Best Growth Stock Picks

High-growth stocks that are financially stable are attractive for many reasons. They provide a strong upside to your portfolio, with less likelihood of downside risks compared to less financially robust companies. Whether it be a well-known tech stock or a risky small-cap, I believe diversification towards growth can add value to your current holdings. Below I’ve compiled a list of stocks with a bright future ahead.

Amphastar Pharmaceuticals, Inc. (NASDAQ:AMPH)

Amphastar Pharmaceuticals, Inc., a specialty pharmaceutical company, focuses on the development, manufacture, marketing, and sale of generic and proprietary injectable, inhalation, and intranasal products. Founded in 1996, and currently lead by Yongfeng Zhang, the company provides employment to 1,541 people and with the company’s market capitalisation at USD $833.54M, we can put it in the small-cap stocks category.

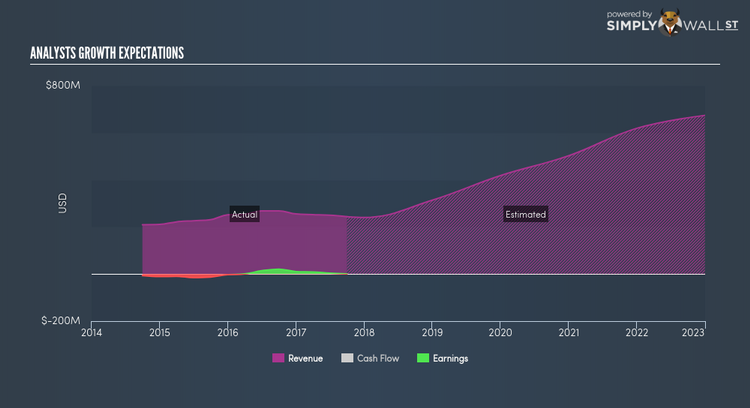

AMPH is expected to deliver an impressive top-line growth of 60.93% over the next couple of years, according to market analysts. Furthermore, the 22.89% growth in operating cash flows indicates that a good portion of this revenue increase is high-quality, day-to-day cash generated by the business, rather than one-offs. The market’s bullish sentiment on AMPH’s capacity to grow at such high rates makes it an interesting stock to dig into deeper. Want to know more about AMPH? Check out its fundamental factors here.

Universal Display Corporation (NASDAQ:OLED)

Universal Display Corporation engages in the research, development, and commercialization of organic light emitting diode (OLED) technologies and materials for use in flat panel displays and solid-state lighting applications. Started in 1985, and headed by CEO Steven Abramson, the company now has 223 employees and with the company’s market cap sitting at USD $5.67B, it falls under the mid-cap category.

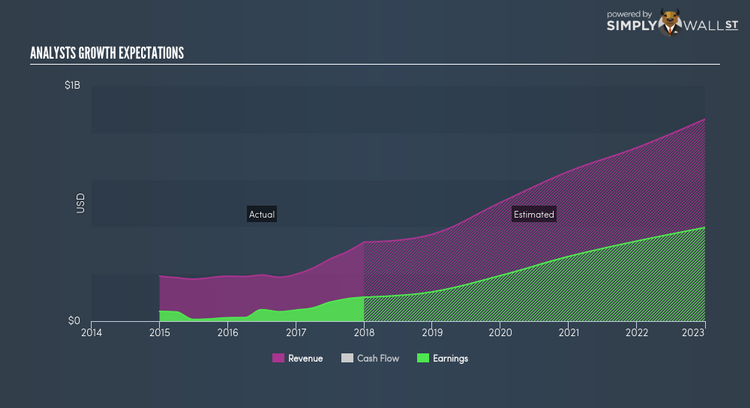

An outstanding 25.95% earnings growth is forecasted for OLED, driven by an underlying sales growth of 49.97% over the next few years. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. This prospective profitability should trickle down to shareholders, with analysts expecting the company to generate a high double-digit return on equity of 24.39%. OLED ticks the boxes for robust growth generation on all levels of line items, which makes it an appealing stock to dig into deeper. Interested to learn more about OLED? I recommend researching its fundamentals here.

Allegiance Bancshares, Inc. (NASDAQ:ABTX)

Allegiance Bancshares, Inc. operates as the bank holding company for Allegiance Bank that provides a range of commercial banking services primarily to small and medium-sized businesses, professionals, and individual customers. Started in 2007, and currently run by George Martinez, the company currently employs 326 people and with the company’s market capitalisation at USD $523.13M, we can put it in the small-cap stocks category.

ABTX is expected to deliver a buoyant earnings growth over the next couple of years of 38.70%, bolstered by an equally impressive revenue growth of 52.09%. It appears that ABTX’s profitability may be sustainable as the fundamental push is top-line expansion rather than unmaintainable cost-cutting activities. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 11.57%. ABTX’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Considering ABTX as a potential investment? I recommend researching its fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.