Bill Gross ETF Topping its Mutual Fund Father

The PIMCO Total Return ETF (BOND) , also known as the Bill Gross ETF, is outpacing the PIMCO Total Return Fund, massive bond mutual fund that served as the inspiration for the ETF.

“Over the three months through Tuesday, the standard shares for individual investors returned 1.34%, vs. 1.09% for the Barclays U.S. Aggregate bond index and 1.25% for the average intermediate-term bond fund,” Karen Damato reports for the Wall Street Journal, citing Morningstar data.

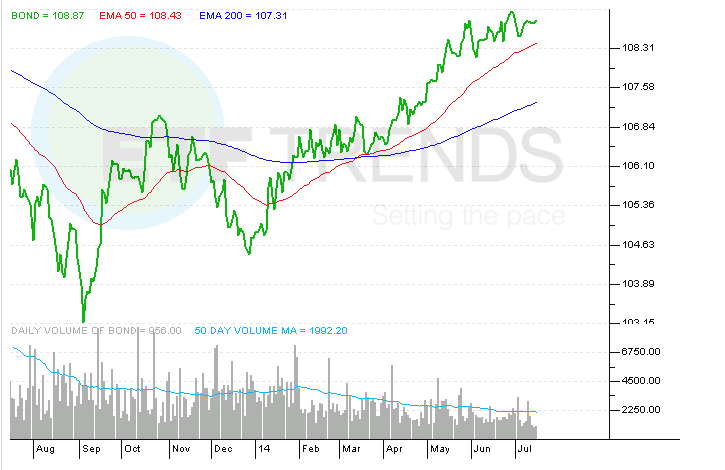

Year-to-date BOND is up nearly 4%, highlighting a key advantage the ETF offers over its mutual fund counterpart: A smaller number of holdings. That allows Gross and his team to more efficiently implement their best ideas without having to be spread across the gigantic number of holdings found in the Total Return Mutual Fund.

While the two fund types are very similar, the Total Return mutual fund can use derivatives. The BOND ETF gained exemptive relief before the SEC lifted the moratorium on derivatives for actively managed ETFs. [Low Cost Access to Bill Gross in an ETF]

The Pimco Total Return ETF’s performance advantage is more striking over the full period since its March 2012 launch: On a cumulative basis since then, the ETF is up about 15%, vs 9% for the institutional shares of the mutual fund,” the Journal reports, citing ETF.com.

With $3.45 billion in assets under management, BOND is the second-largest actively managed behind the PIMCO Enhanced Short Maturity ETF (MINT) . PIMCO had $7.87 billion in active ETF assets at the end of June making it the largest issuer of actively managed ETFs by assets. [Big Growth for Active ETFs]

BOND, home to about 790 holdings, has a 30-day SEC yield of 2.33% and an effective duration of five years, according to PIMCO data.

BOND currently allocates 30% of its weight to mortgage-backed securities and 10% of U.S. government-related bonds. Another 28% goes to ex-U.S. developed market debt.

PIMCO Total Return ETF

ETF Trends editorial team contributed to this post. Tom Lydon’s clients own shares of BOND.

The opinions and forecasts expressed herein are solely those of Tom Lydon, and may not actually come to pass. Information on this site should not be used or construed as an offer to sell, a solicitation of an offer to buy, or a recommendation for any product.