BJ's Wholesale Club (BJ) Q4 Earnings Beat, Comps Rise Y/Y

BJ’s Wholesale Club Holdings, Inc. BJ reported fourth-quarter fiscal 2022 results, with the top and the bottom lines beating the Zacks Consensus Estimate and improving year over year. This operator of membership warehouse clubs registered robust growth in total comparable club sales.

Sturdy membership trends, assortment initiatives, enhanced digital capabilities and a robust real estate pipeline aided the company’s performance. Management remains optimistic about the company’s prospects.

Q4 Insights

BJ’s Wholesale Club reported adjusted earnings of $1.00 per share, which surpassed the Zacks Consensus Estimate of 89 cents. The quarterly earnings increased 25% from 80 cents in the year-ago quarter.

The company generated total revenues of $4,929.6 million, which rose 13.1% from the year-ago quarter’s levels and surpassed the consensus mark of $4,811 million. Net sales moved up 13.2% to $4,827.8 million, while membership fee income jumped 8% to $101.8 million.

Total comparable club sales during the quarter under discussion jumped 9.8% year over year. Excluding the impact of gasoline sales, comparable club sales rose 8.7%. We note that digitally enabled sales rose 22% during the quarter.

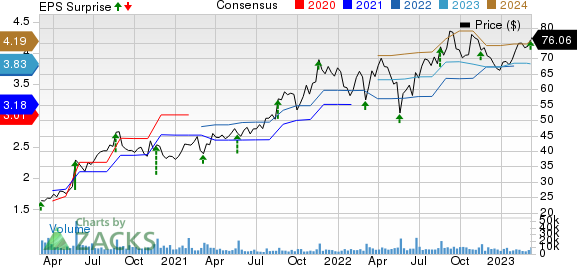

BJ's Wholesale Club Holdings, Inc. Price, Consensus and EPS Surprise

BJ's Wholesale Club Holdings, Inc. price-consensus-eps-surprise-chart | BJ's Wholesale Club Holdings, Inc. Quote

A Look at Margins

In the fourth quarter, the gross profit rose to $903.2 million from $797.2 million in the year-ago period. The merchandise gross margin rate, which excludes gasoline sales and membership fee income, expanded 30 basis points from the year-ago quarter’s level owing to improved inventory management.

Operating income increased 22.7% to $192.8 million, while the operating margin increased 30 basis points to 3.9%. We note that adjusted EBITDA climbed 18.7% to $271.3 million during the quarter, while the adjusted EBITDA margin increased 30 basis points to 5.5%.

SG&A expenses rose 12.1% to $707 million from the year-ago quarter. This reflects higher labor and occupancy costs due to new club and gas station openings, as well as incremental costs related to the transition of the company’s new club support center and other variable costs. As a percentage of total revenues, SG&A expenses shrunk 20 basis points to 14.3%.

Other Details

BJ’s Wholesale Club ended the reported quarter with cash and cash equivalents of $33.9 million. The long-term debt amounted to $447.9 million, while stockholders’ equity was $1,046.8 million.

Net cash provided by operating activities during the 52-week period ended on Jan 28, 2023, was $788.2 million. Cash from operating activities and free cash flow were $175.3 million and $88 million, respectively, during the quarter. Management anticipates capital expenditures of approximately $450 million in fiscal 2023.

As part of its share repurchase program, the company bought back 626,383 shares worth $43.8 million in the fourth quarter. BJ’s Wholesale Club opened five new clubs in the quarter.

Outlook

Management now envisions fiscal 2023 comparable club sales, excluding the impact of gasoline sales, to increase between 4% and 5%, compared with 6.5% growth registered in fiscal 2022. BJ’s Wholesale Club expects membership fee income to increase in the band of 5% to 6% year-over-year.

The company now foresees fiscal 2023 merchandise gross margin expansion of approximately 40 basis points year over year. It expects fiscal 2023 earnings per share to remain approximately flat year over year, including the 53rd-week benefit of low-teens cents per share.

As part of its long-term financial targets, BJ’s Wholesale Club projected a low-to-mid single-digit percentage increase in comparable club sales, excluding the impact of gasoline sales. The company guided total revenue growth of a mid-single-digit percentage. It expects a high-single to low-double-digit percentage increase in earnings per share in the long run.

This Zacks Rank #2 (Buy) stock has advanced 24.7% in the past year against the industry’s decline of 7.6%.

3 More Stocks Hogging the Limelight

Here we have highlighted three more top-ranked stocks, namely Kroger KR, Ollie's Bargain Outlet Holdings OLLI and General Mills GIS.

Kroger, which operates as a supermarket operator, currently carries a Zacks Rank #2 (Buy). The expected EPS growth rate for three to five years is 6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Kroger’s current financial-year revenues and EPS suggests growth of 2.5% and 6.2%, respectively, from the year-ago reported figure. Kroger has a trailing four-quarter earnings surprise of 9.8%, on average.

Ollie's Bargain, largest retailer of closeout merchandise and excess inventory, carries a Zacks Rank #2. The expected EPS growth rate for three to five years is 12.1%.

The Zacks Consensus Estimate for Ollie's Bargain’s current financial-year revenues suggests growth of 3.8% from the year-ago reported figure.

General Mills, which manufactures and markets branded consumer foods, currently carries a Zacks Rank #2. The expected EPS growth rate for three to five years is 7.5%.

The Zacks Consensus Estimate for General Mills’ current financial year sales and earnings suggests growth of 5% and 6.1% from the year-ago period. GIS has a trailing four-quarter earnings surprise of 8.7%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Mills, Inc. (GIS) : Free Stock Analysis Report

The Kroger Co. (KR) : Free Stock Analysis Report

BJ's Wholesale Club Holdings, Inc. (BJ) : Free Stock Analysis Report

Ollie's Bargain Outlet Holdings, Inc. (OLLI) : Free Stock Analysis Report