Better Buy: Activision Blizzard vs. Take-Two Interactive

Top video game stocks have been rewarding investments over the last five years, but shares of Activision Blizzard (NASDAQ: ATVI) were cut nearly in half over the last six months as the company's recent performance failed to impress investors.

Meanwhile, Take-Two Interactive (NASDAQ: TTWO) has enjoyed robust revenue growth stemming from the blockbuster release of Red Dead Redemption 2 in the fall. Despite that success, the stock is down 34% in the last six months.

The video game industry is expected to grow at a double-digit rate, and I believe the leading game companies have a lot to offer investors who are focused on the long term. We'll compare Activision Blizzard and Take-Two on financial fortitude, growth expectations, and valuation to determine which stock is the better buy today.

Image source: Getty Images.

Financial fortitude

First up, we're going to compare both companies on how much cash, debt, and free cash flow they generate. This may not be as interesting as reading about games and growth opportunities, but financial fortitude can go a long way in the video game industry. For instance, Activision CEO Bobby Kotick has made good use of his company's cash over the years, including the merger with Blizzard in 2008, the Vivendi buyback in 2013, and the $5.9 billion acquisition of mobile-game maker King Digital Entertainment in 2016.

Take-Two CEO Strauss Zelnick is known to be a savvy dealmaker, too. However, given Take-Two's relatively smaller size, Zelnick has had to go after smaller fare, such as the $250 million acquisition of Spain-based mobile-game maker Social Point in 2017.

Companies with cash to spare have plenty of opportunities to expand, not only through new game development, but also accretive acquisitions. And there is the potential for dividends and share repurchases.

With that in mind, here's how Activision and Take-Two measure up:

Metric | Activision Blizzard | Take-Two Interactive |

|---|---|---|

Cash | $4.2 billion | $1.6 billion |

Debt | $2.67 billion | $0 |

Revenue (TTM) | $7.5 billion | $2.58 billion |

Free cash flow (TTM) | $1.66 billion | $485 million |

Data source: YCharts. TTM = Trailing 12 months.

Activision has over $2 billion of debt, while Take-Two has zero debt. However, after subtracting debt, both companies have about the same net cash balance of approximately $1.6 billion.

The scales tilt in Activision's favor when considering that it generates significantly more free cash flow than Take-Two. Activision has already used its cash to pay down $1.7 billion of debt in 2018.

Overall, I would give the edge to Activision, as it is equal in net cash balance, but generates significantly more free cash flow, which opens the door to more reinvestment opportunities.

Winner: Activision Blizzard.

Growth expectations

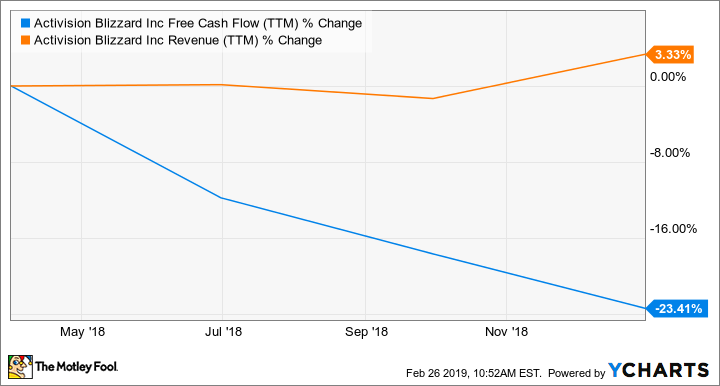

Take-Two has grown much faster than Activision over the last year, as you can see in the following charts. First, a look at Activision's revenue and free-cash-flow growth:

ATVI Free Cash Flow (TTM) data by YCharts.

