Bill Nygren Adds 4 Stocks to Portfolio in 1st Quarter

When he released the Oakmark Fund's first-quarter portfolio earlier this week, renowned investor Bill Nygren (Trades, Portfolio) disclosed he entered four new positions.

To achieve long-term capital appreciation, the guru, who also manages the Chicago-based firm's Select and Global Select funds, usually invests in mid- and large-cap companies. When picking stocks, he looks for growing companies that have shareholder-oriented management teams. According to the fund's fact sheet, he prefers to take a position when the stock is trading at a substantial discount to his estimate of intrinsic value, then waits for the gap between the two to close before selling.

Keeping these criteria in mind, Nygen also sold out of two stocks during the quarter and added to or reduced a number of other holdings. The stocks he established positions in were American Express Co. (NYSE:AXP), Workday Inc. (NASDAQ:WDAY), Match Group Inc. (NASDAQ:MTCH) and Pinterest Inc. (NYSE:PINS).

American Express

Having previously exited a position in American Express in the first quarter of 2016, the guru entered a new 2 million-share stake, giving it 1.79% space in the equity portfolio. The stock traded for an average price of $117.01 per share during the quarter.

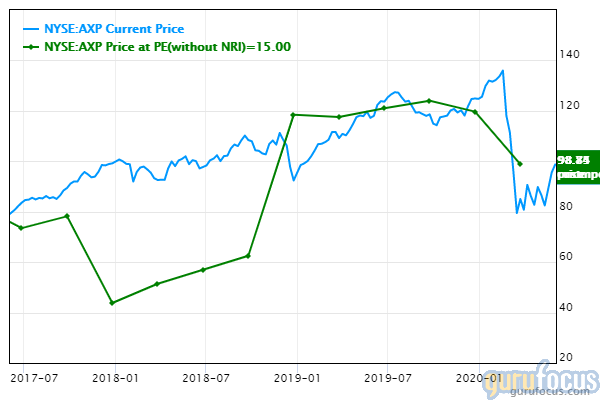

The New York-bases financial services company, which offers credit cards and related services, has a $77.88 billion market cap; its shares were trading around $99.03 on Tuesday with a price-earnings ratio of 14.68, a price-book ratio of 3.72 and a price-sales ratio of 2.56.

The Peter Lynch chart shows the stock is trading near its fair value. The GuruFocus valuation rank of 4 out of 10, however, leans toward overvaluation.

GuruFocus rated American Express' financial strength 3 out of 10 on the back of a low cash-debt ratio of 0.64. A strong net margin and returns that outperform over half of competitors contributed to its profitability rating of 4 out of 10. It also has a one-star business predictability rank, which indicates it returns approximately 1.1% annually over a 10-year period.

In his first-quarter commentary, Nygren noted that the company has made "significant investments" in recent years, improving its "cardholder value proposition."

"We believe this virtuous cycle of growth and reinvestment will allow American Express to continue growing its business at a high single-digit pace in the coming years while investing enough to protect the business from competitive threats," he added. "The organic growth that we expect, combined with potential share repurchases, should result in double-digit EPS growth in a typical year, while the company's high returns and low credit risk should result in peer-leading results during the inevitable downturns."

Of the gurus invested in American Express, Warren Buffett (Trades, Portfolio) has the largest stake with 18.83% of its outstanding shares. Other top guru shareholders include Ken Fisher (Trades, Portfolio), Dodge & Cox, Chris Davis (Trades, Portfolio), Andreas Halvorsen (Trades, Portfolio), First Eagle Investment (Trades, Portfolio), Barrow, Hanley, Mewhinney & Strauss, Jeremy Grantham (Trades, Portfolio), Mario Gabelli (Trades, Portfolio) and Mairs and Power (Trades, Portfolio).

Workday

Nygren invested in 827,000 shares of Workday, allocating 1.12% of the equity portfolio to the position. During the quarter, the shares traded for an average price of $169.05 each.

