Best Dividend Stocks This Month

Black Hills, Spire, and United Parcel Service are three of the best paying dividend stocks for creating diversified portfolio income. A large part of investment returns can be generated by dividend-paying stock given their role in compounding returns over time. Below are more huge dividend-paying stocks that continues to add value to my portfolio holdings.

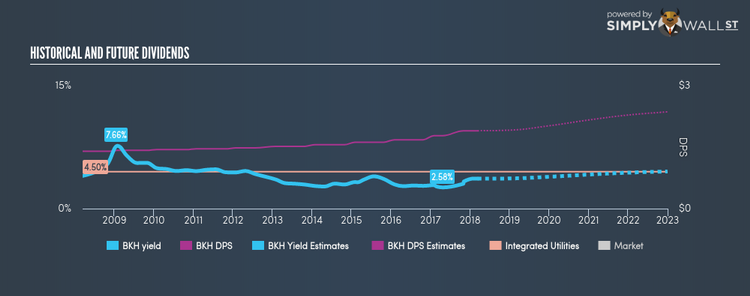

Black Hills Corporation (NYSE:BKH)

Black Hills Corporation, through its subsidiaries, operates as a vertically-integrated utility company in the United States. Started in 1941, and now led by CEO David Emery, the company currently employs 2,744 people and with the company’s market capitalisation at USD $2.79B, we can put it in the mid-cap group.

BKH has a decent dividend yield of 3.65% and pays 49.62% of it’s earnings as dividends , with analysts expecting the payout in three years to be 59.34%. In the last 10 years, shareholders would have been happy to see the company increase its dividend from US$1.40 to US$1.90. They have been reliable as well, ensuring that shareholders haven’t missed a payment during this 10 year period. More detail on Black Hills here.

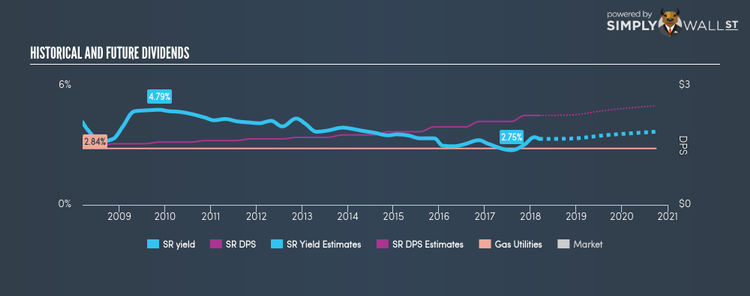

Spire Inc. (NYSE:SR)

Spire Inc., through its subsidiaries, engages in the purchase, retail distribution, and sale of natural gas to residential, commercial, industrial, and other end-users of natural gas customers in the United States. Founded in 1857, and currently lead by Suzanne Sitherwood, the company employs 3,279 people and with the stock’s market cap sitting at USD $3.28B, it comes under the mid-cap stocks category.

SR has a good-sized dividend yield of 3.32% and pays 43.85% of it’s earnings as dividends , with the expected payout in three years being 60.21%. Over the past 10 years, SR has increased its dividends from US$1.50 to US$2.25. The company has been a dependable payer too, not missing a payment in this 10 year period. The company outperformed the us gas utilities industry’s earnings growth of 6.38%, reporting an EPS growth of 63.20% over the past 12 months. Interested in Spire? Find out more here.

United Parcel Service, Inc. (NYSE:UPS)

United Parcel Service, Inc. provides letter and package delivery, specialized transportation, logistics, and financial services. Established in 1907, and currently lead by David Abney, the company size now stands at 346,415 people and has a market cap of USD $95.11B, putting it in the large-cap stocks category.

UPS has a good-sized dividend yield of 3.30% and the company currently pays out 58.90% of its profits as dividends . Over the past 10 years, UPS has increased its dividends from US$1.80 to US$3.64. It should comfort existing and potential future shareholders to know that UPS hasn’t missed a payment during this time. More on United Parcel Service here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.