Bill Ackman's Long Positions Tumble During 1st-Quarter Market Meltdown

According to current portfolio statistics, a GuruFocus Premium feature, several long positions of Bill Ackman (Trades, Portfolio)'s Pershing Square have tumbled over 30% year to date as the coronavirus continues taking its toll on U.S. markets.

Most of the portfolio's top holdings, which include Chipotle Mexican Grill Inc. (NYSE:CMG), Hilton Worldwide Holdings Inc. (NYSE:HLT), Restaurant Brands International Inc. (NYSE:QSR) and Starbucks Corp. (NASDAQ:SBUX), tumbled over 30% from the December 2019 average price as of Wednesday, excluding effects of portfolio hedges the guru announced earlier in the month.

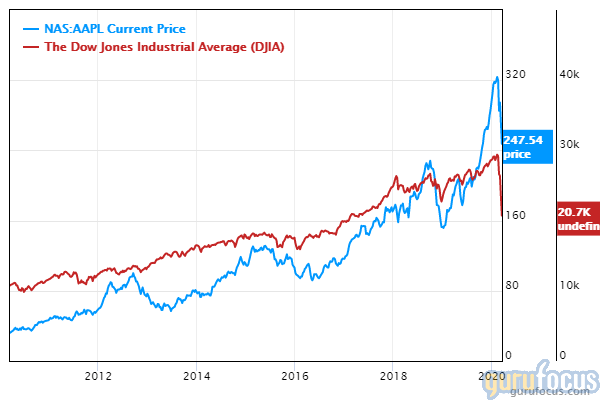

Dow tanks below 20,000 as coronavirus fears outweigh government stimulus package

The Dow Jones Industrial Average closed at 19,898.92, down 1,338.46 or 6.30% from Tuesday's close of 21,237.38. During the day though, the 30-stock index traded at an intraday low of 19,056.49, down 1,130.03 points from Monday's close of 20,186.52. Ongoing coronavirus fears sent the Dow below 20,000 for the first time since around January 2017, the month Donald Trump took the oath as President of the United States.

The Treasury Department announced it is proposing two rounds of direct payments to citizens for a total of $250 billion. The proposal is part of a nearly $1 trillion stimulus package to curtail the impact of the coronavirus outbreak to the economy: John Hopkins University reported that U.S. cases have climbed to over 6,400, including over 100 casualties, up from just 70 U.S. cases around the beginning of the month.

Pershing Square manager calls for 30-day "Spring Break"

Ackman underscored in a tweet addressing President Trump to "shut down the country for the next 30 days and close all borders" to contain the coronavirus outbreak. The Pershing Square manager discussed on CNBC's "Halftime Report" that unlike the flu, the coronavirus has a 14-day incubation period, i.e., one could go 14 days until he or she shows symptoms of the virus. When China closed the city of Wuhan, the epicenter of the virus in the country, people fled Wuhan and then spread the virus around other parts of China. Ackman then said that if we locked down New York only, New Yorkers would then leave New York and then spread the virus across the U.S.

The fund manager thus concluded that the "only answer" to contain the virus in the U.S. is to shut down the entire country and have Americans spend time with family at home.

Guru updates his view on Hilton and the hotel industry

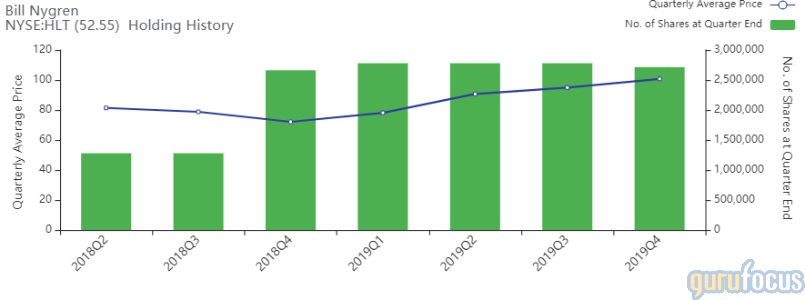

Shares of Hilton tumbled approximately 40.28% from the December 2019 average price of $100.73.

Ackman said that if the U.S. continues the status quo, the hotel industry could "go to zero" because "no business can survive 18 months without revenue." Despite this, the fund manager said he purchased more shares of Hilton on the "bullish" belief that if the U.S. shuts the entire economy for just one month and then gradually reopens the economy, just like how Asian companies have done in the past months, the U.S. can contain the "silent killer" known as the coronavirus and defeat it, saving the country and in turn the economy.

