Best Cyclical Dividend Paying Stock in May

The economic cycle is the underlying driver of consumer cyclical companies’ performances. Companies such as Tailored Brands and Guess’ offer goods and services that are luxuries, instead of absolute necessities, such as entertainment and gambling. During times of growth, consumers tend to make more discretionary purchases which will drive these companies’ profitability. Dividend payouts are, in turn, positively impacted by this growth which means these companies could provide opportune income through dividends. I’ve identify the following consumer cyclical stocks paying high income, which may increase the value of your portfolio.

Tailored Brands, Inc. (NYSE:TLRD)

TLRD has a wholesome dividend yield of 2.12% and the company currently pays out 36.55% of its profits as dividends . In the last 10 years, shareholders would have been happy to see the company increase its dividend from US$0.28 to US$0.72. It should comfort existing and potential future shareholders to know that TLRD hasn’t missed a payment during this time. Dig deeper into Tailored Brands here.

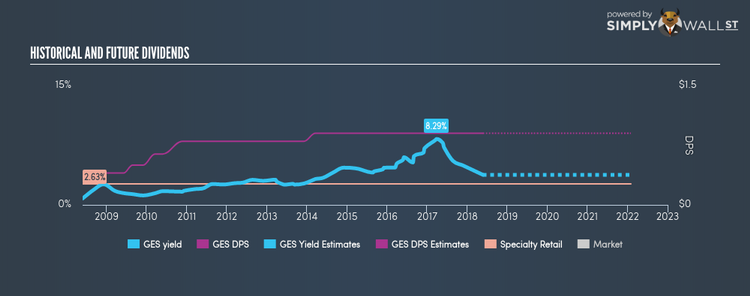

Guess’, Inc. (NYSE:GES)

GES has a good dividend yield of 3.78% and a reasonably sustainable dividend payout ratio , with analysts expecting a 63.09% payout in the next three years. GES’s dividends have increased in the last 10 years, with DPS increasing from US$0.32 to US$0.90. They have been consistent too, not missing a payment during this 10 year period. With a debt to equity ratio of 4.48%, the company looks in good health too. More on Guess’ here.

Foot Locker, Inc. (NYSE:FL)

FL has a solid dividend yield of 3.12% and the company has a payout ratio of 55.54% . In the last 10 years, shareholders would have been happy to see the company increase its dividend from US$0.60 to US$1.38. Much to the delight of shareholders, the company has not missed a payment during this time. Analyst estimates for Foot Locker’s future earnings are certainly promising, predicting a triple digit earnings growth over the next three years. Interested in Foot Locker? Find out more here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.