. Therefore, these companies provide a strong reliable stream of constant income which is a great diversifier during economic downturns. If you’re a buy-and-hold investor, these healthy dividend stocks in the utilities industry can generously contribute to your monthly portfolio income.

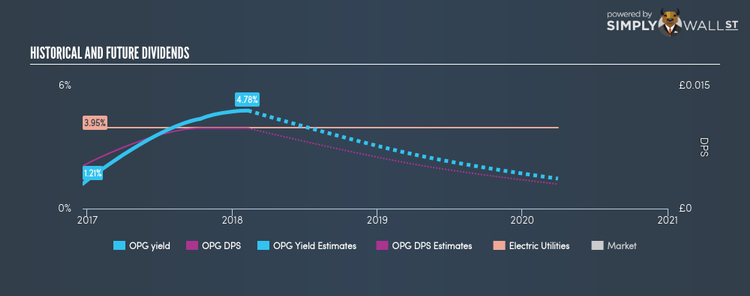

OPG Power Ventures PLC (AIM:OPG)

OPG has a juicy dividend yield of 4.78% and their current payout ratio is 25.06% . With a yield above the savings rate, bank account beating investors will be happy, but perhaps even happier knowing that OPG is in the top quartile of market payers. Comparing OPG Power Ventures’s PE ratio against the Global Electric Utilities industry draws favorable results, with the company’s PE of 7.1 being below that of its industry (18.1). More detail on OPG Power Ventures here.

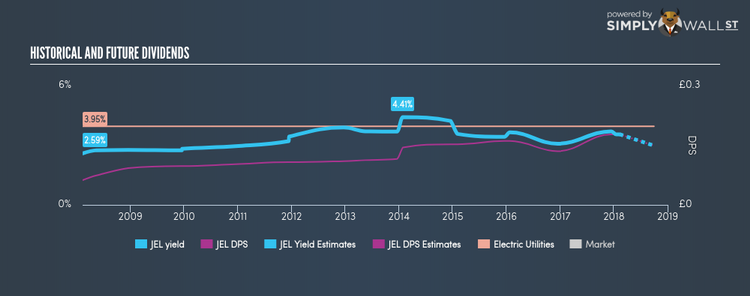

Jersey Electricity plc (LSE:JEL)

JEL has a sizeable dividend yield of 3.55% and the company has a payout ratio of 51.31% . JEL’s dividends have increased in the last 10 years, with DPS increasing from £0.062 to £0.1775. The company has been a dependable payer too, not missing a payment in this 10 year period. More detail on Jersey Electricity here.

Telecom Plus PLC (LSE:TEP)

TEP has an appealing dividend yield of 4.22% and the company currently pays out 125.59% of its profits as dividends . In the case of TEP, they have increased their dividend per share from £0.1 to £0.48 so in the past 10 years. The company has been a reliable payer too, not missing a payment during this time. Over the next three years, analysts predict double digit earnings growth for Telecom Plus of 57.93%. More detail on Telecom Plus here.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.