Best Income Stocks to Buy for March 8th

Here are three stocks with buy rank and strong income characteristics for investors to consider today, March 8th:

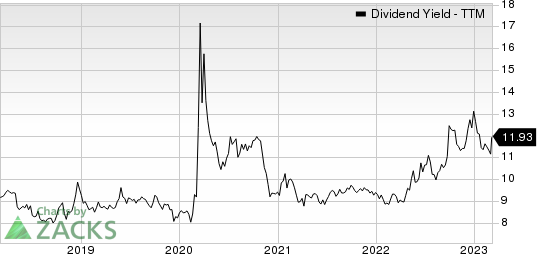

Goldman Sachs BDC GSBD: This specialty finance company that invests primarily in telecommunication services, electronic equipment, instruments and components and real estate management and development industries, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 7.5% over the last 60 days.

Goldman Sachs BDC, Inc. Price and Consensus

Goldman Sachs BDC, Inc. price-consensus-chart | Goldman Sachs BDC, Inc. Quote

This Zacks Rank #1 (Strong Buy) company has a dividend yield of 11.93%, compared with the industry average of 9.87%.

Goldman Sachs BDC, Inc. Dividend Yield (TTM)

Goldman Sachs BDC, Inc. dividend-yield-ttm | Goldman Sachs BDC, Inc. Quote

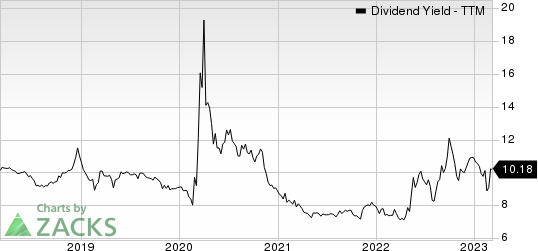

Hercules Capital HTGC: This specialty finance company that provides venture capital to technology and life science-related companies, has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.1% over the last 60 days.

Hercules Capital, Inc. Price and Consensus

Hercules Capital, Inc. price-consensus-chart | Hercules Capital, Inc. Quote

This Zacks Rank #1 company has a dividend yield of 10.18%, compared with the industry average of 9.87%.

Hercules Capital, Inc. Dividend Yield (TTM)

Hercules Capital, Inc. dividend-yield-ttm | Hercules Capital, Inc. Quote

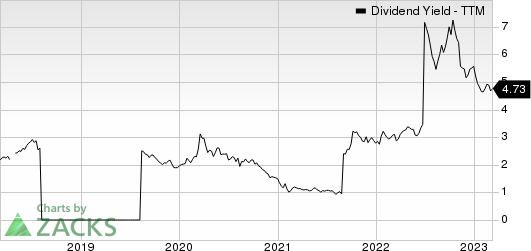

ASE Technology ASX: This company which is a provider of semiconductor manufacturing services in assembly and testing, has witnessed the Zacks Consensus Estimate for its current year earnings increasing nearly 5.1% over the last 60 days.

ASE Technology Holding Co., Ltd. Price and Consensus

ASE Technology Holding Co., Ltd. price-consensus-chart | ASE Technology Holding Co., Ltd. Quote

This Zacks Rank #1 company has a dividend yield of 4.73%, compared with the industry average of 0.00%.

ASE Technology Holding Co., Ltd. Dividend Yield (TTM)

ASE Technology Holding Co., Ltd. dividend-yield-ttm | ASE Technology Holding Co., Ltd. Quote

See the full list of top ranked stocks here.

Find more top income stocks with some of our great premium screens

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Hercules Capital, Inc. (HTGC) : Free Stock Analysis Report

ASE Technology Holding Co., Ltd. (ASX) : Free Stock Analysis Report

Goldman Sachs BDC, Inc. (GSBD) : Free Stock Analysis Report