Best NYSE Dividend Payers

Dividend-paying companies such as Schweitzer-Mauduit International and CenterPoint Energy can diversify your portfolio cash flow by paying constant and large dividends. These stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. Dividends can be underrated but they form a large part of investment returns, playing an important role in compounding returns in the long run. If you’re a long term investor, these high-performing top dividend stocks can boost your monthly portfolio income.

Schweitzer-Mauduit International, Inc. (NYSE:SWM)

Schweitzer-Mauduit International, Inc., together with its subsidiaries, provides engineered solutions and advanced materials for various industries worldwide. Established in 1995, and run by CEO Jeffrey Kramer, the company size now stands at 3,600 people and with the stock’s market cap sitting at USD $1.29B, it comes under the small-cap group.

SWM has a great dividend yield of 4.09% and distributes 151.14% of its earnings to shareholders as dividends . Over the past 10 years, SWM has increased its dividends from US$0.30 to US$1.72. During this period, they haven’t missed a payment, as one would expect from a company increasing their dividend. Schweitzer-Mauduit International could be a good investment for its future growth, with analysts expecting the company’s earnings to grow by an exciting triple-digit over the next 12 months More on Schweitzer-Mauduit International here.

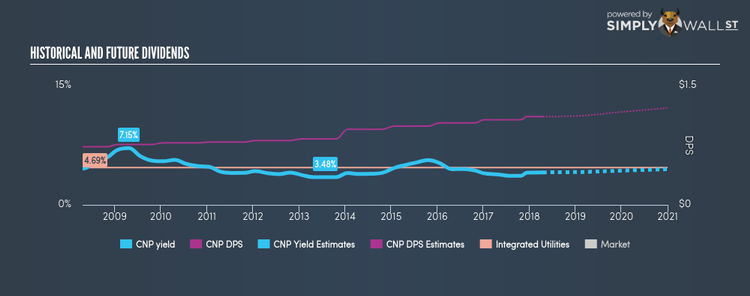

CenterPoint Energy, Inc. (NYSE:CNP)

CenterPoint Energy, Inc. operates as a public utility holding company in the United States. Established in 1882, and currently run by Scott Prochazka, the company now has 7,977 employees and with the stock’s market cap sitting at USD $11.72B, it comes under the large-cap stocks category.

CNP has a large dividend yield of 4.09% and pays 25.73% of its earnings as dividends , with analysts expecting this ratio to be 69.78% in the next three years. The company’s DPS has increased from US$0.73 to US$1.11 over the last 10 years. To the enjoyment of shareholders, the company hasn’t missed a payment during this period. The company recorded earnings growth of 314.82% in the past year, comparing favorably with the us integrated utilities industry average of -2.14%. Interested in CenterPoint Energy? Find out more here.

The Gap, Inc. (NYSE:GPS)

The Gap, Inc. operates as an apparel retail company worldwide. Established in 1969, and currently lead by Arthur Peck, the company provides employment to 135,000 people and has a market cap of USD $11.89B, putting it in the large-cap stocks category.

GPS has a solid dividend yield of 3.28% and is distributing 42.64% of earnings as dividends . GPS has increased its dividend from US$0.34 to US$0.97 over the past 10 years. It should comfort existing and potential future shareholders to know that GPS hasn’t missed a payment during this time. Continue research on Gap here.

For more solid dividend paying companies to add to your portfolio, explore this interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.