Best Defensive Stocks To Buy

A portfolio of defensive stocks is aimed at minimising the risk of capital loss through holding carefully selected companies that are unlikely to perform poorly during tough market conditions. To do this successfully, there are certain fundamentals that you should look for, which include but are not limited to: financial health, liquidity and reliable earnings capacity. I suggest starting with Stella-Jones, Magna International and Royal Bank of Canada.

Stella-Jones Inc. (TSX:SJ)

Stella-Jones Inc. produces, markets, and sells pressure treated wood products in Canada and the United States. Founded in 1992, and currently headed by CEO Brian McManus, the company employs 1,880 people and has a market cap of CAD CA$3.12B, putting it in the mid-cap category.

The company’s capital structureis attractive , with long-term commitments covered by cash and short-term assets at a ratio of 1.68x. This debt is also well-supported by cash flows generated from day-to-day operations, reaching 66.09% of borrowed funds, giving equity investors greater confidence in the safety of their investment. Moreover, as its price gives it a CA$3.12B value on the market , the company benefits from greater liquidity and trading volumes than similar companies of smaller size, which minimises the potential for rapid share price falls in down cycles. The past 5 years show the company has grown earnings by 17.05% annually and recorded a ROA of 10.47% over the previous twelve months (compared to the industry’s 9.48%), showing SJ is a strong candidate for a bear market based on these defensive tenets. Interested in Stella-Jones? Find out more here.

Magna International Inc. (TSX:MG)

Magna International Inc. designs, develops, and manufactures automotive systems, assemblies, modules, and components in North America, Europe, Asia, and South America. Started in 1957, and headed by CEO Donald Walker, the company now has 168,000 employees and with the market cap of CAD CA$27.16B, it falls under the large-cap group.

The company’s capital structureis attractive , with long-term commitments covered by cash and short-term assets at a ratio of 2.5x. Its operating cash flow position also reached a solid 93.46% of total borrowings, meaning if economic conditions dampen the company’s ability to grow earnings, MG should still be able to service debt. Furthermore, at a CA$27.16B market cap and a PE of 10.16x, greater liquidity is offered at a good price relative to the market, helping curtail the rate of decline in share price during periods of mass selling. The past 5 years show the company has grown earnings by 11.43% annually and recorded a ROA of 8.96% over the previous twelve months (compared to the industry’s 6.52%), showing MG is a strong candidate for a bear market based on these defensive tenets. Interested in Magna International? Find out more here.

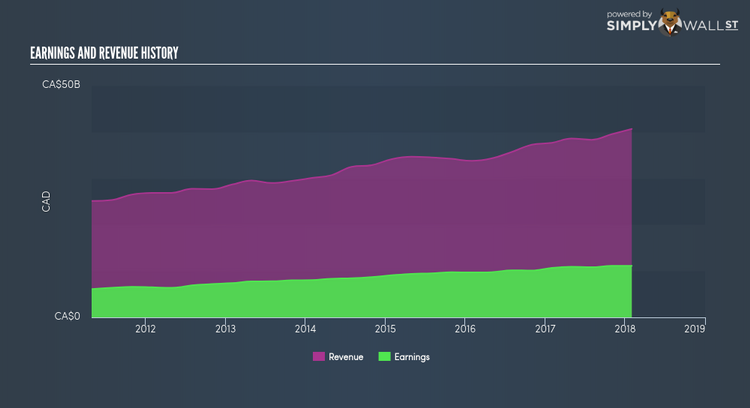

Royal Bank of Canada (TSX:RY)

Royal Bank of Canada, together with its subsidiaries, operates as a diversified financial service company worldwide. Founded in 1864, and now run by David McKay, the company size now stands at 78,648 people and with the market cap of CAD CA$140.13B, it falls under the large-cap stocks category.

At present the company has a strong balance sheet as 66.51% of liabilities are in the form of deposits, which is a good alternative to many other riskier funds. Additionally, of the lending they do engage in, only 0.47% fail to deliver on their initially expected yield, making an investment in the company a safer bet if the cycle turns against you. Furthermore, at a CA$140.13B market cap and a PE multiple of 12.73x, there is a liquid market for the stock which is relatively undervalued compared to the market, which reduces risk of firm price declines and allows you to sell without a large loss due to unattractive spreads. To add to this, RY has recorded a healthy 9.01% annual growth in earnings over the past 5 years and a relatively strong ROA in the past year (that beat the industry), which shows RY has maintained attractive fundamentals for a defensive portfolio. More on Royal Bank of Canada here.

For more robust companies to add to your portfolio, explore this interactive list of defensive stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.