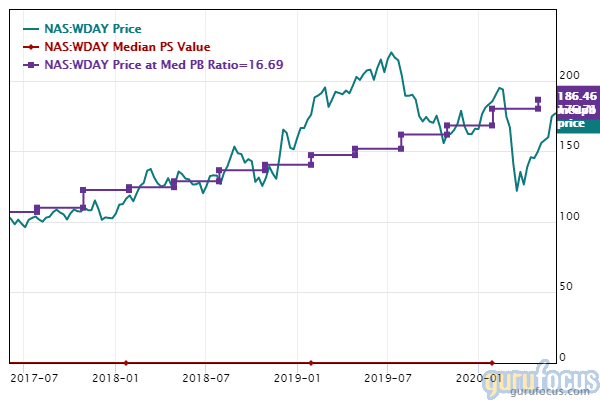

The financial management and human resources software company, which is headquartered in Pleasanton, California, has a market cap of $41.67 billion; its shares were trading around $177.06 on Tuesday with a forward price-earnings ratio of 77.23, a price-book ratio of 15.87 and a price-sales ratio of 10.66.

According to the price chart, the stock is trading below its median book value but above its median price-sales ratio.

Workday's financial strength was rated 5 out of 10 by GuruFocus, driven by a moderate cash-debt ratio of 1.24 and a high Altman Z-Score of 5.32. Its profitability scored a 3 out of 10 rating on the back of negative margins and returns that underperform a majority of industry peers, as well as a stable Piotroski F-Score of 6 and a one-star business predictability rank.

In his quarterly commentary, Nygren wrote that the company's HR software "boasts over 70% market share of cloud deployments" among Fortune 500 companies. He also noted that as the global software market "steadily transitions to cloud," Workday will have "a clear path to significant revenue growth."

"Despite the company's dominant competitive position and trajectory for sustained long-term growth, the stock trades at a lower multiple of revenue than other software companies that don't share Workday's competitive advantages," he added.

With 1.59% of outstanding shares, Frank Sands (Trades, Portfolio) has the largest stake in Workday. Halvorsen, Chase Coleman (Trades, Portfolio), Spiros Segalas (Trades, Portfolio), Stanley Druckenmiller (Trades, Portfolio) and Al Gore (Trades, Portfolio) also have large positions in the stock.

Match Group

The investor picked up 1.5 million shares of Match Group, dedicating 1.04% of the equity portfolio to the stake. The stock traded for an average per-share price of $73.95 during the quarter.

The Dallas-based company, which owns and operates popular online dating sites like Tinder, Match.com, OkCupid, Hinge and PlentyOfFish, has a $26.52 billion market cap; its shares were trading around $92.13 on Tuesday with a price-earnings ratio of 48.1, a price-book ratio of 92.4 and a price-sales ratio of 12.58.

Based on the Peter Lynch chart, the stock appears to be overvalued.

Supported by adequate interest coverage and a robust Altman Z-Score of 8.47, GuruFocus rated Match's financial strength 5 out of 10. The company's profitability scored an 8 out of 10 rating, driven by expanding margins, returns that outperform a majority of competitors and a high Piotroski F-Score of 7, which indicates operations are healthy.

In his commentary for the quarter, Nygren said that Match's current valuation doesn't reflect its "combination of exceptional economics and long-term prospects." Its app, Tinder, is the world's top dating platform, which the guru says gives it "significant scale advantages."

"We believe this puts Tinder in an excellent position to address the more than 50% of singles in the U.S. and Europe who still haven't tried online dating," he wrote. "We also believe Tinder's monetization potential is underappreciated as its 'freemium' model means the vast majority of users currently pay nothing for the service. With over 60% of its users active six days per week, the opportunity to increase adoption of paid features is substantial."

Sands is the company's largest guru shareholder with a 4.36% stake. Steve Mandel (Trades, Portfolio), Pioneer Investments (Trades, Portfolio), Jim Simons (Trades, Portfolio)' Renaissance Technologies, Paul Tudor Jones (Trades, Portfolio), John Hussman (Trades, Portfolio), Lee Ainslie (Trades, Portfolio) and Steven Cohen (Trades, Portfolio) also own the stock.

