Bitcoin could more than double again in 2020 after 30% surge, says Tom Lee

After beating the overall market’s return in 2019, bitcoin (BTC-USD) is off to its hottest start to the year in nearly a decade.

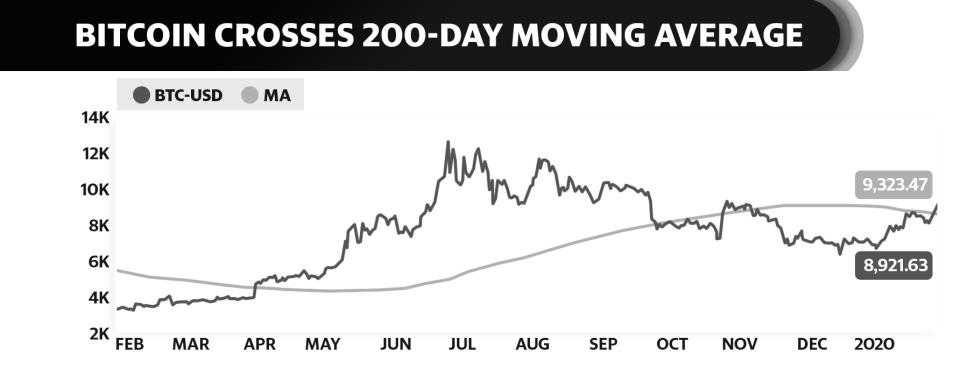

Rising nearly 30% so far in January to top $9,000, the world’s largest cryptocurrency by market cap is now trading above its 200-day moving average — a significant signal for more gains ahead, according to Fundstrat Global Advisors Managing Partner Tom Lee.

In a new note out Wednesday, Lee highlighted that the cryptocurrency has historically traded higher 80% of the time after notching that technical feat.

“Moving above the 200-day [moving average] is validating that Bitcoin is back in a ‘bull market,’” Lee wrote, adding that bitcoin has historically rallied by a larger percentage in the ensuing six months on average when trading above its 200-day moving average than trading below it.

According to Fundstrat research, bitcoin has historically notched forward returns of 193% over the ensuing six months, on average, after topping its 200-day moving average, compared to the modest 10% gain it averages when trading below that mark.

Interestingly, bitcoin’s surge to start the year has come at a time when fears over the spread of coronavirus across the globe has rattled equities in the U.S. and abroad. Lee estimates that to be further support for the theory that bitcoin is increasingly being seen as a safe haven asset, similar to a digital gold. Indeed, over the past three months, bitcoin’s correlation with the S&P 500 has flipped from positive 13% to negative 10%, indicating more market volatility could continue to carry bitcoin higher.

“Bottom line: 2020 looks to be strong for crypto,” Lee concludes. “The biggest risk, in our view, is that crypto demand weakens for retail investors.”

Zack Guzman is the host of YFi PM as well as a senior writer and on-air reporter covering entrepreneurship, cannabis, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read the latest financial and business news from Yahoo Finance

Read more:

New coronavirus observations are ‘surprising and a little concerning’ says Dr. Oz

Illinois becomes the latest state to legalize marijuana, these states may follow

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.