Biogen (BIIB) Q2 Earnings & Sales Beat Estimates, Shares Up

Biogen Inc. BIIB reported second-quarter 2018 earnings per share of $5.80, which beat the Zacks Consensus Estimate of $5.22 by 11.1%. Moreover, the bottom line rose 15.1% year over year.

Earnings excluded certain one-time payments related to some agreements, which include a new collaboration agreement with Ionis Pharmaceuticals, Inc. IONS, acquisition of schizophrenia candidate, BIIB104, from Pfizer and a license agreement with Bristol-Myers BMY for Alzheimer's disease (“AD”) candidate, BIIB092.

Sales came in at $3.36 billion, up 9.1% from the year-ago period. Moreover, sales beat the Zacks Consensus Estimate of $3.25 billion.

We remind investors that the company’s AD candidate, BAN2401, significantly slowed disease progression in patients being evaluated in a mid-stage study.

Shares of Biogen were up almost 7.2% in pre-market trading, presumably due to strong sequential growth for key drugs. The stock has gained 12.4% this year so far against the industry’s 2.5% decrease.

Quarter in Detail

Biogen’s multiple sclerosis (“MS”) revenues were $2.3 billion in the reporter quarter including approximately $113 million in royalties on the sales of Roche’s RHHBY MS drug, Ocrevus. Per a deal with Roche, Biogen is entitled to receive royalties on U.S. sales of Ocrevus.

Oral MS drug Tecfidera’s sales decreased 2% year over year but increased 10% sequentially to $1.09 billion. The other MS drug, Tysabri’s sales declined 6% year over year but were up 1% sequentially to $467 million.

Combined interferon revenues (Avonex and Plegridy) in the second quarter were $626 million, down 9% year over year but up 14% sequentially. Avonex revenues declined 10% from the year-ago period to $502 million. Plegridy contributed $124 million to revenues, which decreased 7% year over year but were up 24% sequentially.

Zinbryta, launched in collaboration with AbbVie, generated no revenues in the quarter as the drug was withdrawn from the market in March 2018 due to growing safety concerns and limited commercial adoption. The drug had contributed $1 million to revenues in the first quarter of 2018 and $16 million in the year-ago quarter.

Biogen’s newest drug Spinraza (spinal muscular atrophy) performed exceptionally as sales grew 108% year over year and 16% sequentially to $423 million driven by strong uptake in both domestic and international markets.

Spinraza U.S. sales were $206 million in the second quarter, increasing 9.6% sequentially. Moreover, in the ex-U.S. markets, Spinraza recorded sales of $217 million, up 23.3% sequentially. The number of patients receiving Spinraza grew 17% in the United States and 47% outside the United States in the quarter under review compared with the first quarter of 2018.

The company said that Spinraza is currently available in 25 countries.

In the second quarter of 2018, Biogen recorded biosimilar revenues of $127 million, up 40% year over year but almost flat sequentially.

Revenues from Anti-CD20 therapeutic programs, which include Biogen’s shares of Rituxan and Gazyva operating profits, increased 23.5% from the year-ago period to $490.4 million.

The R&D spend increased 23.2% year over year and 97.4% sequentially to $981 million. SG&A spend was up 20.1% year over year and almost 3% sequentially to $516.2 million.

2018 Outlook Updated

Biogen raised its revenue expectations for the full year in the range of $13 - $13.2 billion from the previous expectation of $12.7 - $13 billion. The company also increased its earnings expectation from $24.20 - $25.20 per share to $24.90 - $25.50 per share. Operating expenses (R&D + SG&A) are expected to rise 15% to 20% during the year.

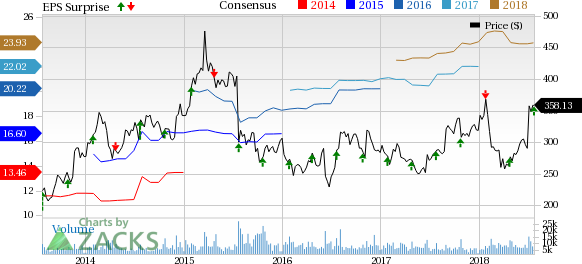

Biogen Inc. Price, Consensus and EPS Surprise

Biogen Inc. Price, Consensus and EPS Surprise | Biogen Inc. Quote

Zacks Rank

Biogen currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Bristol-Myers Squibb Company (BMY) : Free Stock Analysis Report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Ionis Pharmaceuticals, Inc. (IONS) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research