With an impact of 0.35% on the equity portfolio, Nygren purchased 2.2 million shares of Pinterest. During the quarter, the stock traded for an average price of $19.57 per share.

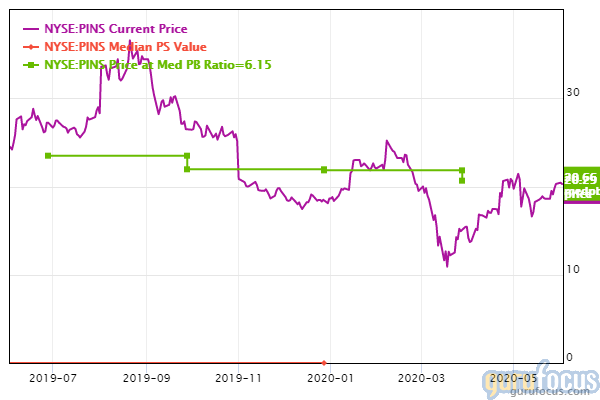

Headquartered in San Francisco, the social networking company, which operates a platform where users can save and organize ideas and inspiration for their personal interests and hobbies, has a market cap of $11.86 billion; its shares were trading around $20.16 on Tuesday with a price-book ratio of 6.01 and a price-sales ratio of 8.89.

The price chart shows the stock is trading near its median price-book ratio and above its median price-sales value.

Pinterest's financial strength was rated 7 out of 10 by GuruFocus on the back of a high cash-debt ratio and robust Altman Z-Score of 18.47. The Sloan ratio suggests poor earnings quality, while the margins and returns are negative and underperform a majority of industry peers.

Nygren wrote in his commentary that Pinterest is "attractively valued" since it recently fell from its high of $36, which it hit last summer. It is also in the early stages of monetizing its platform, despite having over 300 million monthly active users from around the world.

"Unlike many consumer internet companies, users and advertisers are fundamentally aligned on the site," he said. "Pinterest provides its users with information that they are actually looking for as opposed to trying to distract them from a newsfeed or chats with friends. The company also gives advertisers access to an audience of people with high commercial intent along with the ability to integrate ads in a natural way."

PRIMECAP Management (Trades, Portfolio) is the company's largest guru shareholder with a 0.53% stake. Pioneer and Jones also own the stock.

Additional trades and portfolio performance

During the quarter, Nygren also sold out of his holding of Alphabet Inc.'s (NASDAQ:GOOGL) Class A shares as well as his position in American Airlines Group Inc. (NASDAQ:AAL). Other top trades included the expansion of his holding of Alphabet's Class C stock (NASDAQ:GOOG) by 116.23% and reductions to positions in Regeneron Pharmaceuticals Inc. (NASDAQ:REGN), Charter Communications Inc. (NASDAQ:CHTR), Netflix Inc. (NASDAQ:NFLX) and Apple Inc. (AAPL).

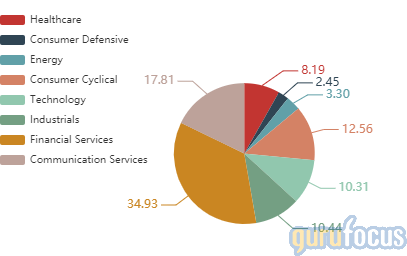

Oakmark's $9.58 billion equity portfolio, which is composed of 53 stocks, is largely invested in the financial services sector with a weight of 34.93%, followed by smaller positions in the communication services (17.81%) and consumer cyclical (12.56%) spaces.

GuruFocus data shows the Oakmark Fund returned 26.98% in 2019, slightly underperforming the S&P 500's return of 31.49%.

Disclosure: No positions.

Read more here:

Warren Buffett's Berkshire Hathaway Turns Up Stake in Liberty SiriusXM

Alan Fournier Adds 4 Stocks to Portfolio

Mario Cibelli Adds 2 Stocks to Portfolio, Gives Alphabet the Boot

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.