Best NYSE Utilities Dividend Picks For The Day

Regulated distribution utilities are among the most defensive investments available with solid cash flow, high dividend pay-out ratios, and low cyclicality. Therefore, these companies provide a strong reliable stream of constant income which is a great diversifier during economic downturns. I’ve identify the following utilities stocks paying high income, which may increase the value of your portfolio.

AT&T Inc. (NYSE:T)

T has a great dividend yield of 5.93% and pays 94.00% of it’s earnings as dividends . The company’s DPS have increased from $1.42 to $1.96 over the last 10 years. Much to the delight of shareholders, the company has not missed a payment during this time.

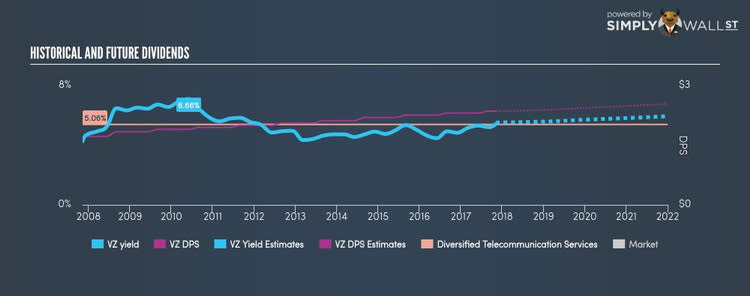

Verizon Communications Inc. (NYSE:VZ)

VZ has an appealing dividend yield of 5.10% and their current payout ratio is 59.53% , with the expected payout in three years being 62.62%. VZ’s dividends have increased since they started paying 10 years ago, with DPS increasing from $1.72 to $2.36. They have been dependable too, not missing a single payment in this time.

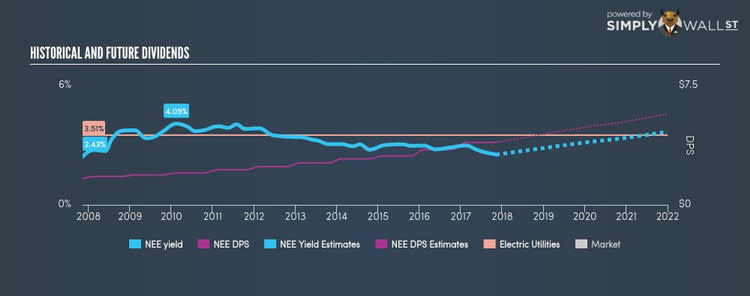

NextEra Energy, Inc. (NYSE:NEE)

NEE has a sizeable dividend yield of 2.53% and is paying out 42.65% of profits as dividends , with analysts expecting the payout ratio in three years to be 62.84%. NEE’s DPS have risen to $3.93 from $1.64 over a 10 year period. It should comfort existing and potential future shareholders to know that NEE hasn’t missed a payment during this time. NextEra Energy’s earnings per share growth of 70.77% over the past 12 months outpaced the us electric utilities industry’s average growth rate of 5.48%.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.