Best Dividend Stocks to Buy Now According to the Zacks Rank

U.S. stocks finished higher for the fourth successive trading session on Sep 13, which, incidentally, is their longest winning streak in the past two months. The drop in commodity prices has raised hopes that the impact of inflation on the economy has passed. At the same time, an uptick in business activity coupled with strong labor market conditions raised hopes that the economy would improve in the near future.

Notably, it’s widely expected that the forthcoming August inflation data may slip from the 40-year high in July. But the likely fall in inflation data won’t be enough to pacify a worried Fed. The central bank still believes that there is less evidence suggesting a drop in inflation to the Fed’s target of 2%.

The current decline in consumer prices is mostly due to cheaper gas prices. However, prices of broader goods and services, including vehicles, housing, food and rent, have continued to increase with little relief in sight. In fact, the core inflation data, which is the primary tool for the Fed to decipher where inflation is headed, eliminates volatile energy prices and are projected to increase in August.

The Fed, thus, in all likelihood, will continue to tighten monetary policy to tame price pressures. However, investors should remain concerned as the central bank’s hawkish stance might tip the economy into a recession. This is because a rate hike increases the cost of borrowing, curtails consumer outlays, dampens economic growth, and impacts the stock market’s northward journey. Let us not forget that current geopolitical issues continue to act as a headwind for the stock market.

Given such uncertainty, it’s judicious for investors to place bets on dividend-paying stocks like Exxon Mobil XOM, Horizon Bancorp IN HBNC, Radian Group RDN, BRT Apartments BRT and Provident Financial Services PFS. These stocks have a sturdy business model, which protects them from market volatility, and are known for providing a steady stream of income. Presently, they carry a Zacks Rank #1 (Strong Buy) or 2 (Buy) and offer high yields. You can see the complete list of today’s Zacks Rank #1 stocks here.

Exxon Mobil produces crude oil and natural gas in the United States and internationally. Exxon Mobil has a dividend yield of 3.65%. In the past 5-year period, XOM has increased its dividend three times, and its payout has advanced 2.8%. Check Exxon Mobil’s dividend history here.

Exxon Mobil Corporation Dividend Yield (TTM)

Exxon Mobil Corporation dividend-yield-ttm | Exxon Mobil Corporation Quote

XOM’s expected earnings growth rate for the current year is 135.9%. Currently, XOM has a Zacks Rank #2.

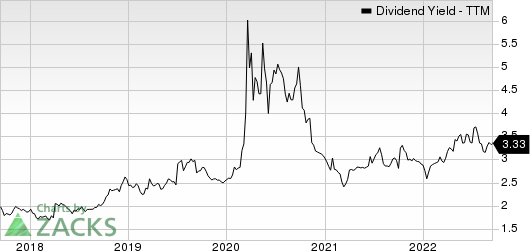

Horizon Bancorp is a bank holding company. Through subsidiaries, they are engaged as a full-service commercial bank. Horizon Bancorp has a dividend yield of 3.33%. In the past 5-year period, HBNC has increased its dividend five times, and its payout has advanced nearly 12.4%. Check Horizon Bancorp’s dividend history here.

Horizon Bancorp IN Dividend Yield (TTM)

Horizon Bancorp IN dividend-yield-ttm | Horizon Bancorp IN Quote

HBNC’s expected earnings growth rate for the current year is 15.5%. Currently, HBNC has a Zacks Rank #1.

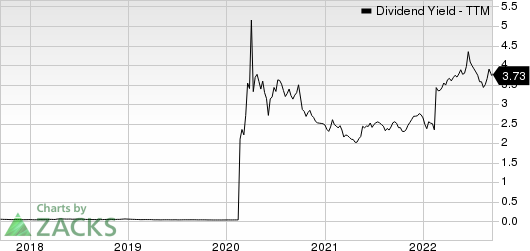

Radian Group is a credit enhancement company, which supports homebuyers, mortgage lenders, loan servicers and investors, with a suite of private mortgage insurance. Radian Group has a dividend yield of 3.78%. In the past 5-year period, RDN has increased its dividend three times, and its payout has advanced 245.8%. Check Radian Group’s dividend history here.

Radian Group Inc. Dividend Yield (TTM)

Radian Group Inc. dividend-yield-ttm | Radian Group Inc. Quote

RDN’s expected earnings growth rate for the current year is 32.7%. Currently, RDN has a Zacks Rank #1.

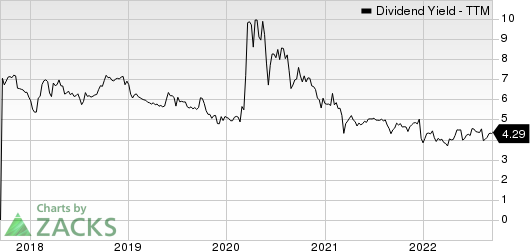

BRT Apartments is a real estate investment trust. BRT Apartments has a dividend yield of 4.32%. In the past 5-year period, BRT has increased its dividend five times, and its payout has advanced almost 5.4%. Check BRT Apartments’ dividend history here.

BRT Apartments Corp. Dividend Yield (TTM)

BRT Apartments Corp. dividend-yield-ttm | BRT Apartments Corp. Quote

BRT’s expected earnings growth rate for the current year is 22.6%. Currently, BRT has a Zacks Rank #2.

Provident Financial Services is the holding company of The Provident Bank, a community- and customer-oriented banking company. Provident Financial Services has a dividend yield of 4.14%. In the past 5-year period, PFS has increased its dividend four times, and its payout has advanced nearly 4%. Check Provident Financial Services’ dividend history here.

Provident Financial Services, Inc Dividend Yield (TTM)

Provident Financial Services, Inc dividend-yield-ttm | Provident Financial Services, Inc Quote

PFS’s expected earnings growth rate for the current year is 3.7%. Currently, PFS has a Zacks Rank #1.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Exxon Mobil Corporation (XOM) : Free Stock Analysis Report

Radian Group Inc. (RDN) : Free Stock Analysis Report

BRT Apartments Corp. (BRT) : Free Stock Analysis Report

Horizon Bancorp IN (HBNC) : Free Stock Analysis Report

Provident Financial Services, Inc (PFS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research