What’s The Best Minimum Volatility ETF?

As the markets continue to digest the ongoing crisis in Europe, unemployment figures, and whether or not central bank action will come to fruition—high beta equities aren’t necessarily the best bet for some. That’s where minimum volatility ETFs come into play.

Minimum volatility ETFs hold lower beta stocks relative to their targeted benchmark. The idea is that investors get exposure to a portfolio with minimized risks—as well as returns. The highs aren’t so high, but the lows aren’t too low either.

Earlier this year, my colleague Paul Baiocchi professed his love for the PowerShares S&P 500 Low Volatility Portfolio (SPLV). However, there are 6 other funds that aim to provide the same strategy to investors.

Deciding on the best fund depends on the exposure you’re targeting. Although there are only seven funds available in the space, exposure ranges from U.S. large-caps to global total market exposure.

The iShares MSCI All Country World Minimum Volatility Fund (ACWV) is currently the only fund that targets the global equity space by selecting its holdings from the MSCI All Country World Index. Like most of the minimum volatility funds, it’s prone to sector biases—consumer staples and health care stocks accounting for nearly a third of the fund. Still, at 35 bps, ACWV is competitive in pricing relative to other total market equity ETFs. Year-to-date, the fund has slightly underperformed the MSCI ACWI Index. However, it showed its true strength during the pullback that started in late April.

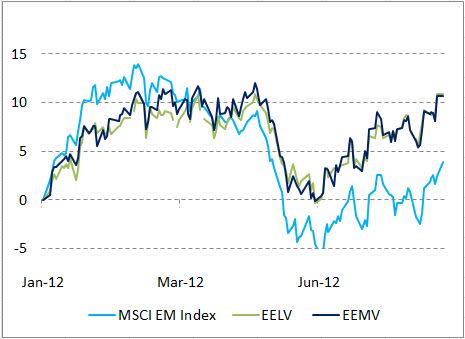

In the emerging markets space, investors have two funds at their disposal—the PowerShares S&P Emerging Markets Low Volatility Fund (EELV) and the iShares MSCI Emerging Markets Minimum Volatility Fund (EEMV). Differences in costs are minimal. EELV’s expense ratio of 29 bps is 4 bps more expensive than EEMV. However, EEMV is much more liquid than EELV, with over 40,000 shares changing hands per day. Both funds are heavily exposed to financials and consumer non-cyclicals, and both contain exposure to South Korea—a country some consider to be a developed economy. EELV does a better job of avoiding South Korea, with only 3 percent invested versus 10 percent in EEMV.

The key difference is that EEMV tilts heavily toward large-caps, with nearly 40 percent invested in companies worth more than $12 billion in market cap, while only about 20 percent of EELV is invested in the space. Still, both funds have performed similarly throughout the course of 2012.

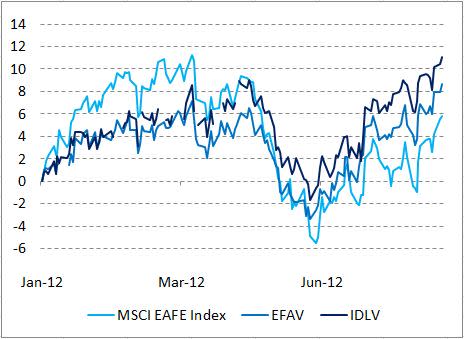

The iShares MSCI EAFE Minimum Volatility Fund (EFAV) and the PowerShares S&P International Developed Low Volatility Fund (IDLV) duke it out in the developed ex-U.S. space. PowerShares’ IDLV comes out as the slightly more expensive fund, with a price tag of 25 bps, while EFAV follows behind at 20 bps. Both funds trade a few thousand shares per day, making them harder to trade for smaller investors. Size tilts and country differences are huge. Nearly 60 percent of EFAV is exposed to large-caps, while about 30 percent of IDLV is invested in the large-cap space. Japan (43 percent) and Canada (16 percent) are the heavyweights in IDLV, while the United Kingdom makes up 28 percent of EFAV with Japan (27 percent) at a close second.

IDLV came out in mid-January, but has outperformed EFAV in uptrends—likely due to EFAV’s heavy exposure to large-caps.

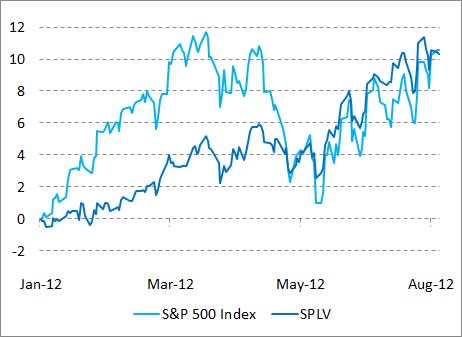

SPLV is the only minimum volatility fund that offers exposure to the U.S. large-cap space by selecting its holdings from the S&P 500. So far, as my colleague Paul pointed out , the fund has done a great job of mitigating risks relative to the S&P 500 during periods of increased volatility—as we saw in the beginning of June.

Just keep in mind that SPLV isn’t immune to sector biases. Nearly one-third of SPLV is exposed to the utilities sector—a space that makes up less than 4 percent of the S&P 500. Meanwhile, non-cyclical consumer goods make up over a quarter of the fund—more than double the exposure in the S&P 500.

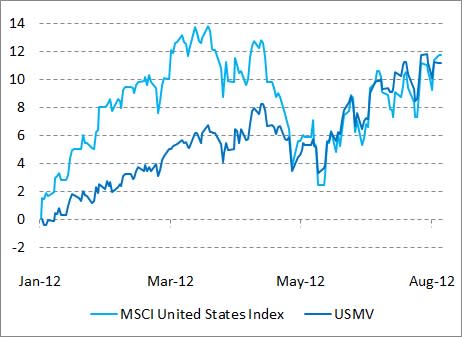

If you’re willing to reach out a little further than just U.S. large-caps, then the iShares MSCI USA Minimum Volatility Fund (USMV) is the best option for you. The fund selects its holdings from the MSCI USA Index—and does so for 15 bps, 10 bps less than SPLV—for much broader exposure. Health care and consumer companies make up the bulk of the fund, while it underweights technology and energy stocks when compared with the MSCI United States Index.

Going for a minimum volatility ETF is a great option for those who don’t want to stomach the highs and lows in the current environment. The key is understanding the biases and tilts within these portfolios.

Contact Ugo Egbunike at uegbunike@indexuniverse.com .

At the time this article was written, the author held positions in SPLV.

Permalink | ' Copyright 2012 IndexUniverse LLC. All rights reserved

More From IndexUniverse.com