Best FAANG Stock for May

Most Wall Street veterans are familiar with the saying, "Sell in May and go away" -- an adage based on arguably stale seasonality stats. Traders who don't subscribe to that theory can certainly find bullish opportunities in May. In fact, we've outlined the 25 best stocks to own in the month of May, historically, including FAANG name Netflix, Inc. (NASDAQ:NFLX).

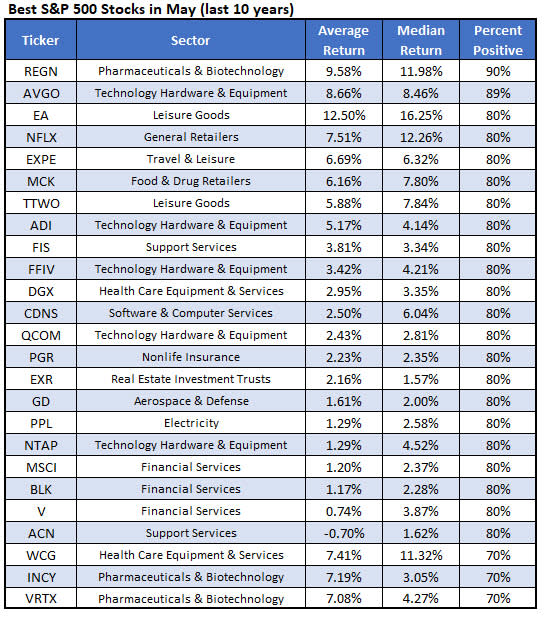

In order to make the list of best S&P 500 Index (SPX) stocks to own in May over the past 10 years, the shares had to have at least eight years' worth of historical returns, per Schaeffer's Senior Quantitative Analyst Rocky White. As you can see, Netflix has averaged a healthy May gain of 7.51%, and ended the month higher 80% of the time, placing it near the top of the list.

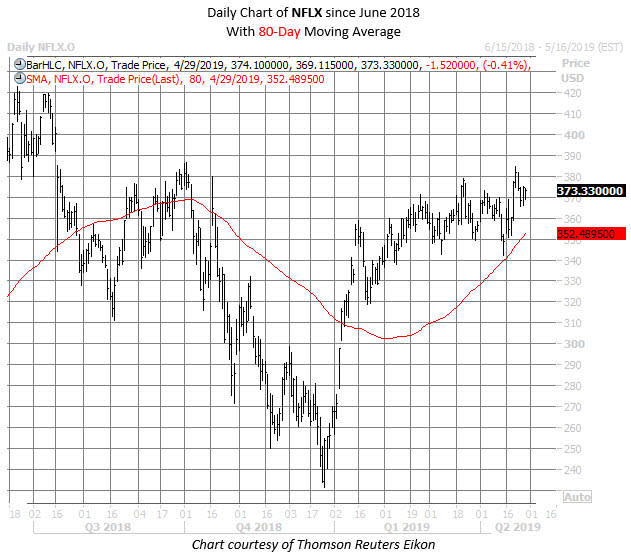

NFLX shares have rallied more than 39% in 2019, traversing a channel of higher highs. The $340-$350 area has emerged as support, and contained the equity's post-earnings pullback earlier this month. In addition, the stock's 80-day moving average is ascending into the region, and recently triggered a bullish signal. However, Netflix stock is now staring up at the $375-$380 neighborhood, which acted as a roadblock in the latter half of 2018. At last check, the equity was down 0.4% at $373.33. Another 7.51% surge in May would put NFLX around $401 -- territory not charted since July, and well north of recent resistance.

Another May rally could shake loose some short-term options bears, too. The stock's Schaeffer's put/call open interest ratio (SOIR) of 1.00 is higher than 78% of all other readings from the past year, indicating that short-term put open interest exceeds call open interest by a wider-than-usual margin at the moment.

However, traders looking to speculate on Netflix's near-term trajectory can pick up options for a relative bargain. The stock's Schaeffer's Volatility Index (SVI) of 30% is in just the 6th percentile of its annual range, suggesting short-term options are pricing in relatively modest volatility expectations. In other words, NFLX's near-term contracts look attractively priced right now.