Best Rated TSX Stocks For Cheap

Companies that trade at market prices below their actual values, such as PFB and AirIQ, are perceived to be undervalued. Investors can profit from the difference by investing in these stocks as the current market prices should eventually move towards their true values. If capital gains are what you’re after in your next investment, I’ve put together a list of undervalued stocks you may be interested in, based on the latest financial data from each company.

PFB Corporation (TSX:PFB)

PFB Corporation manufactures and markets insulating building products made from expanded polystyrene materials primarily for the residential and commercial construction projects in North America. Formed in 1968, and headed by CEO C. Smith, the company now has 395 employees and with the company’s market cap sitting at CAD CA$61.38M, it falls under the small-cap category.

PFB’s shares are now floating at around -47% beneath its intrinsic level of $17.2, at the market price of $9.14, based on its expected future cash flows. This mismatch indicates a potential opportunity to buy low. Moreover, PFB’s PE ratio is trading at 28.1x compared to its building peer level of 8.5x, implying that relative to its peers, PFB’s stock can be bought at a cheaper price. PFB also has a healthy balance sheet, with current assets covering liabilities in the near term and over the long run. It’s debt-to-equity ratio of 24% has over time, indicating PFB’s ability

AirIQ Inc. (TSXV:IQ)

AirIQ Inc. develops and operates an asset management system using specialized software, digitized mapping, wireless communications, the Internet, and the global positioning system in Canada. AirIQ was formed in 1935 and with the company’s market cap sitting at CAD CA$5.06M, it falls under the small-cap stocks category.

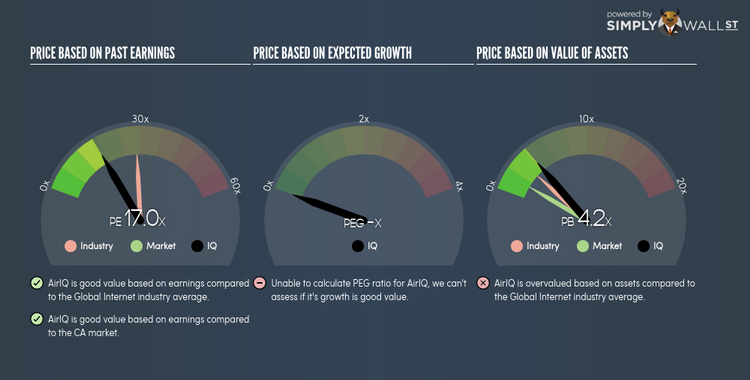

IQ’s stock is now hovering at around -67% under its actual value of $0.52, at the market price of $0.17, according to my discounted cash flow model. This mismatch indicates a potential opportunity to buy low. Moreover, IQ’s PE ratio is trading at around 17x relative to its internet peer level of 28.7x, meaning that relative to its comparable company group, IQ’s stock can be bought at a cheaper price. IQ is also a financially robust company, as current assets can cover liabilities in the near term and over the long run. IQ also has a miniscule amount of debt on its balance sheet, which gives it headroom to grow and financial flexibility.

Armada Data Corporation (TSXV:ARD)

Armada Data Corporation engages in the accumulation and sale of data related to the purchase of new and used vehicles. Armada Data was started in 1999 and has a market cap of CAD CA$2.47M, putting it in the small-cap category.

ARD’s stock is currently floating at around -40% below its value of $0.23, at the market price of $0.14, based on its expected future cash flows. signalling an opportunity to buy the stock at a low price. In terms of relative valuation, ARD’s PE ratio stands at 11x against its its internet peer level of 28.7x, indicating that relative to its comparable company group, we can invest in ARD at a lower price. ARD is also in good financial health, as current assets can cover liabilities in the near term and over the long run. ARD has zero debt on its books as well, meaning it has no long term debt obligations to worry about.

For more financially sound, undervalued companies to add to your portfolio, you can use our free platform to explore our interactive list of undervalued stocks.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.