The Biggest Technical Glitches On Wall Street

Bubbles, sell-offs, and bear markets have become a part of our everyday vocabulary as the financial world has taken investors, as well as innocent bystanders, for quite the roller coaster ride this past decade alone. Whether you’re a stock guru or not, it’s no surprise that Wall Street has experienced some turbulent times over the years, but it’s a bit more frightening when you realize that there has been a growing number of technical difficulties plaguing the very exchanges that investors, both big and small, rely on [see 5 Tweets The Shook The ETF World].

In light of the most recent “glitch-induced” shutdown of the Nasdaq earlier this summer, below we highlight the biggest technical glitches in Wall Street’s history [see also Visual Guide: Major Index Returns by Year from 1970]:

12/9/1987: Blame It on a Squirrel

A stray squirrel lost its life when it touched off a power failure in Trumbull, Connecticut, where Nasdaq’s main computer center is based. The curious rodent managed to shut down the National Association of Securities dealers’ quotation service for about 80 minutes; as a result, Nasdaq officials estimated that approximately 20 million shares were kept from being traded. The power failure didn’t result in significant losses, but it did raise a lot of concerns about the dependability of electronic trading systems.

8/1/1994: The Return of the Rodent

Another squirrel managed to chew through power lines and the Nasdaq’s back-up power system in Trumbull failed to kick in. This led to a half hour interruption on the trading floor and even more criticism was directed at the exchange, as the proclaimed “leader in technology” was dealing with old-fashioned power failures. This inevitably encouraged Nasdaq to invest heavily into revamping and modernizing its computer and communications systems.

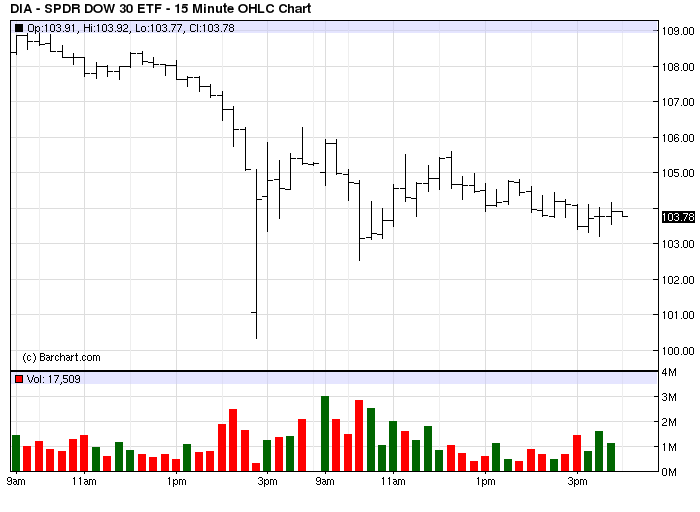

5/6/2010: Flash Crash

The U.S. stock market opened lower on May 6th, 2010 as worries over the Greek debt crisis dominated headlines. Selling pressures intensified beyond belief in the final half hour of trading when the Dow Jones Industrial Average dropped an additional 600 points in a matter of five minutes; a mere 20 minutes later, the Dow had recovered a good chunk of the losses on the day. The Dow Jones Industrial Average ETF (DIA, A) shed 2.87% that day, although losses extended upwards of 8% at their worst. SEC reports concluded that the steep sell-off was a result of unusually high volatility and thinning liquidity coupled with a large institutional sell order [see The Original Businesses of Dow Components].

5/18/2012: Facebook IPO

Nasdaq’s CEO admitted that technical issues had marred Facebook’s (FB) initial public offering on March 18th, 2012. Shares of the social media giant tumbled, a sight generally unseen on day one for new issues, and just barely managed to close above their initial price of $38. Criticism followed as it became apparent that among the technical difficulties were a delay at the start of trading as well as missed trade executions. The Global X Social Media ETF (SOCL, C+) sank 7.8% lower that day.

8/1/2012: Knight Capital Erroneous Trades

Market maker Knight Capital (KCG) experienced a software glitch that flooded the exchanges with erroneous trades resulting in reported losses of $461 million; the company’s stock lost 32% that day and selling pressures persisted the following session, dragging it below $3 a share. This trading glitch led to substantial losses for a number of FocusShares ETFs, for whom Knight served as a lead market maker.

8/20/2013: Goldman Glitches

Another market maker glitch, this time on Goldman’s part, resulted in erroneous stock and ETF options trades that reportedly cost the firm upward of $100 million. The company’s stock (GS) dipped lower that day, although it managed to close in green territory by the end of the trading session.

8/22/2013: Flash Freeze

The Nasdaq halted all trading for three hours on August 22nd because of a technical glitch after its back-up systems failed; though surprisingly, the interruption was met with joy as buyers were quick to return as soon as trading resumed near the end of the session. The PowerShares QQQ (QQQ, B+), which is linked to the NASDAQ-100 Index, gained a bit over 0.5% that day. The exchange shutdown was traced back to software problems and although equity prices evaded substantial losses, concerns were raised surrounding the intricacy, and inherent complexity, of our electronic global financial market.

The Bottom Line

As advanced as our global financial system has become, it’s important to remember it’s far from perfect in the operational sense of the word. Electronic trading systems have brought on countless efficiencies, and have democratized the investing landscape in unimaginable ways; however, with innovation also comes complexity, and at the end of the day we must always be working to improve upon its nuances, though it is highly unlikely we will entirely rid our exchanges of technical glitches.

Follow me on Twitter @SBojinov

[For more ETF analysis, make sure to sign up for our free ETF newsletter]

Disclosure: No positions at time of writing.

Click here to read the original article on ETFdb.com.

Related Posts:

Facebook (FB) Finally Above IPO Price; ETFs That Have Endured The Ride

Daily ETF Roundup: MOO Tumbles After Russian Potash News, VOX Slumps