Best Undervalued Dividend Paying Companies On SEHK

Dividend investors looking for a new stock to add to their portfolio should consider PAX Global Technology, Stella International Holdings and Texhong Textile Group. These companies are currently undervalued, which means investors will gain from dividend income as well as capital appreciation over time. If you’re a long term investor, these cheap dividend stocks can boost your portfolio value.

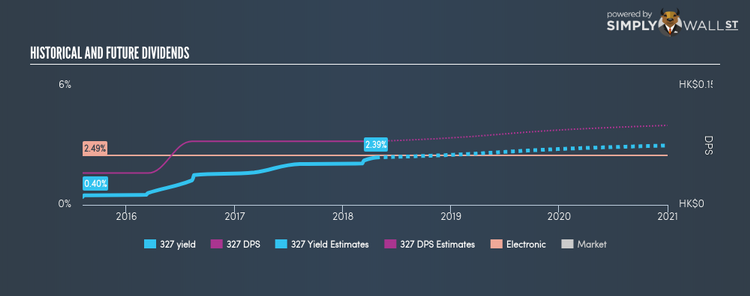

PAX Global Technology Limited (SEHK:327)

PAX Global Technology Limited, an investment holding company, engages in the development and sale of electronic funds transfer point-of-sale products worldwide. Formed in 2000, and now run by Jie Lu, the company provides employment to 1,514 people and with the stock’s market cap sitting at HKD HK$3.69B, it comes under the mid-cap category.

PAX Global Technology has been paying dividend over the past 3 years. It currently paid an annual dividend of HK$0.08, resulting in a dividend yield of 2.39%. At the current payout ratio of 21.78%, 327’s yield exceeds Hong Kong’s low risk savings rate of 1.66%. Analysts forecast future payout ratio to be 16.89%, indicating that 327’s upcoming dividend payments are well-covered by earnings. 327 is also undervalued by 49.08%, which means 327 is currently an attractive buy for those looking for dividend and capital gains. Dig deeper into PAX Global Technology here.

Stella International Holdings Limited (SEHK:1836)

Stella International Holdings Limited develops, manufactures, and retails footwear products and leather goods for men and women. Established in 1982, and run by CEO Li-Ming Chen, the company currently employs 63,000 people and has a market cap of HKD HK$6.90B, putting it in the mid-cap group.

Over the past 10 years, Stella International Holdings has been distributing dividends back to its shareholders, with a recent yield of 6.90%. Not only does 1836’s dividend yield beat Hong Kong’s low risk savings rate of 1.66%, it also exceeds the best-in-class dividend payer average yield of 4.21%. In addition to this, 1836 is also trading beneath its true value by 38.58%, which means 1836 is currently an attractive buy for those looking for dividend and capital gains. Interested in Stella International Holdings? Find out more here.

Texhong Textile Group Limited (SEHK:2678)

Texhong Textile Group Limited, an investment holding company, primarily manufactures and sells yarns, grey fabrics, and garment fabrics. Formed in 1997, and currently headed by CEO Yongxiang Zhu, the company now has 38,024 employees and with the market cap of HKD HK$10.01B, it falls under the large-cap group.

Over the past 10 years, Texhong Textile Group has been distributing dividends back to its shareholders, with a recent yield of 4.11%. 2678’s dividend per share have been growing over the past 10 years, with a payout ratio of 29.77%, indicating earnings are able to cover the payments. Furthermore, 2678’s dividend yield exceed Hong Kong’s low risk savings rate which currently sits at 1.66%. In addition to this, 2678 is also undervalued by 60.93%, meaning 2678 can be bought at an attractive price right now. More on Texhong Textile Group here.

For more mispriced dividend stocks to add to your portfolio, explore this interactive list of undervalued dividend payers.

To help readers see pass the short term volatility of the financial market, we aim to bring you a long-term focused research analysis purely driven by fundamental data. Note that our analysis does not factor in the latest price sensitive company announcements.

The author is an independent contributor and at the time of publication had no position in the stocks mentioned.