Best Dividend Paying Stock in May

Dividend-paying companies such as New Hope and Whitehaven Coal can help grow your portfolio income through their sizeable dividend payouts. Great dividend payers create a safe bet to increase investors’ portfolio value as payouts provide steady income and cushion against market risks Dividends play a key role in compounding returns over time and can form a large part of our portfolio return. As a long term investor, I favour these great dividend-paying stocks that continues to add value to my portfolio.

New Hope Corporation Limited (ASX:NHC)

New Hope Corporation Limited explores, develops, produces, and processes coal, and oil and gas in Japan, Taiwan, China, Chile, Korea, and Australia. Formed in 1952, and run by CEO Shane Stephan, the company currently employs 566 people and with the stock’s market cap sitting at AUD A$1.91B, it comes under the small-cap category.

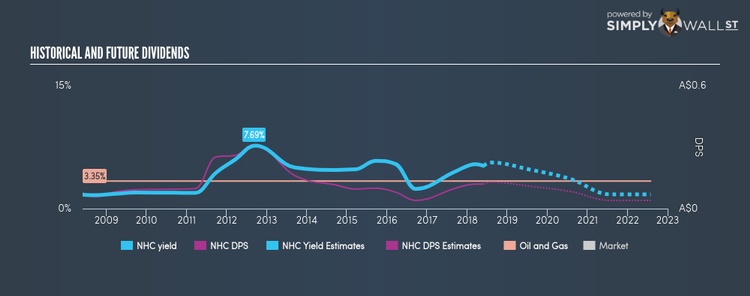

NHC has a sumptuous dividend yield of 5.22% and is paying out 53.02% of profits as dividends . Despite some volatility in the yield, DPS has risen in the last 10 years from AU$0.077 to AU$0.12. More on New Hope here.

Whitehaven Coal Limited (ASX:WHC)

Whitehaven Coal Limited develops and operates coal mines in New South Wales. Formed in 1999, and currently lead by Paul Flynn, the company employs 1,500 people and with the market cap of AUD A$4.94B, it falls under the mid-cap group.

WHC has an alluring dividend yield of 5.22% and pays out 36.99% of its profit as dividends , with analysts expecting this ratio to be 46.41% in the next three years. Despite there being some hiccups, dividends per share have increased during the past 10 years. Whitehaven Coal’s earnings growth over the past 12 months has exceeded the au oil and gas industry, with the company reporting an EPS growth of 197.49% while the industry totaled 157.51%. Continue research on Whitehaven Coal here.

Bendigo and Adelaide Bank Limited (ASX:BEN)

Bendigo and Adelaide Bank Limited provides banking and financial services in Australia. Established in 1858, and currently lead by Michael Hirst, the company currently employs 4,387 people and with the market cap of AUD A$5.28B, it falls under the mid-cap stocks category.

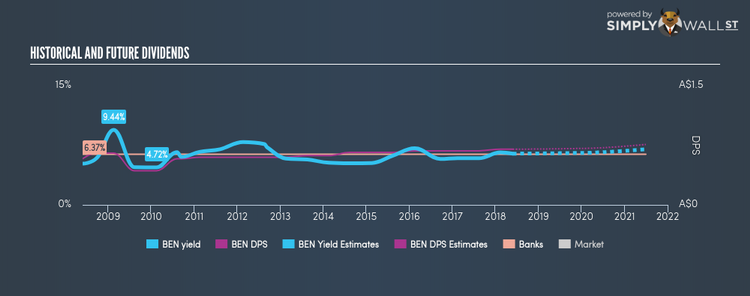

BEN has a great dividend yield of 6.45% and their current payout ratio is 73.10% , with an expected payout of 83.60% in three years. While there’s been some level of instability in the yield, BEN has overall increased DPS over a 10 year period from AU$0.58 to AU$0.70. Bendigo and Adelaide Bank’s performance over the last 12 months beat the au banks industry, with the company reporting 8.75% EPS growth compared to its industry’s figure of 8.48%. More on Bendigo and Adelaide Bank here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.