Bitcoin Sees Red as the Bulls Go in Search of a Weekend Rally

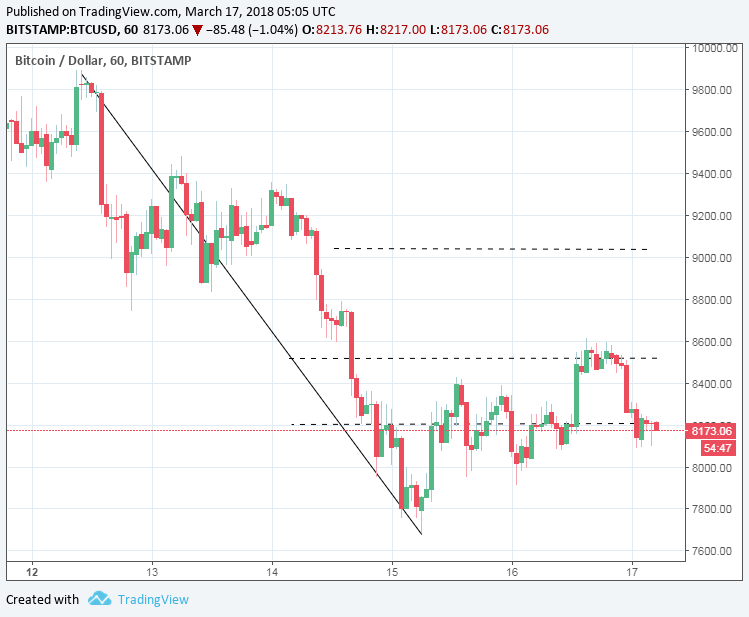

Bitcoin had another choppy day on Friday, with negative market sentiment late Thursday continuing through early Friday pulling Bitcoin down to an intraday low $7,914.08, testing sub-$8,000 support levels and investor resolve from the get go.

A move back through the day’s 23.6% FIB Retracement Level of $8,203.56 provided the necessary support through the middle of the day, as sentiment across the cryptomarket improved, leading to Bitcoin rallying through the day’s 38.2% FIB Retracement Level of $8,526.22, with an intraday high $8,613.06 testing the day’s first major resistance level of $8,580.81.

Sentiment shifted late in the day however, as news hit the wires of SEC investigations into initial coin offerings, raising concerns that investigations into exchanges may not be far away, particularly following the session in Congress on Wednesday.

Bitcoin pulled back to end the day at $8,271.1, a gain of just 0.07%, leaving Bitcoin down 13.3% for the week, the only good news for the Bitcoin bulls being the fact that Bitcoin failed to test the day’s first major support level of $7,837.81, the bad news being Bitcoin hitting intraday lows at sub-$8,000 levels for a 3rd consecutive day.

Get Into Cryptocurrency Trading Today

At the time of writing, Bitcoin was down 1.04% to $8,173.06, with Friday’s late sell-off ultimately pinning Bitcoin back through the early part of the morning.

Bitcoin’s early intraday high $8,307.86 came within the first hour of the day, with the bearish trend intact as Bitcoin pulled back below the day’s 23.6% FIB Retracement Level of $8,203.56.

Bitcoin has managed to avoid sub-$8,000 levels through the early part of the morning and a move through to the day’s 38.2% FIB Retracement Level of $8,526.22 will be needed to support a Saturday rally and to test the day’s first major resistance level of $8,618.

Investors will be looking for signs of a rally that will make key levels material through the middle part of the day and, if Bitcoin fails to move through to $8,500 levels, a pullback could be on the cards, bringing sub-$8,000 support levels into play.

Of little concern through the early part of the weekend will be the Cboe Bitcoin Futures April contract’s closing $8,530, though we will expect this to come into play towards the end of the weekend. Whether the closing price will be a weight will depend upon gains through this afternoon.

We saw Bitcoin struggle to get anywhere near $10,000 levels at the start of the week and, with the bearish trend having formed from Monday’s swing hi $9,892, investors are going to need to be particularly bold for such levels to be reached in the coming days, with $9,000 levels likely to be a push, but not altogether improbable through the weekend.

Elsewhere, Bitcoin Cash managed to recover early losses to move into positive territory at the time of writing, with Cardano and NEO also making gains, though there’s little to write home about just yet.

Buy & Sell Cryptocurrency Instantly

This article was originally posted on FX Empire

More From FXEMPIRE:

GBP/JPY Price forecast for the week of March 19, 2018, Technical Analysis

EUR/USD Price forecast for the week of March 19, 2018, Technical Analysis

Gold Price forecast for the week of March 19, 2018, Technical Analysis

Dow Jones 30 and NASDAQ 100 Price forecast for the week of March 19, 2018, Technical Analysis

Silver Price forecast for the week of March 19, 2018, Technical Analysis