Some Beston Global Food (ASX:BFC) Shareholders Have Taken A Painful 74% Share Price Drop

Every investor on earth makes bad calls sometimes. But really bad investments should be rare. So take a moment to sympathize with the long term shareholders of Beston Global Food Company Limited (ASX:BFC), who have seen the share price tank a massive 74% over a three year period. That might cause some serious doubts about the merits of the initial decision to buy the stock, to put it mildly. The more recent news is of little comfort, with the share price down 44% in a year. Even worse, it's down 18% in about a month, which isn't fun at all. We do note, however, that the broader market is down 8.8% in that period, and this may have weighed on the share price.

View our latest analysis for Beston Global Food

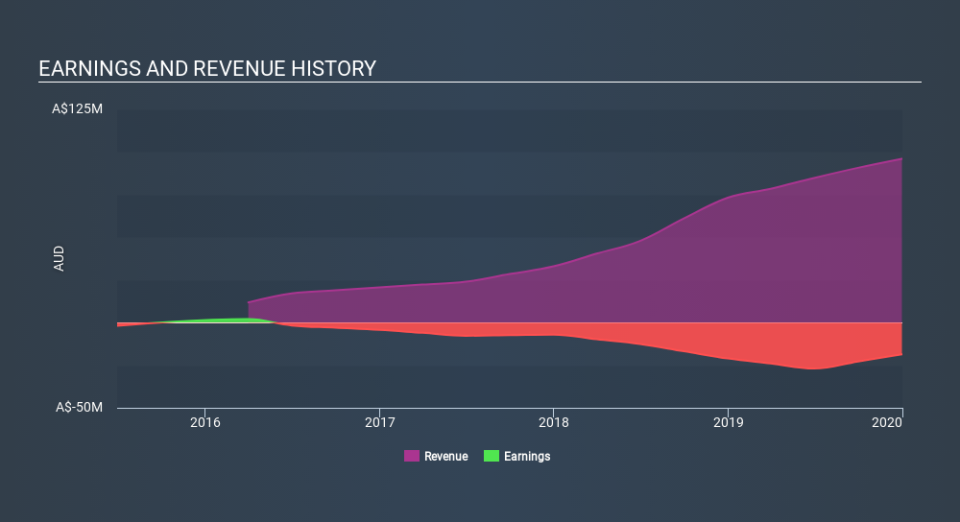

Beston Global Food isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Beston Global Food grew revenue at 53% per year. That's well above most other pre-profit companies. So on the face of it we're really surprised to see the share price down 36% a year in the same time period. You'd want to take a close look at the balance sheet, as well as the losses. Sometimes fast revenue growth doesn't lead to profits. If the company is low on cash, it may have to raise capital soon.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Beston Global Food stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Over the last year, Beston Global Food shareholders took a loss of 44%. In contrast the market gained about 7.3%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Shareholders have lost 36% per year over the last three years, so the share price drop has become steeper, over the last year; a potential symptom of as yet unsolved challenges. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 6 warning signs for Beston Global Food you should be aware of, and 2 of them are significant.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on AU exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.