Best Growth Stock Picks

Investors tend to look for stocks that have a strong future outlook. Why invest in something that will grow slower than the rest of the market? In terms of profitability and returns, stocks such as Affimed N.V and First Financial Bancorp are expected to outperform its peers in the future. If your holdings could benefit from diversification towards growth stocks, whether it be in reputable tech stocks or green small-caps, take a look at my list of stocks with a bright future ahead.

Affimed N.V. (NASDAQ:AFMD)

Affimed N.V., a clinical-stage biopharmaceutical company, focuses on discovering and developing cancer immunotherapies in Germany and internationally. Started in 2000, and currently run by Adi Hoess, the company currently employs 83 people and has a market cap of USD $93.81M, putting it in the small-cap group.

A potential addition to your portfolio? Other fundamental factors you should also consider can be found here.

First Financial Bancorp. (NASDAQ:FFBC)

First Financial Bancorp. operates as the bank holding company for First Financial Bank that provides commercial banking and other banking, and banking-related services to individuals and businesses in Ohio, Indiana, and Kentucky. Started in 1863, and currently run by Claude Davis, the company provides employment to 1,521 people and with the stock’s market cap sitting at USD $1.68B, it comes under the small-cap category.

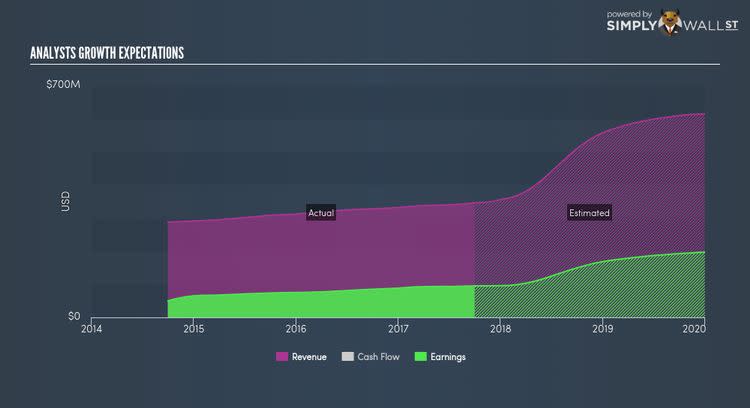

FFBC’s projected future profit growth is an exceptional 99.07%, with an underlying 73.39% growth from its revenues expected over the upcoming years. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 8.87%. FFBC’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Interested to learn more about FFBC? Other fundamental factors you should also consider can be found here.

Sonus Networks, Inc. (NASDAQ:SONS)

Sonus Networks, Inc., doing business as Ribbon Communications, provides real-time communication solutions worldwide. Formed in 2017, and headed by CEO Raymond Dolan, the company provides employment to 1,152 people and with the company’s market cap sitting at USD $795.41M, it falls under the small-cap group.

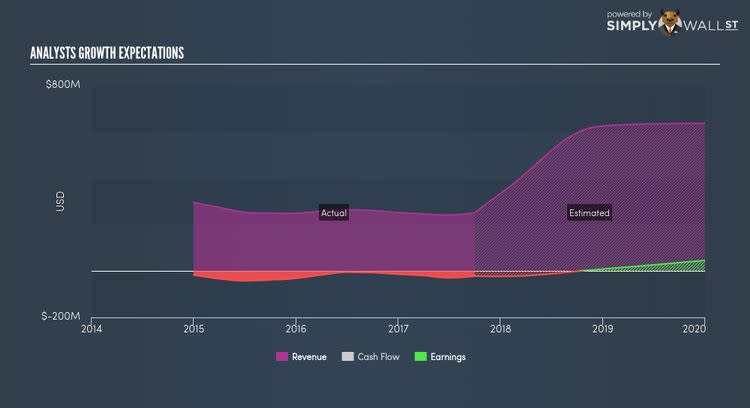

SONS is expected to deliver an impressive triple-digit top-line growth over the next couple of years, according to market analysts. Furthermore, the equally impressive growth in operating cash flows indicates that a large portion of this revenue increase is high-quality, day-to-day cash generated by the business, rather than one-offs. The market’s bullish sentiment on SONS’s capacity to grow at such high rates makes it an interesting stock to dig into deeper. A potential addition to your portfolio? I recommend researching its fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.