Best Growth Stocks To Buy

Some investors like great businesses with a cheap price tag, which will allow them to reap capital gains as the price moves towards the true value of the company. Other investors like to bet on high-growth companies and their potential to grow further. In this article, I’ve put together a list of stocks which delivered strong outcome for two or more fundamental aspects, making them appealing investments .

Sinopec Shanghai Petrochemical Company Limited (SEHK:338)

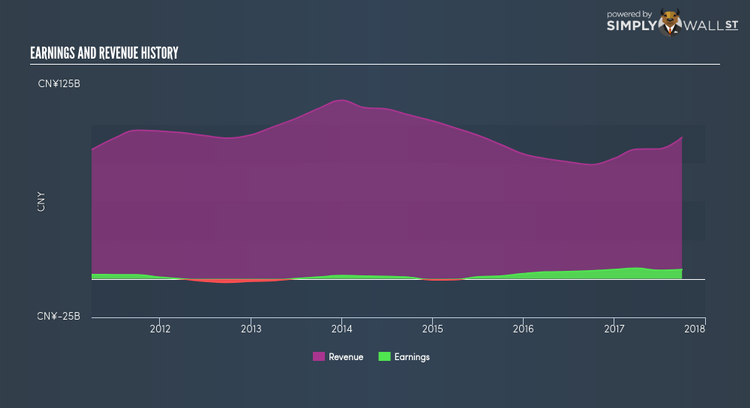

Sinopec Shanghai Petrochemical Company Limited, together with its subsidiaries, manufactures and sells petrochemical products in the People’s Republic of China. Founded in 1972, and run by CEO , the company provides employment to 10,721 people and with the company’s market capitalisation at HKD HK$68.06B, we can put it in the large-cap stocks category.

338’s strong 23.89% returns in the past year, exceeding its chemicals peers’ growth of 8.81% offer investors comfort in its demonstrated capacity to grow its profitability. 338’s upcoming commitments are met by its short-term assets, and its debt is adequately covered by its operating cash, portraying its strong financial capacity. What’s more is, 338’s consistent dividend payout, which has grown over a long period of time, makes it one of the highest dividend payers in the market. Dig deeper into Sinopec Shanghai Petrochemical here.

Xiabuxiabu Catering Management (China) Holdings Co., Ltd. (SEHK:520)

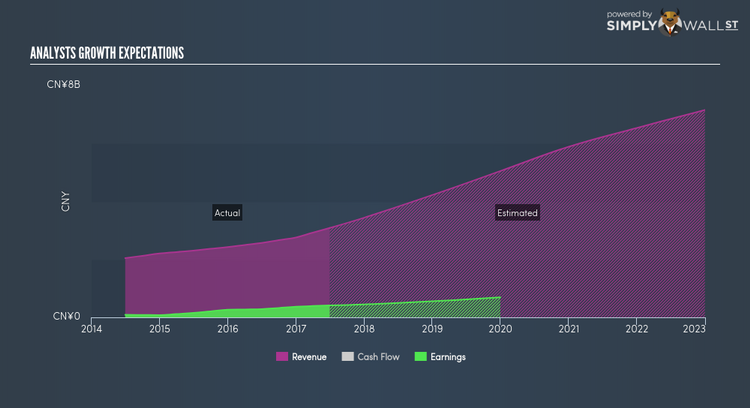

Xiabuxiabu Catering Management (China) Holdings Co., Ltd., an investment holding company, operates Chinese hotpot restaurants primarily under the Xiabuxiabu brand name in China. Started in 1998, and currently headed by CEO Shuling Yang, the company employs 16,888 people and with the market cap of HKD HK$15.10B, it falls under the large-cap category.

520 is an attractive stock for growth-seeking investors, with an expected earnings growth of 22.71% in the upcoming year, with an eye-catching top-line trajectory of 50.02%. 520’s earnings growth in the past year of 46.15%, leading to an equally impressive triple-digit return on equity, is an impressive feat for the company. Likewise, 520 has sufficient cash and investments to meet its upcoming liabilities, and the company has zero debt on its balance sheet, portraying its strong financial capacity. Continue research on Xiabuxiabu Catering Management (China) Holdings here.

Sunny Optical Technology (Group) Company Limited (SEHK:2382)

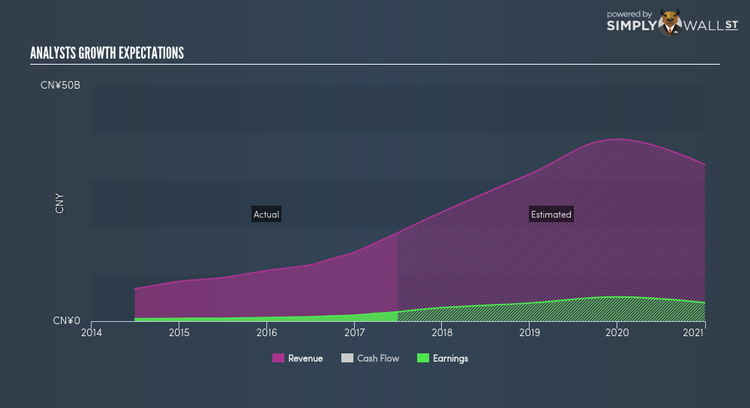

Sunny Optical Technology (Group) Company Limited, an investment holding company, researches and develops, designs, manufactures, and sells optical and optical-related products, and scientific instruments. Established in 1984, and now run by , the company employs 22,147 people and with the market cap of HKD HK$135.09B, it falls under the large-cap group.

2382 is an attractive stock for growth-seeking investors, with an expected earnings growth of 31.30% in the upcoming year, bolstered by an impressive double-digit top-line expansion of 86.06%. 2382’s ability to more than double its earnings in the past, producing an outstanding triple-digit return to shareholders, is an impressive feat for the company. In addition to this, 2382 has sufficient cash and investments to meet its upcoming liabilities, and its debt is adequately covered by its operating cash, which indicates its strong financial position. Dig deeper into Sunny Optical Technology (Group) here.

For more fundamentally-robust companies with industry-beating characteristics to enhance your portfolio, use our free platform to explore our interactive list of big green snowflake stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.