Biblical ETF Makes Misleading Claims

Correction: The article previously stated that Ultimus Fund Solutions was previously an affiliate of Gemini Fund Services, BLES's distributor. BLES's distributor is Northern Lights Distributors, whose parent company, NorthStar Financial Services Group, sold its stake in Gemini Fund Services (including Northern Lights Distributors) to a third-party, who also bought Ultimus Fund Solutions. We apologize for the error.

On Tuesday, Oct. 15, Inspire Investing put out a press release announcing that, through the strength of its biblically based investment methodology, its flagship ETF, the $147 million Inspire Global Hope ETF (BLES) had doubled, even tripled the performance of its "secular" benchmark over multiple time periods, including year to date, one year and since inception.

But the problem is that the fund’s numbers can't be replicated. Also, the press release uses a comparison that is itself misleading, as Inspire is using an apples-to-oranges comparison of price return and total return that significantly inflates BLES' relative outperformance.

Dubious Claims

As one of the few faith-based ETFs on the market, BLES' goal is to invest globally in "biblically aligned" companies that satisfy a set of exclusionary screens that align with conservative Christian values, as well as a certain threshold for positive ESG rankings.

BLES' portfolio breaks down into 50%/50% U.S. and international stocks and, importantly, is equally weighted. As such, the MSCI ACWI Equal Weight is an obvious benchmark for comparison, and it's one that Inspire uses in its literature.

In the press release, Inspire claimed that, as of Sept. 30, 2019, BLES had returned 16.07% year to date. That's nearly double the return of its benchmark, which had returned 8.37%.

(Author's note: After we spoke with Inspire for this story, the firm amended the press release posted on its website to show updated figures of 16.70%, noting that the 16.07% figure was a typo. Using Bloomberg data, we were able to confirm that 16.7% is an accurate total return for BLES year to date. As far as we can tell, Inspire did not reissue the press release for wire distribution.)

However, 8.37% is not the return of the MSCI ACWI Equal Weight year to date. Bloomberg data and MSCI's own fact sheet agree that the actual index return for this period is 10.9%.

The discrepancy arises because Inspire is using not total return, but the price return of the MSCI ACWI Equal Weight, which did in fact rise 8.37% year to date.

BLES' Year-To-Date Returns, Inspire Data Vs. Bloomberg Data | |||

| YTD "Return" Inspire | YTD Total Returns, Bloomberg | YTD Price Change, Bloomberg |

16.70% | 16.68% | 14.50% | |

MSCI ACWI Equal Weight Index | 8.37% | 10.88% | 8.37% |

Sources: Inspire, Bloomberg; data range: Jan. 1, 2019 to Sept. 30, 2019

Price Return Vs. Total Return

The difference between price change and total return is subtle, but important.

The price return of an investment is simply the percentage difference between where that investment's price starts and where it ends up over some period of time. Its total return, meanwhile, incorporates the impact of interest payments, capital gains distributions, reinvested dividends and so forth.

For example, if ETF XYZ's starting value is $100 and its ending value is $110, then the XYZ's price change over that period is 10%. If ETF XYZ also had a 1% dividend over that same time period, which was reinvested, then the investor would see a total return of 11.1%.

In terms of understanding how a security's value changes over time, total return is a far more useful metric than price change, and for that reason, most investors rely on it when evaluating their potential investments, or when comparing their investments to relevant benchmarks.

Price Returns Used For All Time Periods

Inspire similarly uses the MSCI ACWI Equal Weight's price return for its one-year and since-inception comparisons.

Over a one-year period, Inspire claims that BLES was up 1.37%, compared with the MSCI ACWI Equal Weight's drop of 3.63%. However, -3.63% is the price return of the MSCI ACWI Equal Weight, whereas the total return of the index over that period is actually -0.96%.

Furthermore, we were unable to replicate Inspire's 1.37% figure for its ETF; using Bloomberg data, we found the total return for BLES is 0.97%. (Author's note: After we spoke to Inspire for this story, it amended the figure in its posted press release to 1.07%. We were unable to replicate that figure, either.)

BLES' 1-Year Returns, Inspire Data Vs. Bloomberg Data | |||

| YTD "Return" Inspire | 1 Year Total Returns, Bloomberg | 1 Year Price Change, Bloomberg |

1.37% | 0.97% | -1.77% | |

MSCI ACWI Equal Weight Index | -3.63% | -0.96% | -3.63% |

Sources: Inspire, Bloomberg; data range: Sept. 28, 2018 to Sept. 30, 2019

Finally, Inspire claims that, since inception, BLES has delivered 6.62% in annualized returns, or "three times" that of the MSCI ACWI Equal Weight, which returned 2.19%. We were unable to replicate either of these numbers. Instead, using Bloomberg data, we found that BLES had returned 6.30% since inception, compared with its benchmark's 5.17%.

BLES' Since Inception Returns, Inspire Data Vs. Bloomberg Data | |||

| Since-Inception "Return," Inspire | Since-Inception Total Returns, Bloomberg | Since-Inception Price Change, Bloomberg |

6.62% | 6.30% | 10.15% | |

MSCI ACWI Equal Weight Index | 2.19% | 5.17% | 5.95% |

Sources: Inspire, Bloomberg. Data range: Feb. 28, 2017 to Sept. 30, 2019. Returns are annualized.

