Big Lots (BIG) Q4 Earnings Lag Estimates, Comparable Sales Fall

Big Lots, Inc. BIG reported fourth-quarter fiscal 2021, with the top and the bottom line declining year over year. Earnings missed the Zacks Consensus Estimate while sales met the same.

This Columbus, OH-based player reported earnings of $1.75 per share, which lagged the Zacks Consensus Estimate of $1.89 per share. The metric declined from earnings per share (EPS) of $2.59 reported in the year-ago quarter. Management had guided EPS of $1.80-$1.95 for the fiscal fourth quarter.

Net sales inched down 0.3% to $1,732 million year over year but came in line with Zacks Consensus Estimate. The year-over-year downside was due to soft comparable sales. Comparable sales fell 2.3% against a 7.9% rise seen last year. Management highlighted that its fourth-quarter sales were below expectation owing to more-than-anticipated inclement weather in January and the impact of spike in omicron on traffic along with some inventory challenges. Net new stores and relocations contributed roughly 200 basis points (bps) to sales. Total sales rose 7.8% from fourth-quarter fiscal 2019 levels. On a two-year basis, comparable sales rose 5.4%, reflecting sustained underlying growth.

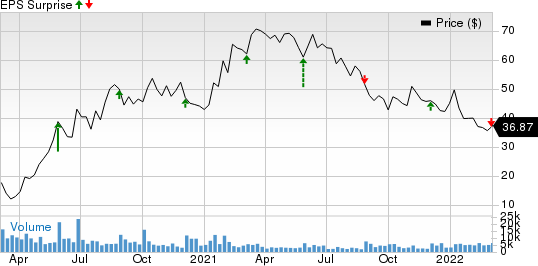

Big Lots, Inc. Price and EPS Surprise

Big Lots, Inc. price-eps-surprise | Big Lots, Inc. Quote

More on Results

Broyhill, one of the company’s key owned brand continues to deliver promising growth. Broyhill brand rose 7% year over year and contributed nearly $140 million to quarterly sales. During the quarter, Real Living brand was up more than 20% year over year.

The company highlighted that its e-commerce business has grown 3.5 times from 2019 levels in terms of profitability. Management believes that e-commerce will become a $1-billion business in the next few years. The company offers curbside pick-up, ship from store capabilities and same-day delivery via Instacart and pick-up. Management continues to witness nearly 65% of its demand being fulfilled via such capabilities. Big Lots continues to experience strength in the Operation North Star strategy and is focused on its key drivers, including customer growth, merchandise productivity, e-commerce and store count.

Gross profit declined to $646.1 million from $685.2 million reported in the year-ago quarter. The company’s gross margin contracted to 37.3% from the year-ago quarter’s figure of 39.4%. Gross margin was hurt by shrink and freight headwinds.

In the reported quarter, selling and administrative expenses came in at $541.2 million, up from $520.6 million reported in the prior-year quarter. The metric (as a percentage of net sales) expanded to 31.2% from the prior-year quarter’s tally of 30%. BIG recorded an operating profit of $67.5 million compared with nearly $131 million recorded in the prior-year quarter.

Other Financial Details

Big Lots ended the quarter with cash and cash equivalents of $54 million and long-term debt of $4 million. Total shareholders’ equity was $1,007.4 million. Inventories increased 32% to $1,238 million in the fiscal fourth quarter.

For 52-weeks ended Jan 29, 2022, BIG generated net cash worth $193.8 million from operating activities. Capital expenditures in the quarter were $38 million, while the metric came in at $161 million for fiscal 2021. Capital expenditure for 2022 is expected between $210 million and $230 million.

During the reported quarter, Big Lots repurchased 2.1 million shares worth $91 million. For fiscal 2021, management repurchased 7.7 million worth $418 million. The board also announced a quarterly cash dividend of 30 cents a share, payable Apr 1, 2022, to shareholders of record as of Mar 18.

During the reported quarter, the company opened 16 new stores while closing nine stores. Big Lots concluded the quarter with 1,431 stores and total selling square footage of 32.7 million.

In 2021, Big Lots opened 23 net new stores, which are performing above expectations. For 2022, the company expects to open more than 50 net new stores, roll out more programs to drive merchandise productivity along with improving its supply chain infrastructure. During the year, the company will accelerate its next-generation furniture sales strategy. The program is presently in action across more than 120 stores. The company plans to scale up the program to almost 650 stores by the third quarter of fiscal 2022. The move will result in almost two points of benefit to the annualized comp for the company.

Image Source: Zacks Investment Research

Outlook

For the first quarter of fiscal 2022, management anticipates EPS in the range of $1.10-$1.20. The view takes into account a comparable sales growth of roughly 10% compared with 2019’s level, same as a low double-digit decline in comparable sales compared with first-quarter 2021. Management expects nearly 130 bps growth from net new and relocated stores in the quarter.

The company expects the quarterly gross margin rate to decline by roughly 50 bps year over year, thanks to higher-than-expected freight costs and increased shrink accrual rate. Management also expects a slight year-over-year rise in expense dollars, mainly due to additional supply chain expenses, inflationary wage impacts and new store-related costs. Such a rise in costs are somewhat likely to be offset by the variable expense impact of reduced sales as well as reduced bonus and equity compensation expense.

For fiscal 2022, the company expects comparable sales and gross margin rates to be almost flat year over year. Management expects modest operating expense deleverage owing to inflationary impacts and growth-related investments.

Shares of the Zacks Rank #5 (Strong Sell) company have declined 15.9% compared with the industry’s 5.6% fall.

3 Retail Stocks to Bet on

Here are some better-ranked stocks — Capri Holdings CPRI, DICK'S Sporting Goods DKS and Dollar Tree DLTR.

Capri Holdings, which offers accessories and footwear, sports a Zacks Rank #1 (Strong Buy) at present. The company has a significant trailing four-quarter earnings surprise, on average. CPRI has an expected EPS growth rate of 30.9% for three to five years. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Capri Holdings’ current financial-year sales suggests growth of 37.1% from the year-ago period.

DICK'S Sporting Goods, which operates as a sporting goods retailer, flaunts a Zacks Rank #1 at present. DKS has a trailing four-quarter earnings surprise of 104.2%, on average.

The Zacks Consensus Estimate for DICK'S Sporting Goods’ current financial year sales and EPS suggests growth of 27.8% and 152.5% each from the respective year-ago period’s reported numbers. DKS has an expected EPS growth rate of 11.7% for three-five years.

Dollar Tree, the operator of discount variety retail stores, holds a Zacks Rank of 2 (Buy) at present. DLTR has a trailing four-quarter earnings surprise of 11.8%, on average. DLTR has expected EPS growth rate of 12.2% for three to five years.

The Zacks Consensus Estimate for DLTR’s current financial-year sales suggests growth of 5.9% from the year-ago period’s reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Dollar Tree, Inc. (DLTR) : Free Stock Analysis Report

Big Lots, Inc. (BIG) : Free Stock Analysis Report

DICK'S Sporting Goods, Inc. (DKS) : Free Stock Analysis Report

Capri Holdings Limited (CPRI) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research