Best Rated NYSE Dividend Stocks

Pinnacle West Capital is one of the ten dividend stocks that can help raise your investment income by paying sizeable dividends. These stocks are a safe bet to increase your portfolio value as they provide both steady income and cushion against market risks. A large part of investment returns can be generated by dividend-paying stock given their role in compounding returns over time. Below are more huge dividend-paying stocks that continues to add value to my portfolio holdings.

Pinnacle West Capital Corporation (NYSE:PNW)

Pinnacle West Capital Corporation, through its subsidiary, Arizona Public Service Company, provides retail and wholesale electric services primarily in the state of Arizona. Established in 1920, and now run by Donald Brandt, the company size now stands at 6,339 people and has a market cap of USD $10.14B, putting it in the large-cap category.

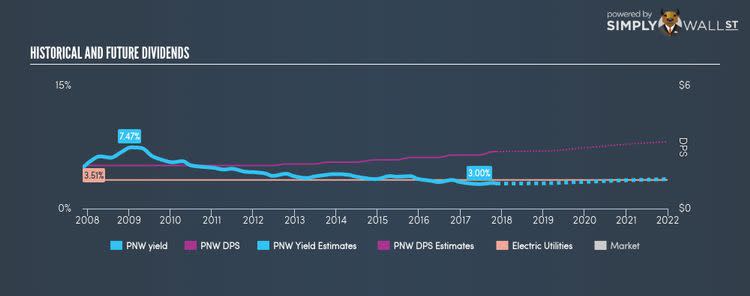

PNW has a good-sized dividend yield of 3.06% and the company currently pays out 56.28% of its profits as dividends , with analysts expecting the payout ratio in three years to be 63.31%. PNW’s dividends have seen an increase over the past 10 years, with payments increasing from $2.1 to $2.78 in that time. It should comfort existing and potential future shareholders to know that PNW hasn’t missed a payment during this time.

The Western Union Company (NYSE:WU)

The Western Union Company provides money movement and payment services worldwide. Established in 2006, and headed by CEO Hikmet Ersek, the company size now stands at 10,700 people and with the market cap of USD $9.00B, it falls under the mid-cap stocks category.

WU has a sizeable dividend yield of 3.46% and is paying out 155.45% of profits as dividends . The company’s DPS have increased from $0.04 to $0.7 over the last 10 years. It should comfort existing and potential future shareholders to know that WU hasn’t missed a payment during this time. The company also looks promising for it’s future growth, with analysts expecting an impressive triple-digit earnings per share increase over the next year.

CF Industries Holdings, Inc. (NYSE:CF)

CF Industries Holdings, Inc. manufactures and distributes nitrogen fertilizers and other nitrogen products worldwide. Started in 1946, and run by CEO W. Will, the company now has 2,950 employees and with the company’s market cap sitting at USD $8.24B, it falls under the mid-cap category.

CF has a good dividend yield of 3.32% and is paying out -65.51% of profits as dividends , with analysts expecting a 60.04% payout in the next three years. In the last 10 years, shareholders would have been happy to see the company increase its dividend from $0.016 to $1.2. They have been consistent too, not missing a payment during this 10 year period. CF Industries Holdings also looks promising for it’s growth over the next year, with analysts expecting a double digit earnings per share increase of 97%.

For more solid dividend payers to add to your portfolio, you can use our free platform to explore our interactive list of top dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.