Data Service Snafus?

When we spoke to Inspire for this article, CEO Robert Netzly blamed Inspire's data provider, Ultimus Fund Solutions, for the inconsistencies.

Ultimus Fund Solutions, which according to the most recent semi-annual report is owned by the same third-party firm that owns BLES's distributor, "gets their data directly from the NYSE and index providers, as far as I know," said Netzly. The performance figures for BLES, he stressed multiple times in a phone interview, are "all FINRA reviewed and approved."

"This is the only performance data FINRA allows us to publish," he added in an email.

Netzly also claimed that the data for the MSCI ACWI Equal Weight returns came from the index's fact sheet—an incorrect assertion, as the MSCI ACWI Equal Weight's fact sheet matches the Bloomberg data listed above.

"I don't know why Bloomberg might have different numbers," said Netzly.

When asked why Inspire compares BLES' total return to the MSCI ACWI Equal Weight's price return in its literature, Netzly acknowledged that was what Inspire was doing—"We're using the market price of the ETF compared to the price return of the index"—but failed to provide a reason, despite several follow-ups.

Benchmarks Switched In Spring

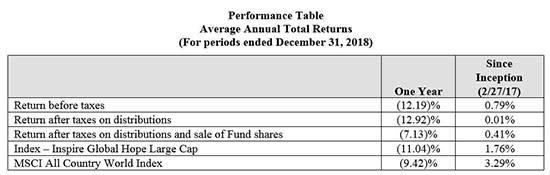

Complicating matters is the fact that, between April and May of this year, the benchmark for comparison that Inspire had been using in its literature changed.

Prior to the MSCI ACWI Equal Weight, Inspire had been comparing BLES in its literature to the vanilla MSCI ACWI, a market-cap-weighted total stock index.

The fund's most recent prospectus, dated April 1, uses the MSCI ACWI; while its most recent Semi-Annual Review, dated May 31, uses the MSCI ACWI Equal Weight.

(For a larger view, click on the image above)

Source: BLES' prospectus, dated April 1, 2019

(For a larger view, click on the image above)

Source: BLES' Semi-Annual Review, dated May 31, 2019

(Author’s Note: BLES’ Semi-Annual Review uses the MSCI ACWI Equal Weight – Price Return, once again explicitly comparing BLES' total return to its benchmark's price return.)

Interestingly, BLES' relative performance compared with the MSCI ACWI isn't nearly as positive. Whereas Bloomberg data shows BLES indeed outperforms the MSCI ACWI on all time frames examined—albeit much more modestly than Inspire claims—BLES actually lags the total return of its former benchmark across those same time periods.

Returns Of BLES Vs. MSCI ACWI | |||

| YTD Total Return | 1-Year Total Return | Since-Inception Total Return |

16.68% | 0.97% | 6.30% | |

MSCI ACWI | 16.72% | 1.96% | 9.14% |

Source: Bloomberg

When asked about the reason for the benchmark switch, Netzly at first denied using the MSCI ACWI as a comparative benchmark (instead falsely claiming that BLES' starting universe draws from the MSCI ACWI). Then, when pressed, he once again pointed to the firm's data provider as the reason for the switch.

"The data provider for our fund trust, who puts together our prospectus, did not have access to the equal-weight version of that index," he said, adding that internally, Inspire had always compared it to the MSCI ACWI Equal Weight.

"Even if we were using a market cap [index] and switched in an equal weight [index], it's just making it more accurate," he added. "The appropriate benchmark to use is an equally weighted benchmark, because it's an equally weighted fund."

Weighing Apples Against Oranges

Comparing an equal weight fund with an equal weight benchmark makes intuitive sense. However, comparing total return to price return makes less sense, and it's a choice that Inspire elected not to explain further to us, when pressed.

"A price return index on an income-generating asset class (like equities or bonds) measures the actual performance of exactly nothing," said Dave Nadig, managing director of ETF.com. "It represents no real-world investor experience, and no rational investor would ever choose one as the benchmark for any investment's performance."

"It’s equivalent to comparing your height to everyone in a room, when you get to stand on a step stool," he added. "You’ll get a number; you might even be 'tallest.' But mostly, you’ll get laughed out of the room."

In its press release, Inspire lauds how its relative performance data encourages "confidence" in the concept of biblical investing.

"The stellar performance of BLES bolsters our confidence that biblical values and good returns are not mutually exclusive,” said Netzly in the release. "BLES has shown the world that Inspire’s approach to investing in the most inspiring, biblically aligned companies in the world has yielded better returns than its secular benchmark."

Contact Lara Crigger at lcrigger@etf.com

Editor's Note: We stand by our reporting, but have agreed to append the following statement from Inspire:

Inspire Investing disagrees with numerous claims in the recent article. We acknowledge that we made an honest mistake by inadvertently using the total return of our ETF compared with the price return of the index, and we began correcting that section of our release prior to the ETF.com article. Unfortunately, the article misrepresents the accuracy and source of our data. Inspire is updating the press release, and our administrator has verified the accuracy of our NAV performance: click here.

Recommended Stories