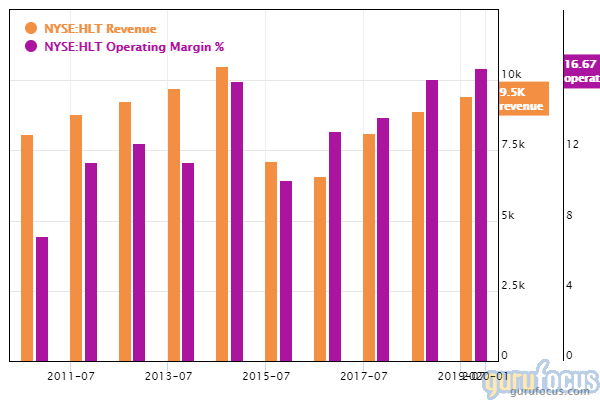

GuruFocus ranks Hilton's profitability 7 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7, expanding operating margins and a three-year revenue growth rate that outperforms 82.81% of global competitors.

Pershing Square owns 10,556,805 shares of Hilton, giving the stake 17.87% weight in the equity portfolio. Other gurus with holdings in the McLean, Virginia-based company include Bill Nygren (Trades, Portfolio) and PRIMECAP Management (Trades, Portfolio).

Restaurant industry has similar repercussions

Ackman mentioned during his CNBC interview that the restaurant industry could also fail to survive a coronavirus recession of 12 to 18 months: While capitalism "does not work in an 18-month shutdown," capitalism can work following just a one month break. The fund manager reiterated that he let his firm's 50 employees begin working from home starting Feb. 27 just so that he could prevent his father from getting the coronavirus. The virus "dies if we minimize transmission," according to Ackman.

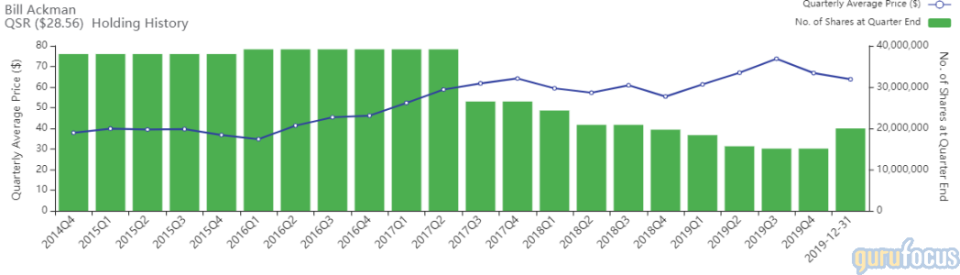

The fund manager said he also added shares to his Restaurant Brands International holding, a company that has tumbled approximately 48.96% from the average price of $63.77.

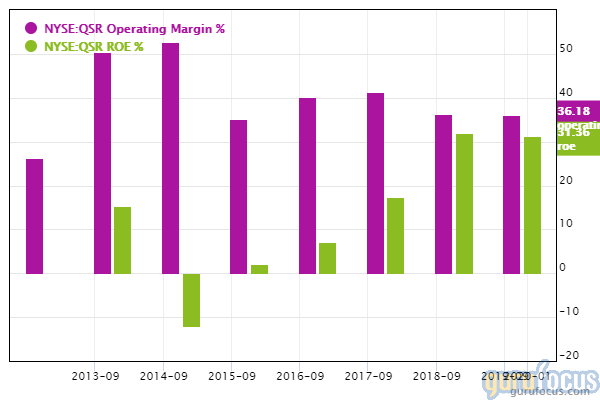

GuruFocus ranks the Toronto-based company's profitability 8 out of 10 on several positive investing signs, which include a high Piotroski F-score of 7 and a return on equity that outperforms 94.94% of global restaurants. Additionally, the quick-service restaurant's operating margin is outperforming 97.08% of global competitors despite contracting over the past five years.

Ackman's firm owns 15,084,304 shares of Restaurant Brands International, giving the position 14.68% weight in the equity portfolio. Chipotle and Starbucks, the firm's other two restaurant holdings, occupy 22.03% and 7.32% of the equity portfolio. Shares of the Mexican fast-food restaurant tumbled approximately 36.97% from the December 2019 average price of $885, while shares of the Seattle-based coffee chain tanked approximately 32.61% from the average price of $85.31.

See also

Ackman's other holdings include Lowe's Companies Inc. (NYSE:LOW), The Howard Hughes Corp. (NYSE:HHC), Agilent Technologies Inc. (NYSE:A) and Warren Buffett (Trades, Portfolio)'s conglomerate Berkshire Hathaway Inc. (NYSE:BRK.A)(NYSE:BRK.B).

Disclosure: The author has no positions in the stocks mentioned in this article. The performances of stocks discussed in this article reflect Ackman's holdings according to his December 2019 13-F filing. The performances do not include hedges, short positions or other new holdings Ackman or his firm might have purchased during the first quarter.

Read more here:

Warren Buffett's Market Indicator Indicates Modestly Overvalued US Market

4 Most Broadly-Owned Airline Stocks as US Announces Fund Stimulus

Warren Buffett's Top Holdings Sink on Coronavirus Fears

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.