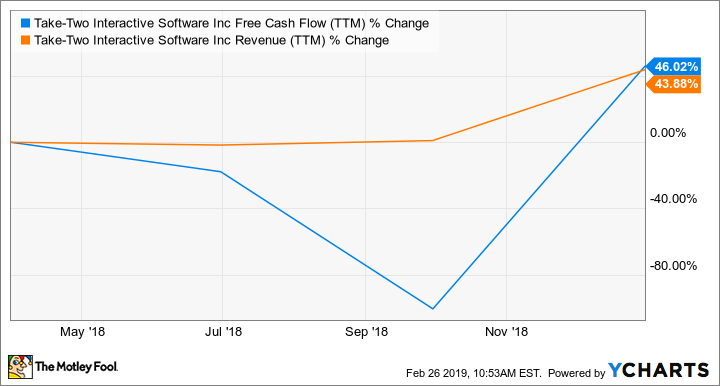

Here's a look at Take-Two's performance:

TTWO Free Cash Flow (TTM) data by YCharts.

Activision has a more diversified game roster than Take-Two, which has provided the Call of Duty maker more opportunities to grow digital revenue from players buying additional content while playing a game. The industry has shifted to this model of selling add-on content after the initial sale, as it lengthens the life cycle of a game and keeps players engaged for more extended periods. It also helps boost margins since digital add-on content is less costly than making the game itself. In 2017, Activision generated more than $4 billion, or more than half of its annual revenue, from in-game spending.

However, Activision has run into problems lately with some of its games not performing well. The company's monthly active users have steadily declined, and this has hurt in-game spending. Activision still managed to grow non-GAAP revenue by 7% year over year in the fourth quarter. But fourth-quarter adjusted revenue of $2.835 billion was below management's guidance of $3 billion.

The company is moving fast to fix the problem by beefing up its game development staff and cutting costs in other areas to double down on its franchises with the best growth opportunities. Management is calling 2019 a transition year, which means there likely won't be much growth in the near term. Analysts expect Activision to post revenue growth of less than 1% in 2019, but adjusted earnings per share are expected to drop by 15% to $2.20.

On the other side, Take-Two is looking strong. The company saw non-GAAP revenue jump 140% year over year in the last quarter driven by the blockbuster release of Red Dead Redemption 2, which has already sold 23 million copies since October.

NBA 2K19 has also been a strong seller. The latest version of the basketball series is on pace to be Take-Two's best-selling sports title in the company's history. Other games contributed to the company's growth recently, such as Social Point's mobile games Monster Legends and Dragon City, as well as Grand Theft Auto Online and Sid Meier's Civilization VI.

The massive success of Red Dead Redemption 2 will make year-over-year growth comparisons difficult for Take-Two in fiscal 2020 (which ends in March). This is why analysts expect the company to report a decline in revenue in the next fiscal year of 5.4%, with earnings expected to increase by 4% over fiscal 2019.

Overall, given the engagement issues plaguing Activision now, and considering Take-Two's momentum and long-term opportunities to grow through new franchises, I would give Take-Two the edge here.

Winner: Take-Two Interactive.

Valuation and dividends

So far, we have a tie, which means this better-buy contest is coming down to valuation. Here's how both stocks stack up on key valuation metrics:

Metric | Activision Blizzard | Take-Two Interactive |

|---|---|---|

Trailing P/E | 17.86 | 27.38 |

Forward P/E | 16.26 | 17.49 |

P/Sales | 4.27 | 3.58 |

Dividend yield | 0.88% | NA |

Dividend payout as a percentage of free cash flow | 15.61% | NA |

Data source: Yahoo! Finance and YCharts.

Activision wins on every measure except the price-to-sales ratio. The Overwatch maker has a lower price-to-earnings ratio, and its more diverse game portfolio brings in a larger stream of revenue and free cash flow, which allows Activision to distribute a small portion of its profits to shareholders in the form of dividends.

Winner: Activision Blizzard.

Activision Blizzard is the better buy

I like both Take-Two and Activision. Take-Two has the momentum, but Activision still has a lot going for it, such as growth opportunities in esports, consumer products, and cinematic experiences based on its best-selling games. Throw in a lower valuation and a dividend, and Activision gets my vote for the better buy today.

More From The Motley Fool

John Ballard owns shares of Activision Blizzard. The Motley Fool owns shares of and recommends Activision Blizzard and Take-Two Interactive. The Motley Fool has a disclosure policy.