Best Growth Stock in May

High growth companies such as Home Capital Group and Avino Silver & Gold Mines has a positive future outlook in terms of their returns, profitability and cash flows. The prospects of these companies tend to outperform others, regardless of how the stock market is generally doing. Below I’ve put together a list of great potential investments for you to consider adding to your portfolio if growth is a dimension you would like to firm up.

Home Capital Group Inc. (TSX:HCG)

Home Capital Group Inc., through its subsidiary, Home Trust Company, provides deposit, mortgage lending, retail credit, and credit card issuing services in Canada. The company size now stands at 669 people and with the company’s market cap sitting at CAD CA$1.11B, it falls under the small-cap group.

An outstanding 70.80% earnings growth is forecasted for HCG, driven by the underlying 52.25% sales growth over the next few years. An affirming signal is when net income increase is supported by top-line growth. Since net income isn’t artificially inflated by one-off initiatives such as cost-cutting, we know this profit growth is more likely to be sustainable. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a positive return on equity of 7.89%. HCG’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Want to know more about HCG? Check out its fundamental factors here.

Avino Silver & Gold Mines Ltd. (TSX:ASM)

Avino Silver & Gold Mines Ltd., together with its subsidiaries, engages in the production and sale of silver, gold, and copper; and the acquisition, exploration, and advancement of mineral properties. The company was established in 1968 and with the company’s market cap sitting at CAD CA$95.05M, it falls under the small-cap group.

ASM’s projected future profit growth is a robust 25.53%, with an underlying 73.25% growth from its revenues expected over the upcoming years. It appears that ASM’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. ASM’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Should you add ASM to your portfolio? Other fundamental factors you should also consider can be found here.

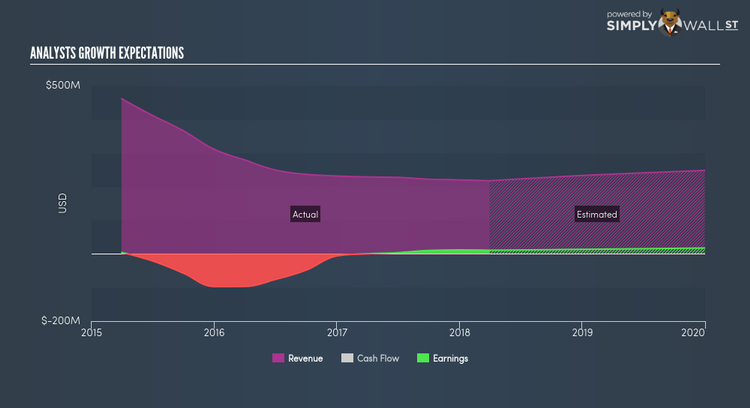

5N Plus Inc. (TSX:VNP)

5N Plus Inc. produces and sells specialty chemicals and engineered materials in Europe, Asia, and the Americas. The company employs 641 people and with the stock’s market cap sitting at CAD CA$276.97M, it comes under the small-cap stocks category.

Could this stock be your next pick? Other fundamental factors you should also consider can be found here.

For more financially robust companies with high growth potential to enhance your portfolio, explore this interactive list of fast growing companies.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.