Best Value Stocks to Buy for September 21st

Here are three stocks with buy rank and strong value characteristics for investors to consider today, September 21st:

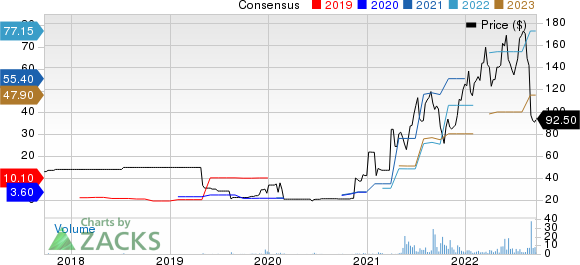

Orient Overseas International OROVY: This Hong Kong-based container transport and logistics services company which also provides freight management services, extensive domestic distribution services and supply-chain management, carries a Zacks Rank #1(Strong Buy) and has witnessed the Zacks Consensus Estimate for its current-year earnings increasing 14.0% over the last 60 days.

Orient Overseas International Ltd. Price and Consensus

Orient Overseas International Ltd. price-consensus-chart | Orient Overseas International Ltd. Quote

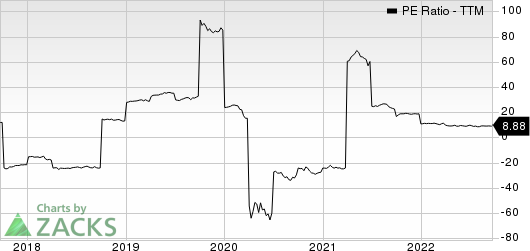

Orient Overseas International has a price-to-earnings ratio (P/E) of 1.20 compared with 11.40 for the industry. The company possesses a Value Score of A.

Orient Overseas International Ltd. PE Ratio (TTM)

Orient Overseas International Ltd. pe-ratio-ttm | Orient Overseas International Ltd. Quote

Permian Resources Corporation PR: This independent oil and natural gas company which focuses on the responsible acquisition, optimization and development of high-return oil and natural gas properties, carries a Zacks Rank #1 and has witnessed the Zacks Consensus Estimate for its current-year earnings increasing 6.3% over the last 60 days.

Permian Resources Corporation Price and Consensus

Permian Resources Corporation price-consensus-chart | Permian Resources Corporation Quote

Permian Resources Corporation has a price-to-earnings ratio (P/E) of 3.61 compared with 5.50 for the industry. The company possesses a Value Score of A.

Permian Resources Corporation PE Ratio (TTM)

Permian Resources Corporation pe-ratio-ttm | Permian Resources Corporation Quote

Axis Capital HoldingsAXS: This company which provides a broad range of specialty insurance and reinsurance solutions to its clients on a worldwide basis, through operating subsidiaries and branch networks based in Bermuda, the United States, Europe, Singapore, Canada, Latin America and the Middle East, carries a Zacks Rank #1, and has witnessed the Zacks Consensus Estimate for its current year earnings increasing 5.8% over the last 60 days.

Axis Capital Holdings Limited Price and Consensus

Axis Capital Holdings Limited price-consensus-chart | Axis Capital Holdings Limited Quote

Axis Capital Holdings has a price-to-earnings ratio (P/E) of 8.28 compared with 15.90 for the industry. The company possesses a Value Score of A.

Axis Capital Holdings Limited PE Ratio (TTM)

Axis Capital Holdings Limited pe-ratio-ttm | Axis Capital Holdings Limited Quote

See the full list of top ranked stocks here.

Learn more about the Value score and how it is calculated here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Axis Capital Holdings Limited (AXS) : Free Stock Analysis Report

Orient Overseas International Ltd. (OROVY) : Free Stock Analysis Report

Permian Resources Corporation (PR) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research