Biogen (BIIB) Surges Amid Rumors of Acquisition by Samsung

Shares of Biogen BIIB gained 9.5% on Dec 29 following news on its potential acquisition by the South-Korean conglomerate Samsung Group.

Per an article in The Korean Economic Daily, the U.S.-based biopharmaceutical entity approached the Samsung Group to sell its shares for an estimated aggregate value of more than $42 billion (above 50 trillion won). The total value of the deal is roughly $283 per Biogen’s share, a premium of nearly 20% above its closing price on Dec 28.

However, the Samsung Group denied this media report about its acquisition of Biogen, per a Reuters article. BIIB is yet to comment on the Korean news.

Biogen and the Samsung Group’s subsidiary Samsung Bioep already have a joint venture since 2012 for the development and commercialization of biosimilar versions of branded drugs. There are three marketed biosimilars developed under this JV.

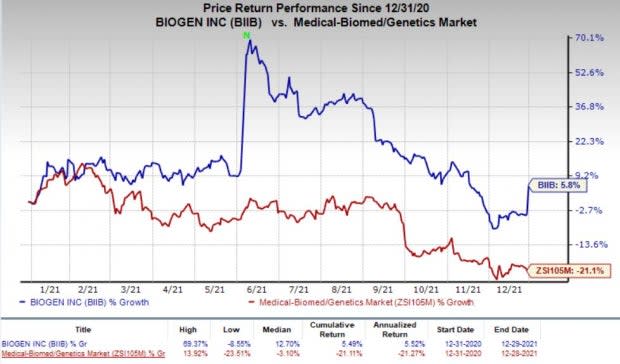

Investors seemed cheerful about the rumored acquisition of Biogen that drove its share price yesterday. The stock has gained 5.8% so far this year against the industry’s decline of 21.1%.

Image Source: Zacks Investment Research

Biogen is a global biopharmaceutical company engaged in developing treatments for neurological and neurodegenerative diseases. The stock price was driven by the regulatory progress of its controversial Alzheimer’s disease (AD) drug Aduhelm, which was granted an accelerated approval on Jun 7, 2021. Shares surged almost 70% in the first half of 2021 and significantly gained on Jun 8 following FDA nod to Aduhelm.

However, Biogen’s shares have started declining since Jun 10 and plunged 37.5% in the past six months and a half. The downside was primarily due to skepticism over demand for Aduhelm. Although Aduhelm became the first medicine to be approved for reducing the clinical decline associated with AD, the launch of the drug had been slower than expected amid some near-term challenges.

In July, the FDA approved an update on the label of Aduhelm. The updated label mentions that Aduhelm treatment should be initiated in patients with mild cognitive impairment due to Alzheimer’s disease or mild Alzheimer’s dementia. For earlier or later stages of the disease, there is no safety or effectiveness data available to support the initiating treatment with Aduhelm.

Earlier this month, Biogen announced that it is lowering the price of Aduhelm by approximately 50% effective Jan 1, 2022, as early sales of the drug fell much short of expectations. The approval of the drug in Europe is also uncertain now as last week, the Committee for Medicinal Products for Human Use of the European Medicines Agency gave a negative opinion BIIB’s marketing authorization application for aducanumab. Moreover, big companies like Roche RHHBY and Eli Lilly LLY are developing their own AD candidates, which are expected to be launched in a couple of years.

Roche’s pipeline candidate for AD, gantenerumab, is an anti-amyloid beta antibody developed for subcutaneous administration.

In October 2021, Roche announced that the FDA granted gantenerumab a Breakthrough Therapy Designation based on data that showed the candidate to significantly reduce brain amyloid plaque in the ongoing SCarlet RoAD and Marguerite RoAD open-label extension studies as well as other studies.

Lilly developed donanemab, also an anti-amyloid beta antibody, for AD.

Lilly already initiated a rolling submission with the FDA seeking an approval for donanemab to treat early Alzheimer's disease under the accelerated approval pathway based on data from TRAILBLAZER-ALZ. Results from the study showed that treatment with donanemab induced a rapid amyloid plaque reduction at week 24 in participants with early symptomatic AD.

Lilly expects the rolling submission to be completed by the end of first-quarter 2022.

Moreover, the competitive landscape remains challenging for Biogen’s MS products with newer entrants. The Ocrevus launch by Roche is adversely impacting its MS franchise sales, mainly Tysabri. Multiple generic versions of its other key drug Tecfidera are also launched to significantly erode the drug’s sales. Further, BIIB’s spinal muscular atrophy (SMA) treatment Spinraza is facing an increased competitive pressure from new drugs, including Novartis’ NVS Zolgensma.

The FDA approved Zolgensma in May 2019 to treat children below two years. Competition from new entrants like Novartis’ Zolgensma is hurting sales of Spinraza in the United States.

Although Biogen’s commercial portfolio seems to falter amid the rising competition and the slow launch of Aduhelm, the same has a strong pipeline with five late-stage candidates targeting different neurological disorders, including AD.

The decline in Biogen’s shares in the second half of 2021 makes it an attractive target of a potential acquisition.

Biogen Inc. Price

Biogen Inc. price | Biogen Inc. Quote

Zacks Rank

Biogen currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novartis AG (NVS) : Free Stock Analysis Report

Biogen Inc. (BIIB) : Free Stock Analysis Report

Roche Holding AG (RHHBY) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research