Bill Gates' Foundation Buys Into Voya Asia Pacific High Dividend Equity Income Fund

- By Graham Griffin

The Bill and Melinda Gates Foundation Trust, founded by Bill Gates (Trades, Portfolio) and his wife Melinda in 2000, has revealed a new holding in Voya Asia Pacific High Dividend Equity Income Fund (NYSE:IAE).

The Bill and Melinda Gates Foundation is the largest private foundation in the world with over $40 billion in total assets. Six years after it was established, the group's trustees created a two-entity structure: the Foundation, which distributes money to grantees, and the Foundation Trust, which manages the group's endowment. The investments of the Foundation Trust are managed by an outside team of portfolio managers. The goal of the foundation is to distribute donations and income from investments in the form of grants to encourage and fund philanthropic business activity.

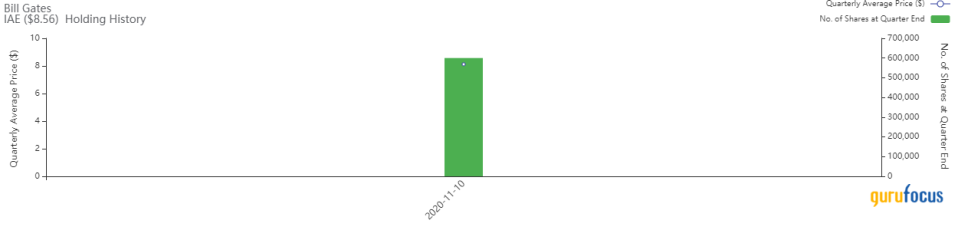

According to GuruFocus' Real-Time Picks, a Premium feature, the new holding was established on Nov. 10. Managers of the trust purchased 600,092 shares that traded at an average price of $8.12 on the day of the purchase. Overall, the purchase had a 0.02% impact on the equity portfolio and GuruFocus estimates the total gain of the holding at 5.42%.

Voya Asia Pacific High Dividend Equity Income Fund is a U.S.-based diversified, closed-end fund. The fund's investment objective is to generate total returns through a combination of current income, capital gains and capital appreciation. The fund seeks to achieve its investment objective by investing primarily in a portfolio of high dividend yielding equity securities of Asia-Pacific companies. Its portfolio composition consists of financials, information technology, industrials, consumer staples, utilities, materials, consumer discretionary and others.

On Nov. 25, the stock was trading at $8.58 per share with a market cap of $102.09 million. The Peter Lynch chart suggests the stock may be trading above its intrinsic value.

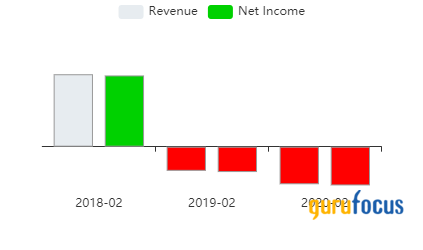

GuruFocus gives the company a financial strength rating of 7 out of 10 and a profitability rank of 1 out of 10. There is currently one severe warning sign issued for a low Piotroski F-Score of 3, which implies poor business operation. Negative revenue and net income contribute to the poor profitability rank despite the company maintaining no debt.

Portfolio overview

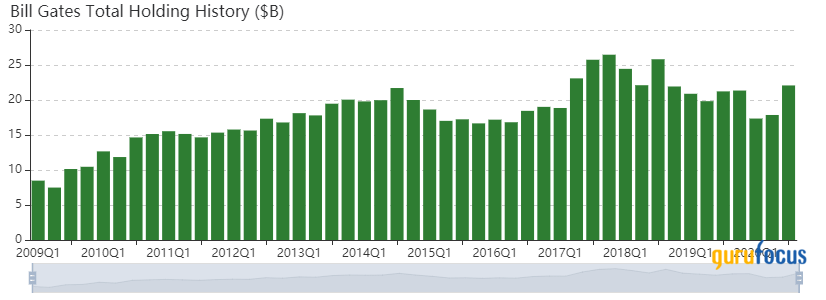

At the end of the third quarter, the portfolio contained 24 stocks, with two new holdings in Boston Properties Inc. (NYSE:BXP) and Uber Technologies Inc. (NYSE:UBER). It was valued at $22.08 billion and has seen a turnover rate of 7%. Top holdings include Berkshire Hathaway Inc. (NYSE:BRK.B), Waste Management Inc. (NYSE:WM), Canadian National Railway Co. (NYSE:CNI), Caterpillar Inc. (NYSE:CAT) and Walmart Inc. (NYSE:WMT).

By weight, the top three sectors represented are financial services (45.43%), industrials (32.29%) and consumer defensive (8.50%).

Disclosure: Author owns no stocks mentioned.

Read more here:

Tweedy Browne Burns Oil Holdings in the 3rd Quarter

Mario Cibelli Cuts Simply Good Foods, Adds Stitch Fix in 3rd Quarter

Stanley Druckenmiller Slashes JPMorgan Chase and PayPal in the 3rd Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.