BlackBerry (BB) Q4 Earnings Beat, Software Sales Strong

BlackBerry Limited BB performed well in the fourth quarter of fiscal 2018 (ended Feb 28), reporting better-than-expected earnings and revenues. The company’s earnings per share (excluding 11 cents from non-recurring items) came in at 5 cents, comparing favorably with the Zacks Consensus Estimate of breakeven earnings. Moreover, the bottom line expanded 150% year over year. Results were boosted by robust software sales.

Quarterly Results in Detail

In the quarter under review, total revenues (on a reported basis) were $233 million, down 18.5% year over year. On an adjusted basis, the metric declined 5.6% year over year to $239 million. However, the reported figure surpassed the Zacks Consensus Estimate of $211 million.

Segment-wise, Enterprise software and services generated approximately 47.7% of the revenues while BlackBerry Technology Solutions contributed 19.2%. Licensing, IP and other raked in 24.3% of the sales, whereas Handheld devices contributed 0.8%. Services access fees revenues accounted for the balance.

Geographically, North America has contributed 63.1% of the total GAAP revenues. Meanwhile, Europe, the Middle East and Africa have notched up 27% of the revenue pie. Similarly, Latin America and the Asia-Pacific regions have yielded 1.7% and 8.2%, respectively, of the total revenues, in fiscal fourth quarter. The company had approximately 3,500 enterprise customer orders in the reported quarter.

Quarterly operating income (on an adjusted basis) came in at $19 million compared with $16 million in the fiscal third quarter. The company exited fourth-quarter fiscal 2018 with cash and cash equivalents of $816 million compared with $734 million at the end of fiscal 2017. While long-term debt in the quarter under review was $782 million, the same at the end of fiscal 2017 was $591 million.

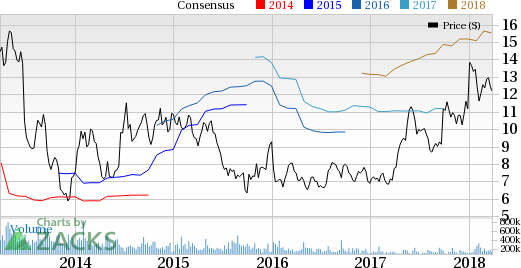

BlackBerry Limited Price, Consensus and EPS Surprise

BlackBerry Limited Price, Consensus and EPS Surprise | BlackBerry Limited Quote

Fiscal 2019 Outlook

BlackBerry, which recently sued Facebook FB and its WhatsApp and Instagram messaging units for alleged infringement of its mobile messaging technologies included in its BBM app , expects its total software and services billings to grow in double-digits in fiscal 2019. The bottom line (on an adjusted basis) and free cash flow are also projected to improve in the same period.

Zacks Rank & Key Picks

BlackBerry has a Zacks Rank #3 (Hold). Two better-ranked stocks in the broader Zacks Computer and Technology industry are Motorola Solutions, Inc. MSI and Nokia Corporation NOK, carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Motorola and Nokia have gained more than 15% and 16%, respectively, over the last three months.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Facebook, Inc. (FB) : Free Stock Analysis Report

Nokia Corporation (NOK) : Free Stock Analysis Report

Motorola Solutions, Inc. (MSI) : Free Stock Analysis Report

BlackBerry Limited (BB) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research