Best Value Stocks to Buy for November 4th

Here are four stocks with buy rank and strong value characteristics for investors to consider today, November 4th:

MarineMax, Inc. HZO: This recreational boat and yacht retailer has a Zacks Rank #1 (Strong Buy), and seen the Zacks Consensus Estimate for its current year earnings rising 9.2% over the last 60 days.

MarineMax, Inc. Price and Consensus

MarineMax, Inc. price-consensus-chart | MarineMax, Inc. Quote

MarineMax has a price-to-earnings ratio (P/E) of 7.41, compared with 9.80 for the industry. The company possesses a Value Score of A.

MarineMax, Inc. PE Ratio (TTM)

MarineMax, Inc. pe-ratio-ttm | MarineMax, Inc. Quote

Covenant Logistics Group, Inc. CVLG: This company that provides transportation and logistics services has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 4.1% over the last 60 days.

Covenant Logistics Group, Inc. Price and Consensus

Covenant Logistics Group, Inc. price-consensus-chart | Covenant Logistics Group, Inc. Quote

Covenant Logistics has a price-to-earnings ratio (P/E) of 8.12, compared with 20.30 for the industry. The company possesses a Value Score of A.

Covenant Logistics Group, Inc. PE Ratio (TTM)

Covenant Logistics Group, Inc. pe-ratio-ttm | Covenant Logistics Group, Inc. Quote

Radian Group Inc. RDN: This company that provides hardware platform and supply chain solutions has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 3.6% over the last 60 days.

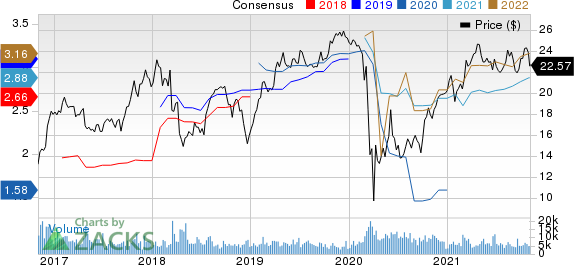

Radian Group Inc. Price and Consensus

Radian Group Inc. price-consensus-chart | Radian Group Inc. Quote

Radian Group has a price-to-earnings ratio (P/E) of 7.84, compared with 18.50 for the industry. The company possesses a Value Score of B.

Radian Group Inc. PE Ratio (TTM)

Radian Group Inc. pe-ratio-ttm | Radian Group Inc. Quote

Repsol, S.A. REPYY: This integrated energy company has a Zacks Rank #1, and seen the Zacks Consensus Estimate for its current year earnings rising 13.3% over the last 60 days.

Repsol, S.A. Price and Consensus

Repsol, S.A. price-consensus-chart | Repsol, S.A. Quote

Repsol has a price-to-earnings ratio (P/E) of 6.66, compared with 8.40 for the industry. The company possesses a Value Score of B.

Repsol, S.A. PE Ratio (TTM)

Repsol, S.A. pe-ratio-ttm | Repsol, S.A. Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Radian Group Inc. (RDN) : Free Stock Analysis Report

Repsol SA (REPYY) : Free Stock Analysis Report

MarineMax, Inc. (HZO) : Free Stock Analysis Report

Covenant Logistics Group, Inc. (CVLG) : Free Stock Analysis Report

To read this article on Zacks.com click here.