Best Growth Stock Picks

EnerCare is one of many stocks the market is bullish on. Its expected double-digit top-line and bottom-line growth exceeds its peers, and its financially stable position lessens the chances of risk. Investment in growth companies can benefit your current holdings, whether it be in established tech giants or undiscovered micro-caps. Here, I’ve put together a few companies the market is particularly optimistic towards.

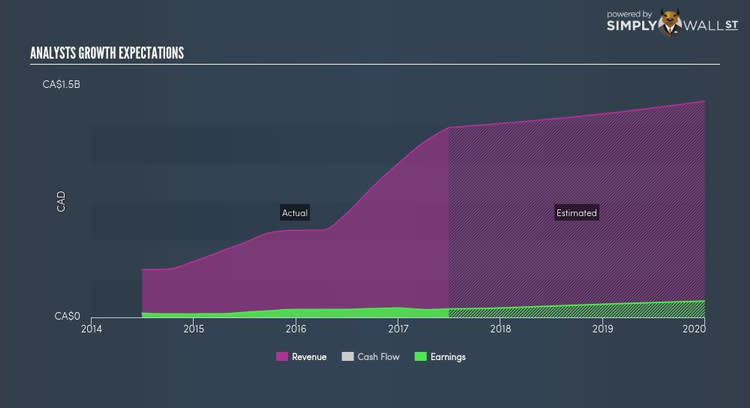

EnerCare Inc. (TSX:ECI)

Enercare Inc., through its subsidiaries, provides home and commercial services, and energy solutions in Canada and the United States. Formed in 2002, and now run by John MacDonald, the company currently employs 3,950 people and with the stock’s market cap sitting at CAD CA$2.13B, it comes under the mid-cap group.

ECI’s forecasted bottom line growth is an exceptional 73.02%, driven by the underlying double-digit sales growth of 10.51% over the next few years. Though some cost-cutting activities may artificially inflate margins, it appears that this isn’t solely the case here, as profit growth is also coupled with top-line expansion. Moreover, the 32.31% growth in operating cash flows shows that a decent part of earnings is driven by robust cash generation from operational activities, not one-off or non-core activities. ECI’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. Considering ECI as a potential investment? Have a browse through its key fundamentals here.

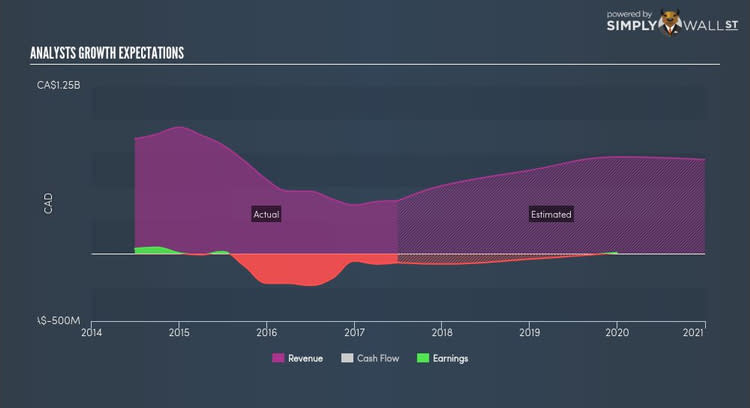

Trinidad Drilling Ltd. (TSX:TDG)

Trinidad Drilling Ltd. designs, builds, and operates drilling rigs for the oil and gas industry primarily in Canada, the United States, and internationally. Formed in 1996, and currently headed by CEO Brent Conway, the company size now stands at 1,529 people and with the stock’s market cap sitting at CAD CA$423.86M, it comes under the small-cap category.

TDG’s projected future profit growth is an exceptional 75.45%, with an underlying 70.11% growth from its revenues expected over the upcoming years. Profit growth, coupled with top-line expansion, is a positive indication. This is because net income isn’t artificially inflated by unsustainable activities such as one-off cost-reductions expected in the future. Furthermore, the high growth of over 100% in operating cash flows indicates that a large portion of this earnings increase is high-quality, day-to-day cash generated by the business, rather than one-offs. TDG’s bullish prospects on both the top and bottom lines make it an interesting stock to invest more time to understand how it can add value to your portfolio. A potential addition to your portfolio? I recommend researching its fundamentals here.

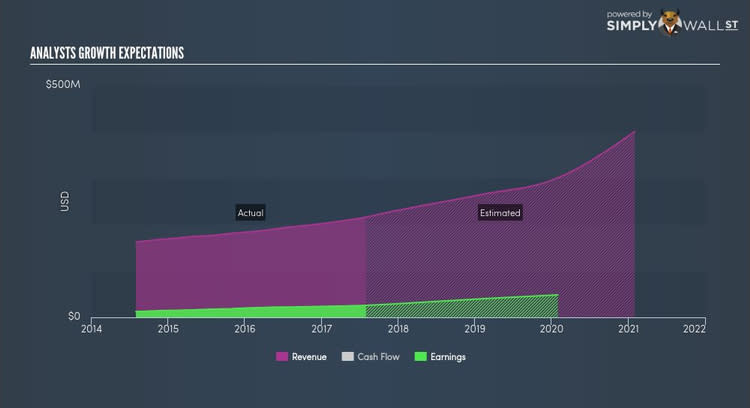

The Descartes Systems Group Inc (TSX:DSG)

The Descartes Systems Group Inc. provides federated network and logistics technology solutions worldwide. The company was established in 1981 and has a market cap of CAD CA$2.90B, putting it in the mid-cap group.

DSG is expected to deliver an extremely high earnings growth over the next couple of years of 69.36%, driven by a positive double-digit revenue growth of 30.87% and cost-cutting initiatives. An affirming signal is when net income increase also comes with top-line growth. Even though some cost-reduction initiatives may have also pushed up margins, in the case of DSG, it does not appear extreme. We see this bottom-line expansion directly benefiting shareholders, with expected positive return on equity of 9.22%. DSG’s impressive outlook on all aspects makes it a worthy company to spend more time to understand. Considering DSG as a potential investment? Have a browse through its key fundamentals here.

For more financially robust companies with high growth potential to enhance your portfolio, use our free platform to explore our interactive list of these stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.